Trading Across Time Zones, The Global Market Timings in IST

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

Investing in global stock markets has become easier than ever for Indian investors. With just a few clicks, you can participate in exchanges across continents—from New York to Tokyo. However, to make the most of this access, understanding the trading hours of different stock markets in Indian Standard Time (IST) is crucial. Whether you’re tracking global trends, trading international stocks, or analyzing how global cues impact the Indian markets, knowing the timings can help you plan smarter trading strategies.

Let’s explore the trading hours of major stock exchanges around the world, all converted to IST for your convenience.

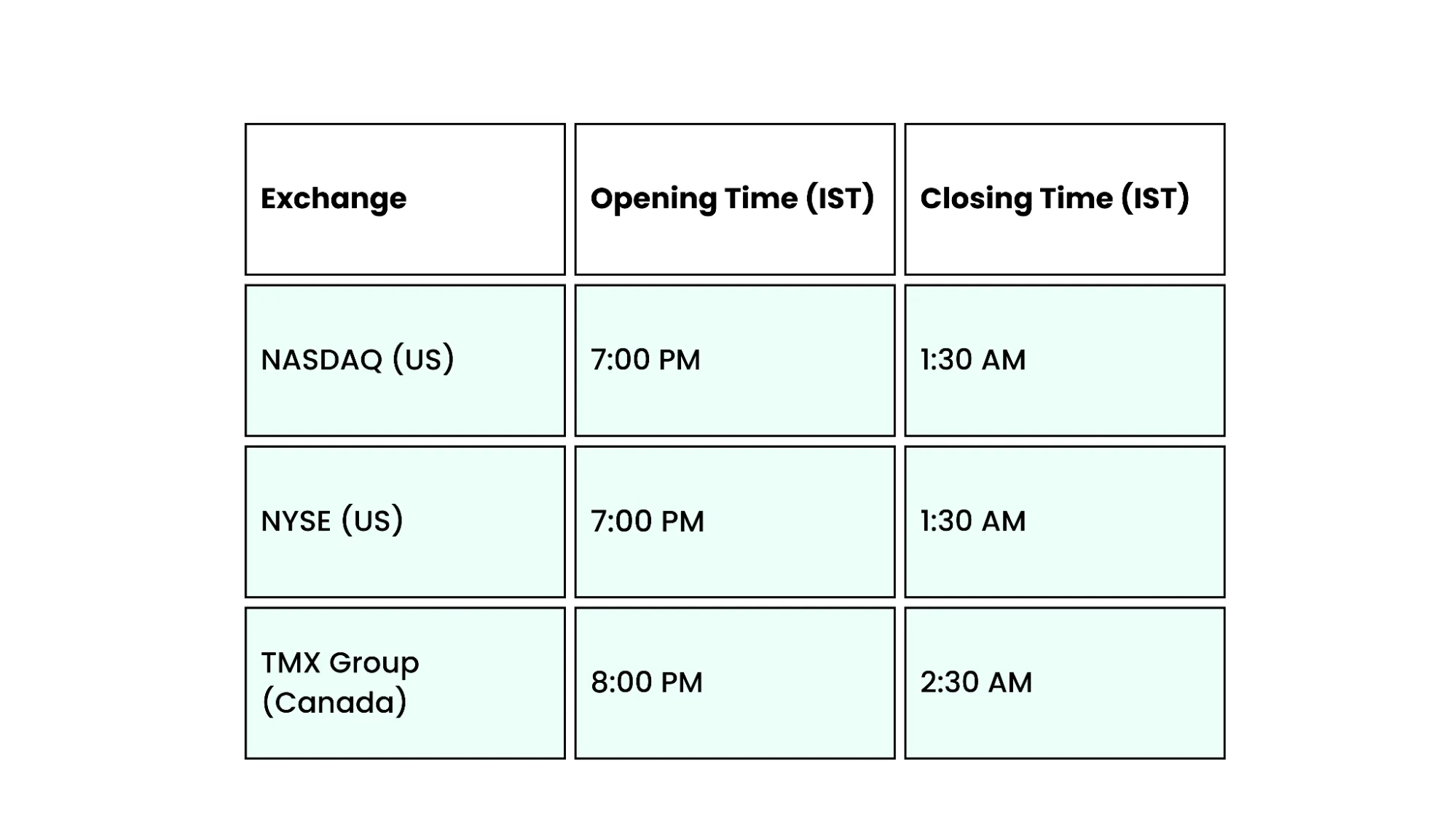

North American Stock Market Timings (in IST)

North America is home to two of the largest stock exchanges in the world—the New York Stock Exchange NYSE trading hours and the NASDAQ trading hours. These exchanges significantly influence global market sentiment. Canada’s Toronto Stock Exchange (TMX) also plays a key role in the region. The US stock market open time and close time as below.

Key Insight:

Since these exchanges open in the evening and close late at night in India, they are mostly followed by night traders and professionals tracking after-hours global cues.

Movements in US indices like the Dow Jones, S&P 500, and NASDAQ Composite often influence the opening direction of the Indian markets the next day.

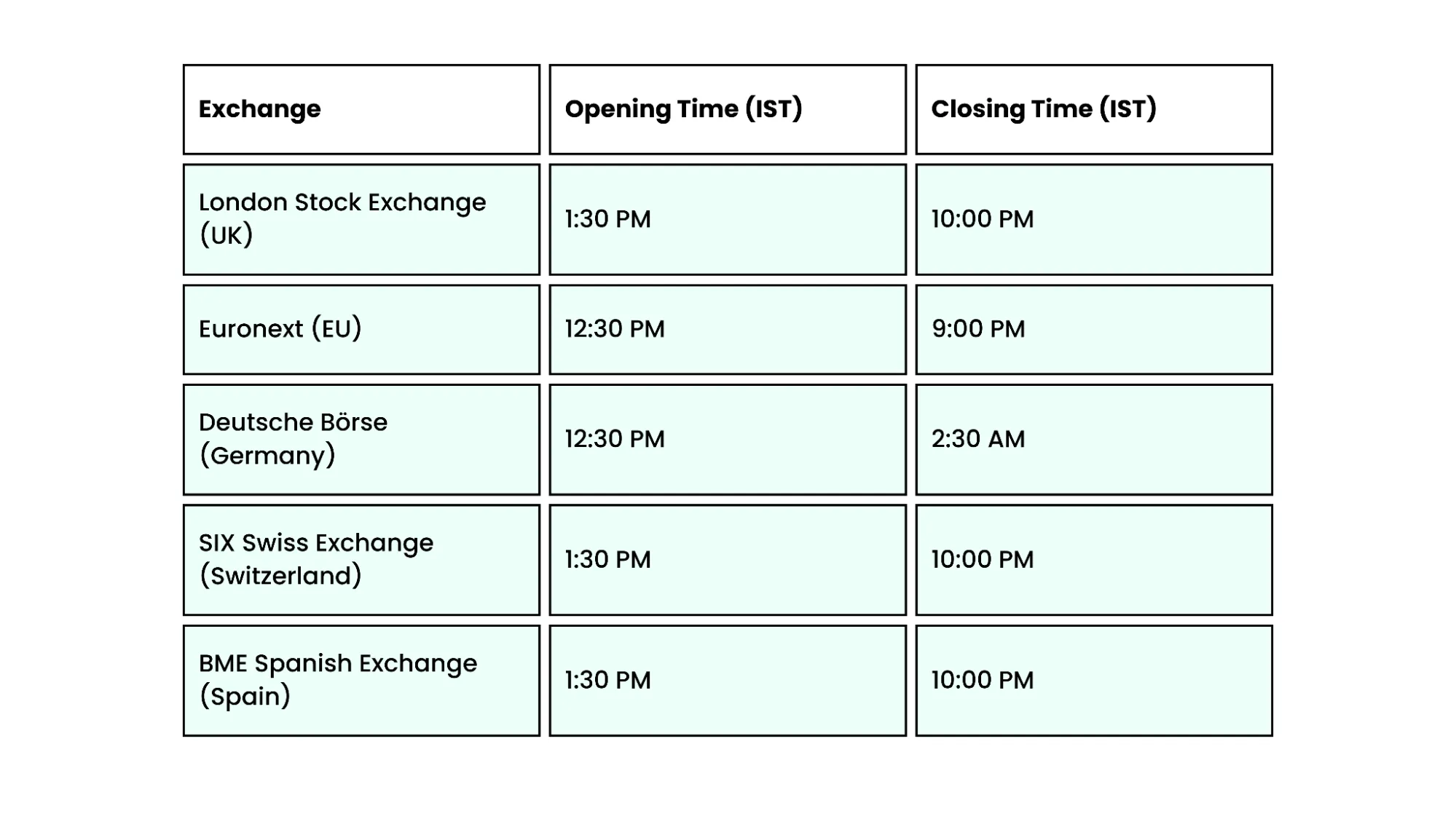

European Stock Market Timings (in IST)

Europe has some of the oldest and most influential stock exchanges, such as the London Stock Exchange (LSE) and Euronext. These markets often overlap with the Indian trading hours, making them highly relevant for investors tracking foreign cues.

Key Insight:

Since European exchanges open around midday IST, Indian traders can track them during local market hours. The overlap with the US pre-market session also makes it a key period for international trading activity.

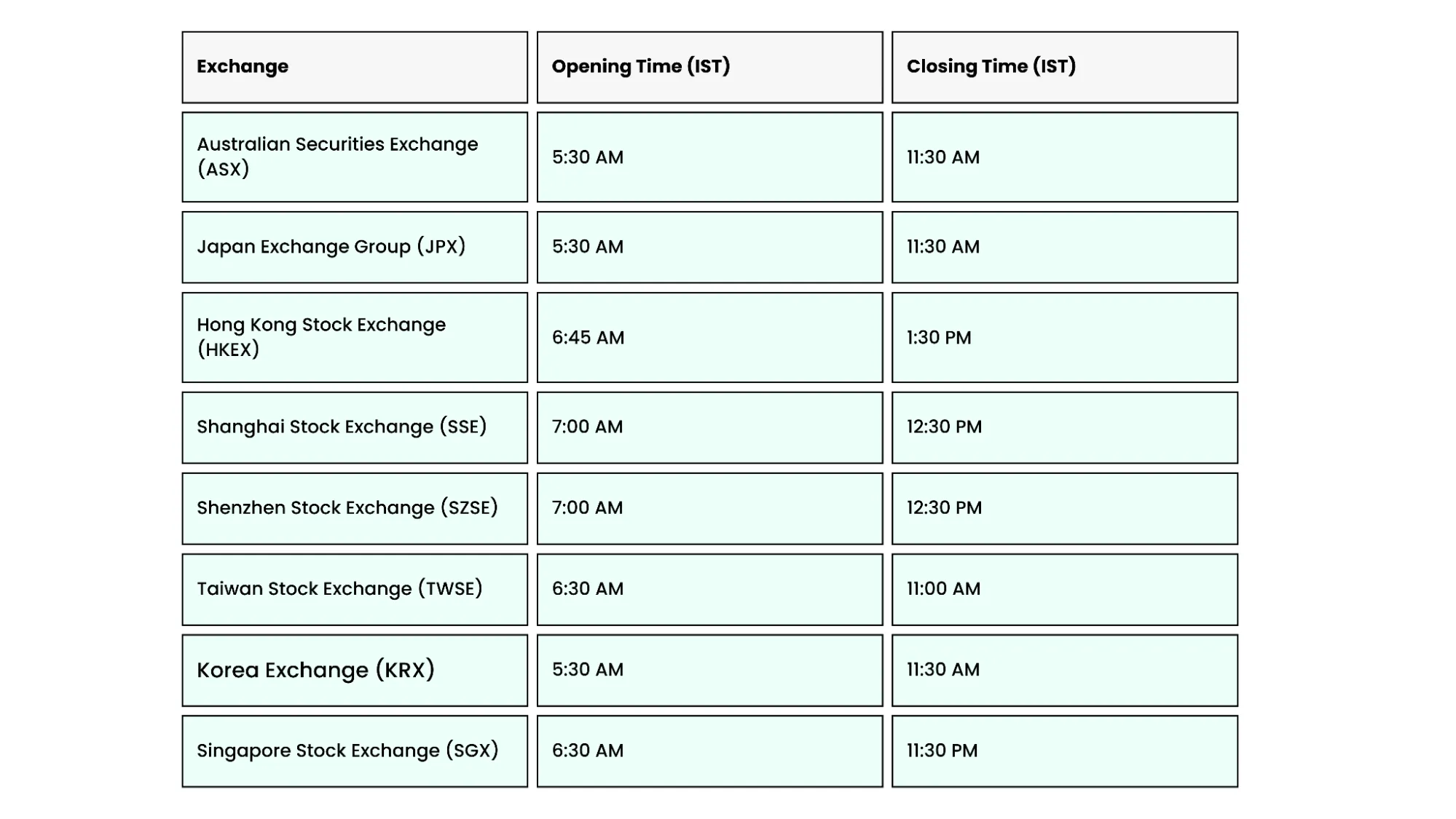

Asia-Pacific Stock Market Timings (in IST)

The Asia-Pacific region is home to some of the largest and most active exchanges, including the Shanghai Stock Exchange (SSE), Japan Exchange Group (JPX), and Hong Kong Stock Exchange (HKEX). Their movements often influence the opening of Indian markets due to their time zone proximity.

Key Insight:

These markets influence early-morning trends in India. For instance, movements in the Nikkei 225 (Japan) and Hang Seng Index (Hong Kong) can give clues about how the Indian markets might open.

GIFT Nifty – The Global Gateway for Indian Investors

The GIFT Nifty, traded on the NSE International Exchange in GIFT City, Gujarat, offers a bridge between the Indian and global markets. Its extended trading hours allow Indian traders to participate in the overnight price action of global indices.

-

Session 1: 6:30 AM – 3:40 PM IST

-

Session 2: 4:35 PM – 2:45 AM IST

Key Insight:

GIFT Nifty provides Indian traders with a way to trade on global cues even after the domestic markets have closed, helping them capture extended-hour movements.

Why Do Global Market Timings Matter?

For Indian investors, tracking international market hours is more than just a time check—it’s a strategic advantage. Here’s why it matters:

-

Impact on Domestic Markets:

Movements in major global indices, such as the Dow Jones, NASDAQ, or FTSE 100, often influence the opening sentiment of the Indian stock market.

-

Pre-Market and After-Hours Trading:

Some global exchanges allow pre-market and after-hours trading, giving investors insights into market sentiment before the official opening.

-

Currency and Commodity Impact:

Global markets also impact currency and commodity prices, affecting stocks and sectors in India. For instance, fluctuations in crude oil prices in the US can directly impact Indian oil and gas companies.

Track and Trade

Global stock market timings in IST are crucial for Indian investors looking to expand their portfolios or anticipate international market trends. By aligning your trading strategies with global market hours, you can enhance your ability to make well-timed, informed decisions. Whether you are a trader aiming to capture cross-border opportunities or an investor seeking to diversify, keeping track of global market timings can help you stay ahead.

Disclaimer: Tax loss harvesting is a tax-saving strategy that involves selling investments at a loss to offset capital gains. However, it should not be the sole reason for altering your investment decisions. Always consider your long-term financial goals and consult with a financial advisor or tax professional to understand the implications and ensure compliance with tax regulations

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)