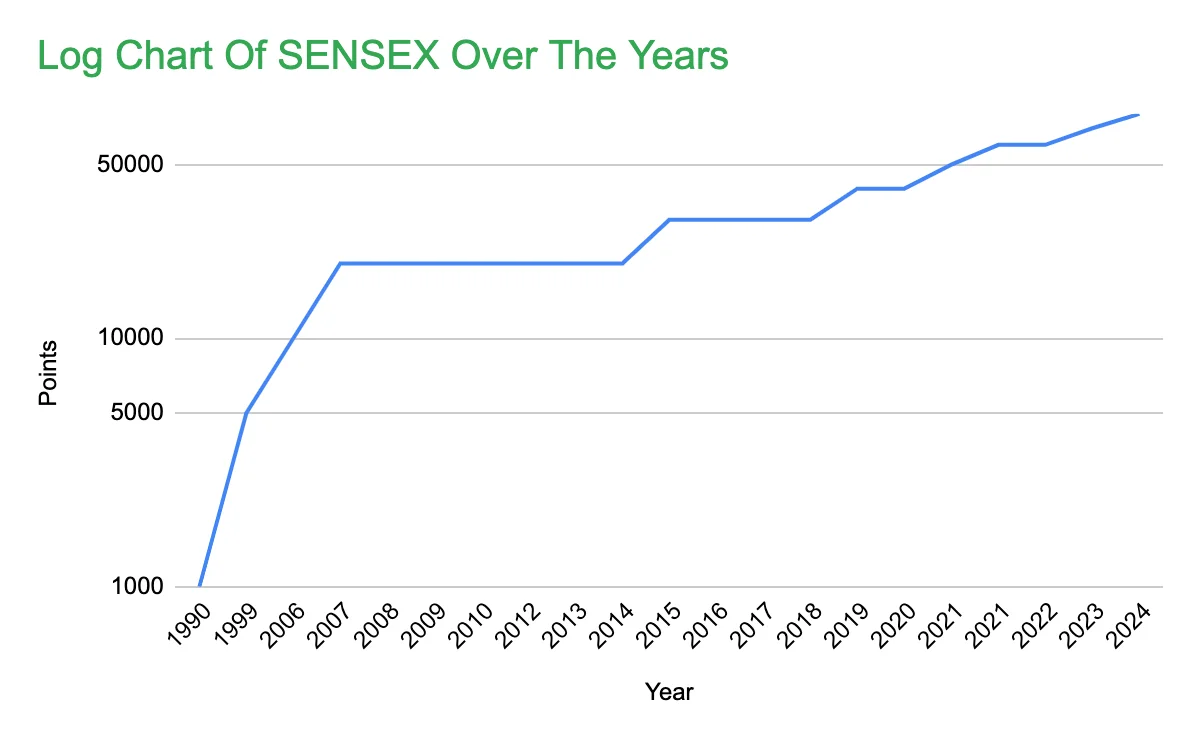

BSE Sensex crosses 80,000 mark!

The Sensex has served as a gauge of economic sentiment across time, indicating how the nation has responded to opportunities and challenges both domestically and internationally. There are various significant turning points along the way to 80,000 points, each of which signifies a turning point in the state of the Indian economy and market.

The Sensex has demonstrated incredible durability, rising from its starting point of about 550 points in January 1986 to over 74,000 points in 2024. From the early 1990s liberalization measures to the latest technological innovations and changes, the rise of the Sensex tells a tale of flexibility, hope, and sound economic policy.

1,000 Points (25 July, 1990)

It took the Sensex more than four years to climb by 1,000 points in the first place. Though it only took 270 sessions to reach the next 1,000 points. This milestone was important since it represented India's early stages of economic liberalization. This level denotes rising investor confidence and the start of significant inflows of both domestic and foreign capital into the market. Structural economic reforms began at this time, opening the door for further important turning points in the decades that followed.

5,000 Points (11 October, 1999)

Sensex, India’s benchmark stock index, touched the 5,000-point mark in October 1999, over 13 years since it started. The achievement reflected the optimism of the late 1990s, driven by strong economic growth, corporate earnings, and increasing foreign investment. The period also saw the rise of the information technology sector, which contributed significantly to market gains.

10,000 Points (February 6, 2006)

The Sensex crossing the magical figure of 10,000 points in February 2006 truly marked an important milestone after 20 years since its launch in 1986. Significant economic reforms, such as privatization, liberalization, and globalization, were implemented in India during this time. These reforms opened the door for international investments and set the stage for rapid economic growth. Stimulated infrastructure development and job creation brought about by the flood of foreign investors stimulated consumer expenditure and contributed to a growing economy. In the early 2000s, a huge inflow of foreign direct investment and the rise of the middle class propelled the Sensex to new heights as it crossed 11,000, 12,000, and 13,000 to 20,000 levels within two years.

20,000 Points (October 29, 2007)

Sensex showed remarkable growth, doubling to 20,000 in less than two years. The boom in the commodity market, the huge pull factor of the Chinese economy, and large foreign investments drove this swift change. IT, financial sectors, pharma, and healthcare were at the forefront. This rapid surge reflected strong investor confidence and the rapid pace of economic activities.

30,000 Points (March 4, 2015)

The move from 20,000 to 30,000 took almost a decade, with the Sensex crossing 30,000 in March 2015. The 2008 global financial crisis posed a challenge, but steady economic policies and strong corporate earnings ensured sustained growth. This increased productivity, supported long-term development, and attracted more global investors. The recovery phase highlighted the resilience of the Indian economy and the strength of its corporate sector.

40,000 Points (May 23, 2019)

The Sensex moved to 40,000 points by May 2019 after a journey of four years. Domestic economic reforms, including the GST adoption, boosted business confidence. A stable political environment after the 2019 elections added to positive market sentiments, signaling to foreign investors that India was on the right economic track. Despite challenges like demonetization in 2016, incremental flows into the market supported the growth.

50,000 Points (January 21, 2021)

The Sensex breached 50,000 in almost two years as markets rebounded from pandemic lows. Prompt government stimulus programs, vaccine rollouts, and a global economic recovery contributed to this milestone. Domestic retail investors showed consistent confidence, with monthly SIP contributions highlighting the strength of domestic investment offsetting foreign selling.

60,000 Points (September 24, 2021)

Fastest-ever, the Sensex reached 60,000 points within just eight months of crossing 50,000 in January 2021. Tech-savvy corporate earnings, robust domestic consumption, and strong international investment sentiments fueled this surge. Massive retail participation and optimism in technology and growth sectors further propelled the index levels.

70,000 Points (December 11, 2023)

The Sensex reached 70,000 in December 2023 after just over two years. Sustained investor confidence and recovery from the pandemic-induced crisis were key factors. Technology and pharmaceuticals played significant roles, alongside trends of digitalization and innovation.

80,000 Points (July 3, 2024)

The latest milestone of 80,000 points was achieved in less than a year, reflecting continued resilience and optimism in the economy. Strong corporate performance, robust foreign and domestic investments, and positive macroeconomic conditions underscored this achievement. It highlights the long-term potential of the Indian economy and the confidence of investors in its future.

Conclusion

The Sensex's long-term climb demonstrates development, stability, and sound economic policy, despite dips during the 2008 financial crisis and the 2020 pandemic. Supported by domestic inflows, restrained inflation, and government infrastructure spending, the index is expected to approach six figures soon. Each 10,000-point milestone marks the state of the market and economy, showcasing stages of growth, investor trust, and significant reforms influencing the financial environment in India.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)