How Algorithmic trading revolutionizes modern markets with efficiency and speed

Algorithmic Trading

A few friends were discussing their experiences with buying and selling stocks. They noted how frustrating it can be when prices change unexpectedly (slippage) and how difficult it is to remain calm and make good decisions. One of them spoke about algo trading. They initially thought it was like a robot trading for you, but he explained it differently. Instead of manually clicking to buy or sell, a computer program makes the trades—faster, smarter, and without emotions interfering. It’s a big shift in trading where speed and accuracy really matter.

What is Algorithmic Trading?

At its core, algorithmic trading is a computer-based trade execution method. Algorithms analyze several market factors—price, volume, timing—and execute trades without human intervention based on pre-set criteria defined by the user. The goal is to enhance trading efficiency and accuracy while reducing the emotional impact on trading decisions, making automated trading for beginners and experts stress-free. For example, imagine a trader wanting to buy 1,000 shares of a stock. Instead of purchasing them all at once and pushing the price up, an algorithm can break the order into smaller chunks and execute them at the best possible prices, avoiding excessive slippage. This is a simple algorithmic trading example.

Advantages of Algo trading

The hype surrounding algo trading has advantages:

- Efficiency and speed

With algo trading, trades take place in milliseconds; it is quicker than manual trading. This speed enables traders to take advantage of fast-moving opportunities that manual trading cannot take.

- Real-time Execution

An algorithm will execute trades at the speed of lightning all the time whenever the requirements have been met. There will be no possibility of a missed opportunity or delay caused by human hesitation.

- Reduced Human Error

Algo trading also eliminates some errors caused in standard human trading processes, like mistaken orders or failure to stick to conditions for executing trades. This will allow trades to execute with much higher accuracy rates.

- Improved accuracy and consistency

Algo-Trading works on strict rules, eliminating emotional influences such as fear and greed that may come in the way of trading consistently and with great performances over time.

- Avoiding Emotional Influence

Algorithms eliminate the possibility of emotional influence in order-taking. Rational and objective decisions can be made, preventing impulse trading due to fear or greed.

- The Structured Approach

Algorithms operate under fixed parameters, providing a seriously structured, disciplined approach by eliminating fancies or haphazard guesses of when to execute a trade.

- Varieties of Trading Strategies

Algo trading opens up for traders an avenue of strategies such as scalping, trend-following, arbitrage, etc., allowing for diversification and optimization of their portfolios.Once the profitable algo trading strategy is developed then trade is just one click away, which can generate profitable trades without any distraction.

- Scalping, Trend Following, and More

Traders can utilise algorithms to execute various strategies ranging from scalping for small, frequent profits to trend-following for larger, long-term gains.

- Flexibility and Adaptability

Such systems are flexible enough to adjust their strategies in response to varying conditions such as traders' objectives, risk tolerances, and market forces. Many such systems include a proposal validation and strategy refinement feature.

Customization Options

Algo trading systems are highly customizable, letting traders adjust strategies based on their goals, risk tolerance, and market conditions, with tools for testing and refining strategies. It allows you to start building a simple algo indicator in the initial journey.

How Does It Work?

Algo trading generally follows this simple workflow:

- Market Analysis: The algorithm scans real-time market data to spot patterns or signals.

- Decision Making: Based on pre-set rules, the algorithm decides whether to buy or sell. As per the criteria mentioned by user.

- Execution: It sends orders to the market automatically through broker.

In the case where an individual is a novice or someone who seeks to refine his or her way of executing algorithmic trading,here algo trading guide could be invaluable. Such a guide provides training from understanding market signals to coding basic algorithms and validating them against historical data so that optimum strategies can be tested out in the real world. In addition, it will also provide tips on qualified platform selection and help in avoiding mistakes like overfitting the strategy and neglecting risk management.

As an example of a moving average strategy, an algorithm goes long on a stock when its price crosses above a specific level and sell when its price crosses below. These criteria which can be coded by user and Algo follows the same to initiate the order.

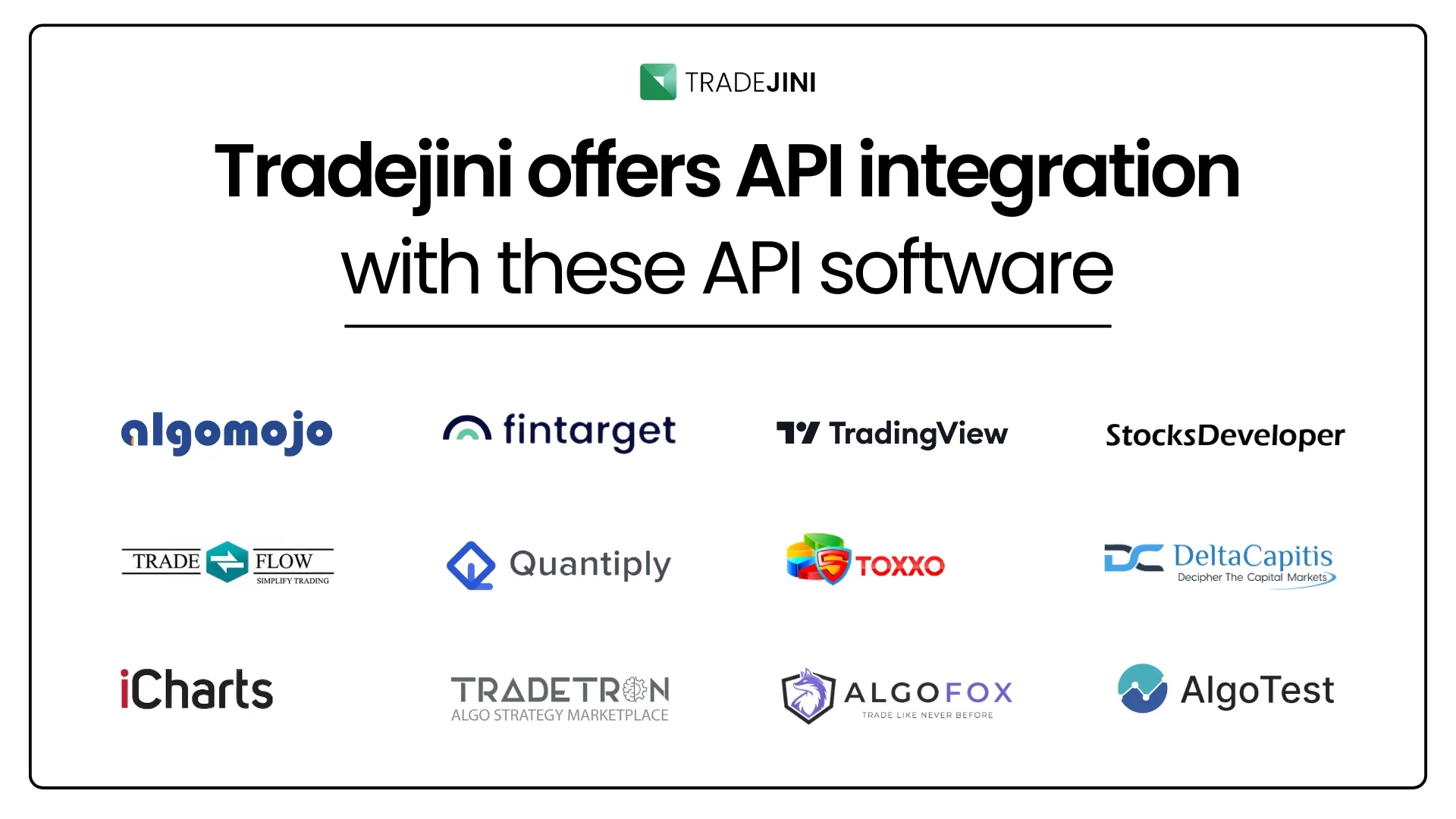

Tradejin offers its users free API integration, providing access to a wide range of algorithmic trading platform.

Who Is Using It?

What was once reserved for hedge funds and big players at institutions is now being employed even by retail traders. This is because platforms such as TradeJini provide an API and user-friendly software, and an individual having basic knowledge of programming can also experiment. Algo trading for stocks and intraday algo trading both can be used by applying strategies as per the criteria defined.

Challenges to Be Aware

It is not all rainbows and sunshine. Algo trading is no magic wand that would bring in profit. Here are some challenges:

- Complexity: Developing a trustworthy algorithm demands a certain level of knowledge in programming, finance, and the behavior of markets. Additionally the strategy should be backtested and it should be a profitable strategy only then it can generate you good ROI.

- Overfitting: Algorithms are sometimes over-designed for past data, and performance suffers in real time.

- Market Impact: Algorithms create volatility by causing flash crashes.

How does this Algo trading work with API integration

It is very surprising user puts code in API software and the trade is generated in the broker terminal. Is this some magic? There is some connection lets learn and look into it automated trading platform process

To get started, the user first needs to link the API software to the broker portal. After that, they also need to connect the broker within the API software. This connection ensures that any trading strategies created in the API software are automatically sent to the broker for execution. Orders can only be placed once the broker and API are properly linked, allowing seamless strategy execution.

Is Algo Trading the Future?

Algo trading in India is witnessing a fast growth pace, especially since SEBI opened the doors to its use back in 2008. In fact, now, a huge part of trading volume on NSE is contributed by algorithms. With ever-increasing internet penetration and accessibility to trading platforms, algo trading is no more a distant dream for retail traders.

But remember, while technology can enhance trading, it is not a substitute for understanding the markets. Whether you are a seasoned trader or a newbie exploring algo trading, the golden rule remains: Know what you are doing.

Algo in Action:

Algorithmic trading is revolutionizing the way we look at markets, making them more efficient and accessible. However, as with any tool, its effectiveness depends on how it is used. If you are someone who loves numbers, patterns, and the thrill of the markets, algo trading might just be the perfect match for you. So, are you ready to let the machines do the heavy lifting while you focus on strategy? Let's get trading—algorithmically!

Disclaimer: This blog is for informational/educational purposes only and does not constitute financial or investment advice. Readers should conduct their research and consult professionals before making any investment decisions. The author is not responsible for any financial outcomes.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

_11zon%20(1).webp?alt=media&token=dc59a5d2-1294-4cbe-8e08-3a0ac216596e)