A closer look at Laurus Labs beyond the market noise

_11zon.webp?alt=media&token=984f6439-6c74-4487-9e58-85d72206365e)

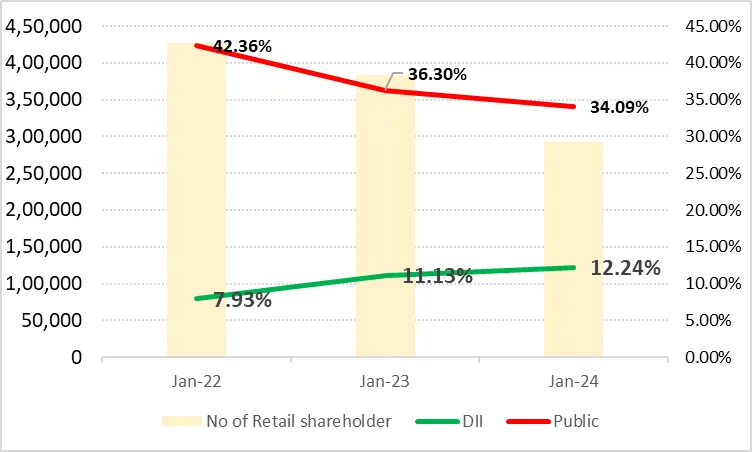

Laurus Labs has been one of the most talked-about stocks on social media in recent years. The company’s share price dramatically rose from ₹85 to ₹700. The stock price declined and settled around ₹500 mark by Jan 2025. Back in March 2022, 4.2 lakh retail investors held positions in Laurus. But by December 2024, the numbers had dropped sharply to 2.85 lakh, with over 1.35 lakh investors selling their shares. Interestingly, during the same period, Domestic Institutional Investors (DIIs) increased their stake from 7.93% to 12.24%.

At Tradejini, we decided to explore Laurus Labs and understand its business model, financials, and whether the management has followed through on its commitments over the years.

What does Laurus Labs Do?

Contract Development and Manufacturing Organization (CDMO):

In simple terms under the CDMO business model, Laurus acts like a ‘hired chef’ for big pharmaceutical companies. ‘Synthesis’ means they make special ingredients (not the final medicine) that these companies need for their new drugs. For instance, a big U.S. company is inventing a new cancer drug. They ask Laurus Lab to figure out how to make a key chemical for it and then produce large quantities of it (manufacturing). Laurus Lab does the tricky lab work and delivers the essential ingredients.

Generic FDF (Finished Dosage Formulations)

Generic FDF refers to the final form of medicine that you pick up from a pharmacy, such as tablets, capsules, or injections. ‘Generic’ means it is not a brand-name drug (like Tylenol) but a more affordable alternative that offers the same therapeutic effect as branded drugs at a lower cost.

For example, Laurus manufactures an HIV pill that combines three key ingredients: Tenofovir, Lamivudine, and Dolutegravir. These ingredients are mixed and made into a tablet, and the final product. That’s an FDF!

Active Pharmaceutical Ingredients (API)

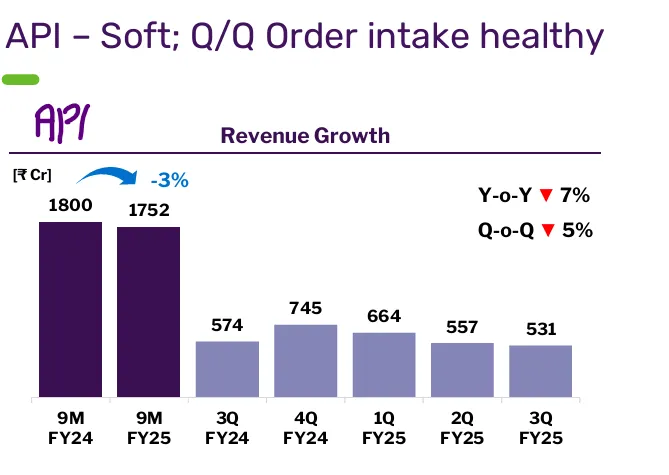

APIs are the key chemicals that pharmaceutical companies use to make medicines. Laurus produces these chemicals, which are then used by major drug companies to manufacture medicines. Laurus specializes in APIs for HIV treatments, cancer drugs, and diabetes medications. Cancer drugs, in particular, are complex to make and highly valuable. Laurus has one of India’s biggest facilities for manufacturing these high-potency chemicals. API Sales have been declined in this segment by 3%

Key takeaways

-

The company funded its capital expenditure through debt, leading to ₹110 crore in annual interest expenses.

-

It has maintained an average operating profit margin of around 15%, with the potential to increase to 20% if anticipated sales are met.

-

Laurus is investing ₹2,600 crore over three years to build new plants in the animal health and crop science segments of its CDMO business. By FY26, these new segments are expected to contribute ₹270–550 crore in revenue.

-

The company’s goal is to grow total sales to ₹6,700–7,300 crore by FY26 (from ₹5,041 crore in FY24) with stronger profit margins.

More than just molecules:

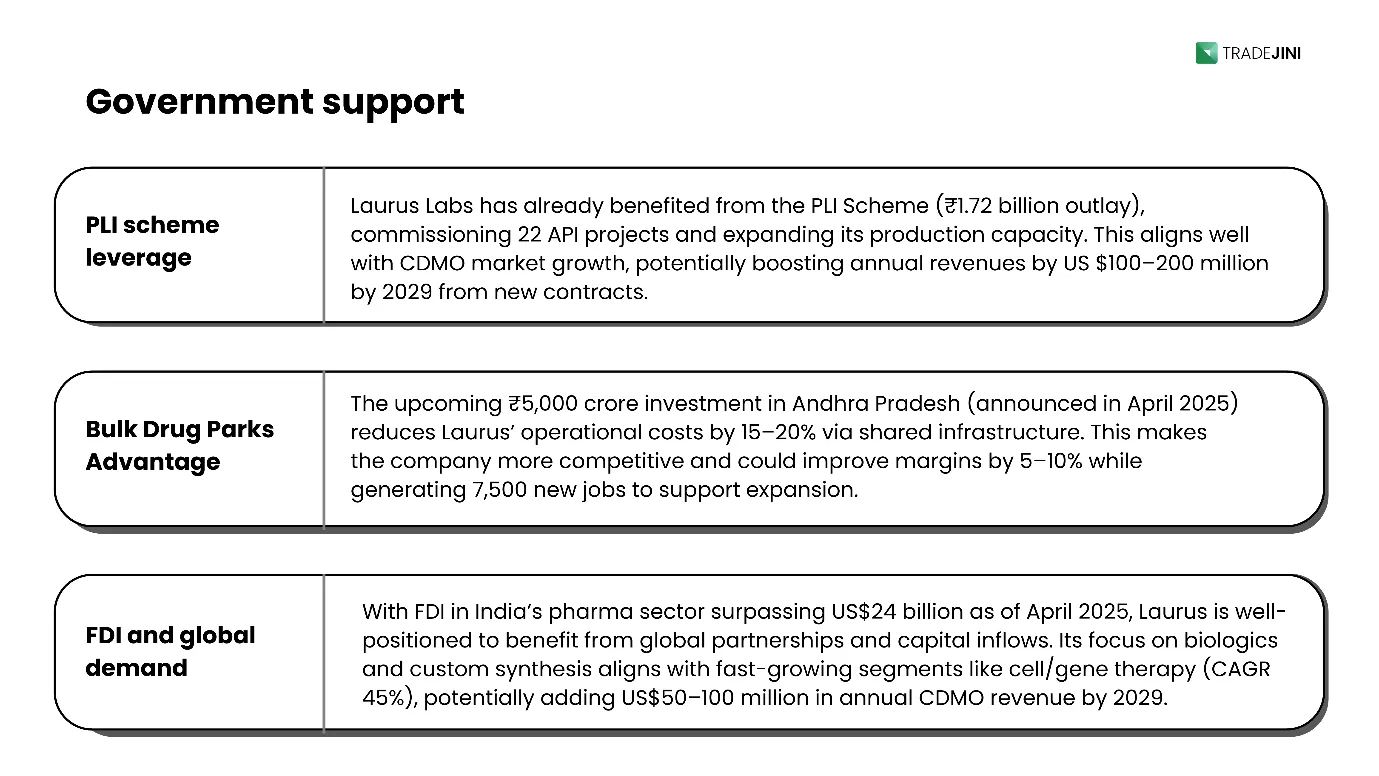

Laurus Labs stands to gain significantly from the CDMO market’s growth from US$15.63 billion to US$44.63 billion by 2029. Its strategic investments under the PLI Scheme and Bulk Drug Parks, combined with FDI-driven capacity expansion and a focus on high-growth areas like biologics, position it to increase revenues by 2-3x over current levels. The company’s cost competitiveness, enhanced by government initiatives, and its ability to secure long-term contracts with global pharma giants will drive profitability and market dominance, aligning perfectly with India’s rise as a CDMO powerhouse.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)