Analyzing India’s Battery Sector Through Amara Raja and Exide

As electric mobility gains momentum and the energy ecosystem evolves, India's leading battery firms, Amara Raja and Exide, are shifting gears. But behind the glossy EV headlines lies a deeper story of margins, market share, and capital bets.

According to a Crisil Ratings report, the domestic lead-acid battery industry is projected to grow by 10-11% in fiscal 2025, closely following the ~12% growth seen in fiscal 2024. This expansion will be driven by sustained demand in the automotive sector, along with increasing 5G adoption, 4G network expansion, the rise of data centers, and higher demand from the railway sector.

Growth in the automotive battery segment continues to fuel expansion in the lead-acid space, supported by both new vehicle sales and the replacement market. In response, manufacturers are investing in capacity expansion, backward integration into lead recycling, and diversification into lithium-ion batteries.

The Industry’s capital expenditure of ₹11,000-12,000 crore is planned between fiscals 2024 and 2026, leading to some increase in debt. However, strong cash flows and a stable operating margin of 12-13% are expected to support debt protection metrics and maintain credit stability.

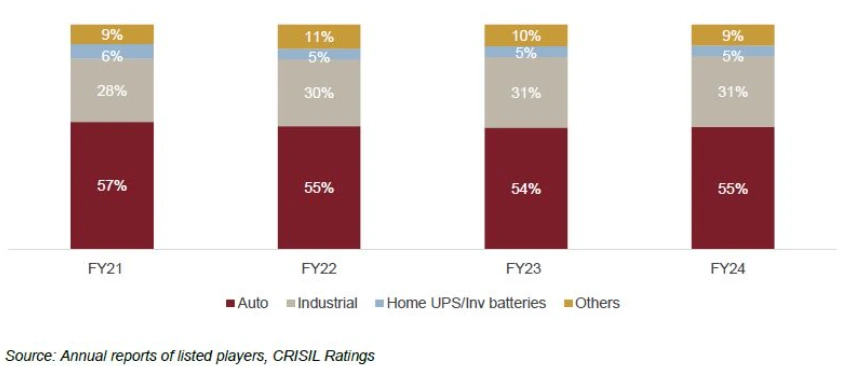

Led by Amara Raja Energy & mobility and Exide Industries, the five major lead-acid battery manufacturers account for over 80% of the industry’s revenue, underscoring these trends. Currently, about 55% of the sector’s revenue comes from the automotive market, with the remainder contributed by industries such as telecommunications, home inverters, healthcare, and railways.

Reducing automotive dependence

To reduce reliance on the cyclical automotive sector, major battery manufacturers are expanding into lithium-ion battery production, which serves a broad range of industries. Beyond electric vehicles (EVs), lithium-ion batteries are gaining traction in emerging sectors such as renewable energy storage, data centers, consumer electronics, and industrial power applications due to their high energy density, longer lifespan, and superior efficiency.

India continues to depend heavily on imports to meet its lithium-ion battery demand. Crisil Ratings says, over the past three fiscals, imports have surged by approximately 45%, reaching around ₹26,000 crore in fiscal 2024. The majority of these imports come from China, South Korea, and Japan, with China alone supplying over 75% of India’s requirements.

Despite the strong demand from EV, technology, and energy sector, domestic lithium-ion battery production will scale up gradually. Between fiscals 2025 and 2028, only 15-20 gigawatt hours (GWh) of capacity is expected to become operational, fulfilling just 25-30% of the projected requirement. To ensure stability, manufacturers are likely to establish supply agreements and offtake arrangements for a significant share of this capacity.

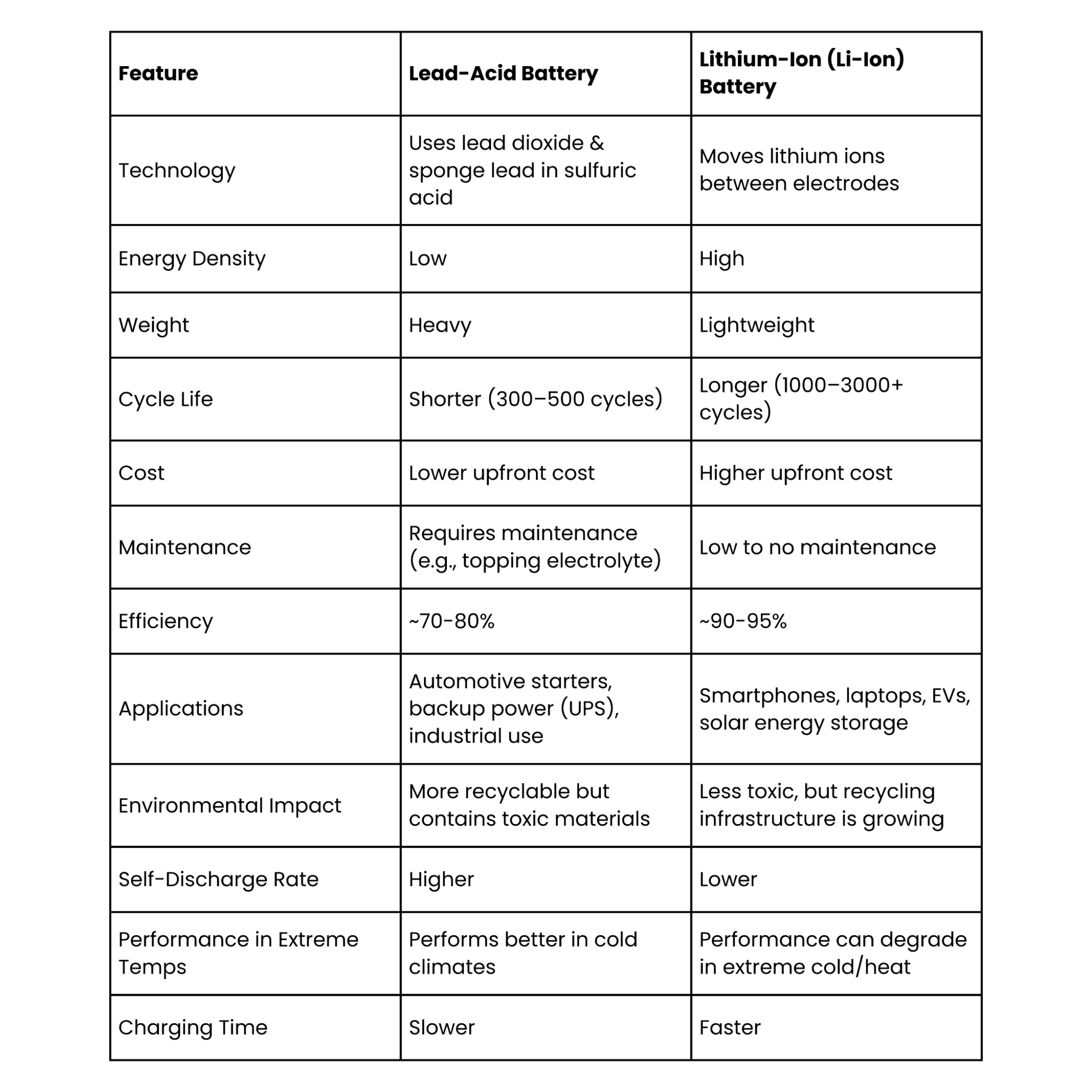

Difference between Lead-Acid battery and Li-Ion battery

Both battery types play crucial roles in energy storage, with lead-acid dominating legacy applications and lithium-ion leading modern, high-performance sectors.

1. Amara Raja Energy & Mobility Ltd.—Overview

Amara Raja Energy & Mobility Ltd. (ARE&M), one of India’s leading energy storage and mobility solutions providers, has built a strong presence in the lead-acid battery space across automotive and industrial segments. The company is best known for its flagship brand, Amaron, which is widely used in the Indian automotive aftermarket.

Amara Raja operates six manufacturing facilities in Andhra Pradesh and maintains a well-integrated supply chain supported by in-house plastic moulding and lead recycling capabilities. It serves both OEMs and the replacement market and exports to over 50 countries across Asia, the Middle East, and Africa.

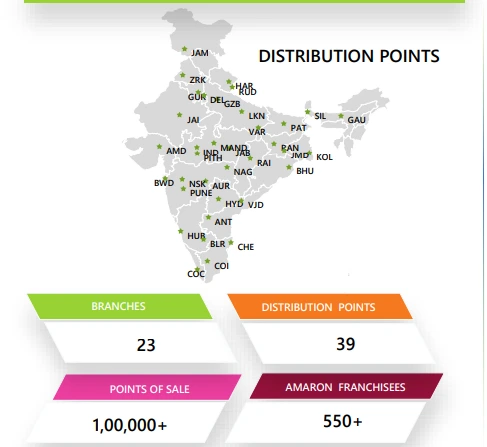

It operates through a strong nationwide network comprising 23 branches, 39 distribution points, over 10,000 points of sale, and more than 550 franchise partners, enabling strong market reach and customer service across India.

In line with India’s energy transition and EV ambitions, the company is making strategic investments in lithium-ion cell and pack manufacturing. It is developing a Gigafactory for Li-ion cells (initial 16 GWh) and a pack assembly unit (initial 2 GWh) under its energy and mobility strategy. This is supported by its Energy & Mobility incubation hub, 'Energizing the Future,' aimed at advancing R&D, prototyping, and innovation.

Amara Raja has also made investments in international technology companies, including a strategic stake in InoBat Auto (Slovakia), as part of its efforts to secure access to advanced cell chemistries and global battery tech.

Financially, Amara Raja maintains a conservative balance sheet, with low debt levels, healthy cash flows, and a history of consistent dividend payouts. The company is listed on Indian stock exchanges and enjoys strong investor confidence backed by stable operating performance and long-term growth visibility.

With a diversified product mix, forward-looking energy initiatives, and a reputation for quality and reliability, Amara Raja is well-positioned to benefit from the ongoing electrification and energy storage megatrends in India and beyond

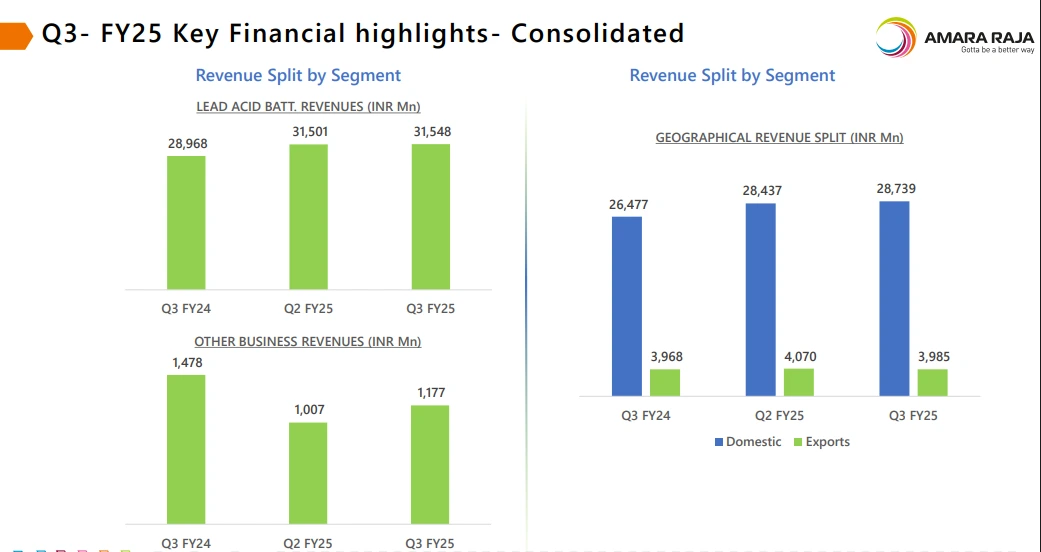

Amara Raja’s approximate revenue share between Lead-Acid & Li-Ion batteries

Amara Raja Energy & Mobility Ltd.’s revenue composition is dominated by lead-acid batteries, which contributed about 96% of total revenue in Q3 FY25. The remaining 4% comes from other segments, including lithium-ion batteries and new energy solutions. While Amara Raja is actively investing in lithium-ion technology and expanding its presence in new energy markets, the financial impact of these initiatives remains modest for now, with lead-acid batteries continuing to underpin the company’s financial performance

2. Exide Industries Ltd.—Overview

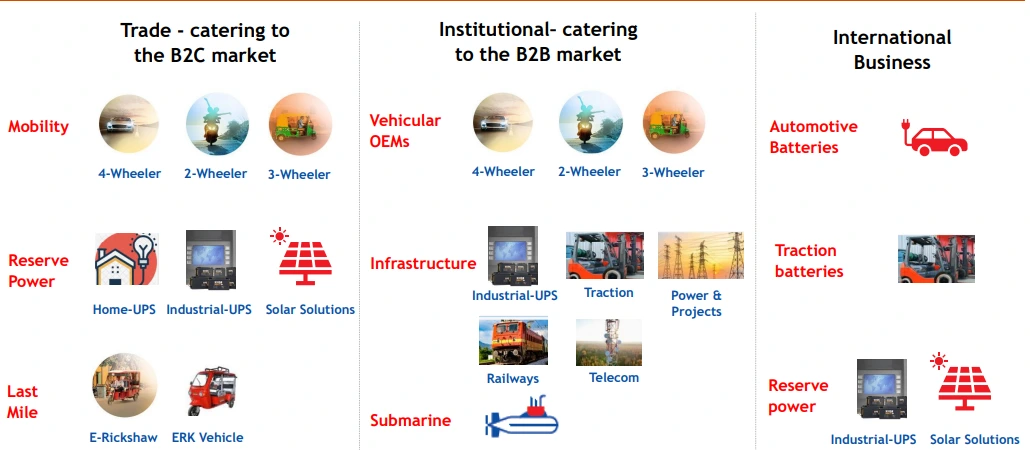

Exide Industries Ltd. is a market leader in India’s energy storage sector with a legacy of over 75 years. The company manufactures a wide range of lead-acid batteries and power storage solutions for automotive, industrial, inverter, and home UPS segments. Its products are exported to over 60 countries through a robust global network.

Exide operates 10 manufacturing facilities across India and has a presence in Sri Lanka, the UK, and Singapore. It is the only Indian battery manufacturer with three large lead recycling plants. The company also maintains an extensive distribution network with over 95,000 dealers and distributors.

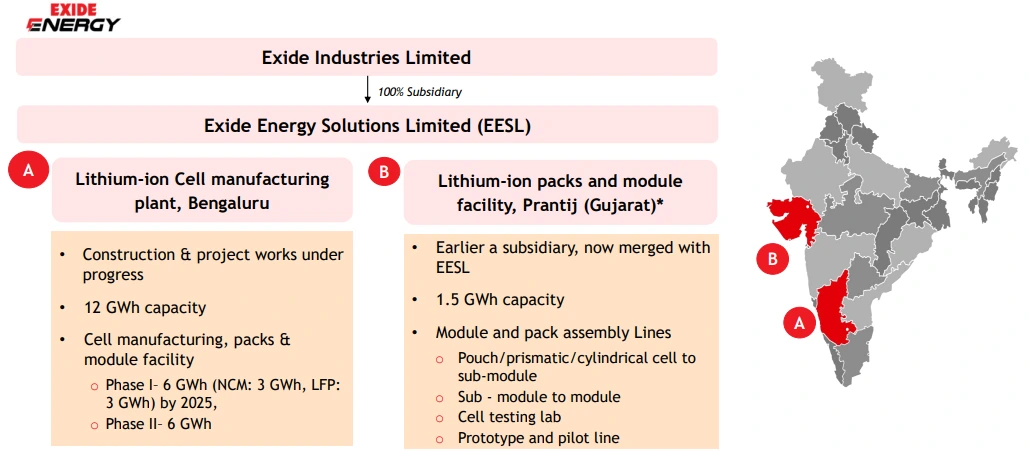

To support the energy transition and EV ecosystem, Exide, through its subsidiary, Exide Energy Solutions Ltd. (EESL), is setting up a 12 GWh lithium-ion cell manufacturing facility in Bengaluru, Karnataka. Construction is progressing with building work, equipment installation, and utility connections underway. The project is funded via a mix of internal accruals and loans, with a total equity investment of ₹2,852.24 crore (as of Oct 2024), including

Exide has partnered with global battery technology firm SVOLT to accelerate R&D capabilities and build in-house technical expertise. Simultaneously, it is expanding its team across functions and onboarding local and international suppliers to ensure supply chain readiness. Structured customer acquisition efforts are ongoing, including engagement with large OEMs across mobility and industrial segments.

Financially strong, Exide is a debt-free company, has been consistently profitable since its inception, and has been listed since 1979.

With a strong foundation, sustainable practices, and a forward-looking strategy, Exide Industries is well-positioned to benefit from India’s evolving energy and mobility landscape.

Exide’s approximate revenue share between Lead-Acid & Li-Ion batteries

As of the Q3 FY25 investor report, lead-acid batteries account for approximately 90–95% of Exide’s total revenue, reflecting their status as the company’s core business and primary revenue driver. In contrast, lithium-ion batteries contribute less than 5% of revenue, as this segment is still in its early stages, with significant commercial production expected to commence from FY26 onwards.

Financial performance comparison of Amara Raja & Exide

1. Market share and market cap

| Metric | Amara Raja | Exide |

|---|---|---|

| Market Cap | ₹ 19,000 Cr. (approx) | ₹ 32,500 Cr. (approx) |

| Market Share | Second biggest player | Highest market share |

Exide Industries holds a larger market capitalization of ₹32,500 crore compared to Amara Raja Batteries' ₹19,000 crore. It also commands a greater market share in the domestic battery market, while Amara Raja Batteries is the second-largest player. Its higher market presence is largely attributed to its extensive manufacturing capacity and strong foothold in the industry. Exide further strengthens its position with a dominant share in the replacement battery segment.

2. Revenue & growth trends

| Metric | Amara Raja | Exide |

|---|---|---|

| Sales TTM | ₹ 12,228 Cr. | ₹ 17,075 Cr. |

| Compounded Sales Growth (3 yrs.) | 16% | 17% |

Exide's higher sales growth is driven by its larger market share, though both companies have experienced similar growth rates. Amara Raja is entering the lithium-ion battery segment with significant investments in a gigafactory. Meanwhile, Exide holds an early-mover advantage in lithium-ion R&D through strategic collaborations with global technology partners.

3. Profitability analysis

| Metric | Amara Raja | Exide |

|---|---|---|

| Operating Profit Margin (OPM) | 14% | 11% |

| Profit After Tax (PAT) | ₹948 Cr. | ₹793 Cr. |

| 3-Year Compounded Profit Growth | 12% | 2% |

Amara Raja demonstrates stronger profitability and efficiency compared to Exide. It maintains a higher operating profit margin of 14% versus Exide’s 11%, indicating better cost management. Despite having lower revenue, Amara Raja achieves a higher profit after tax (PAT) of ₹948 crore, surpassing Exide’s ₹793 crore. Additionally, Amara Raja has significantly outpaced Exide in profit growth, with a three-year compounded profit growth rate of 12% compared to Exide’s 2%, highlighting its superior financial performance over the period.

4. Efficiency & return ratios

| Metric | Amara Raja | Exide |

|---|---|---|

| Return on Capital Employed (ROCE) | 18.7% | 10.2% |

| Return on Equity (ROE) | 14.0% | 14.0% |

| Asset Turnover Ratio | 1.34 | 1.02 |

Amara Raja demonstrates superior financial efficiency compared to Exide across key performance metrics. With a Return on Capital Employed (ROCE) of 18.7% against Exide’s 10.2%, Amara Raja utilizes its capital more effectively. Its Return on Equity (ROE) stands at 14.0%, nearly double Exide’s 7.05%, indicating stronger shareholder returns. Additionally, Amara Raja’s higher asset turnover ratio of 1.34 compared to Exide’s 1.02 reflects its ability to generate more revenue per unit of assets, further reinforcing its operational efficiency.

5. Valuation metrics

| Metric | Amara Raja | Exide |

|---|---|---|

| Stock P/E Ratio | 20.00 | 41.2 |

| Industry P/E | 24.40 | 24.40 |

| Price-to-BookValue (P/BV) | 2.61 | 2.36 |

| EV/EBITDA | 10.60 | 18.20 |

A comparison of valuation metrics indicates that Exide is trading at a higher premium than Amara Raja. Exide's Price-to-Earnings (P/E) ratio stands at 41, which is twice Amara Raja’s 20 P/E, suggesting that Exide is valued more aggressively by the market. While the industry P/E average is 24.40, Amara Raja trades below this level, whereas Exide trades above it. In terms of Price-to-Book Value (P/BV), Exide appears slightly cheaper at 2.36 compared to Amara Raja’s 2.61. However, the EV/EBITDA ratio, which measures valuation relative to earnings before interest, taxes, depreciation, and amortization, favours Amara Raja at 10.6 against Exide’s 18.20, indicating that Amara Raja may be the more attractively valued stock.

6. Financial stability & leverage

| Metric | Amara Raja | Exide |

|---|---|---|

| Debt-to-Equity Ratio | 0.05 | 0.14 |

| Current Ratio | 1.56 | 1.34 |

| Quick Ratio | 0.69 | 0.49 |

| Contingent Liabilities | ₹179 Cr. | ₹271 Cr. |

Both companies maintain strong financial stability, with Amara Raja having a lower debt-to-equity ratio of 0.05 compared to Exide’s 0.14. However, Amara Raja holds a slight advantage in liquidity, reflected in its marginally higher current ratio of 1.56 versus Exide’s 1.34, indicating a better capacity to meet short-term obligations. Its quick ratio of 0.69, compared to Exide’s 0.49, further underscores its stronger immediate liquidity. Additionally, Amara Raja’s contingent liabilities stand at ₹179 crore, significantly lower than Exide’s ₹271 crore, reinforcing its overall financial resilience.

Road ahead for battery manufacturers

The Indian battery industry is undergoing a significant transformation, supported by consistent demand in both automotive and industrial segments and accelerated by the country’s push toward energy transition and electrification. Lead-acid batteries continue to anchor the sector with steady growth, while lithium-ion technologies are emerging as the next frontier, offering opportunities across electric mobility, data centers, renewable energy storage, and other high-growth applications.

In this dynamic environment, Exide Industries and Amara Raja Energy & Mobility have emerged as key players shaping the industry's future. Exide brings decades of market leadership, a broad product footprint, and a proactive stance in lithium-ion research and development through strategic global collaborations. Its focus on backward integration, widespread distribution, and investments in advanced cell manufacturing positions it as a forward-looking, diversified energy storage company.

Amara Raja, meanwhile, stands out for its operational efficiency, financial prudence, and focused execution. The company has consistently delivered strong profitability and capital returns while simultaneously investing in next-generation battery technologies and strengthening its global capabilities. Its ongoing development of lithium-ion cell and pack manufacturing, supported by a structured R&D ecosystem, reflects its commitment to innovation and long-term relevance.

As the industry evolves in response to both domestic and global trends, these two companies are not only adapting to change but also driving it. Their strategies, rooted in both scale and innovation, will play a pivotal role in shaping the next phase of India’s battery and energy storage landscape.

*Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

.webp?alt=media&token=cea85b8e-d443-40d5-881a-25b098d9fba0)