India’s Bankruptcy law to save airlines

.webp?alt=media&token=1a7cbe7f-841d-44e3-8fc9-a670e3b2df2a)

Introduction

Go First filed a voluntary application for Corporate Insolvency under the Insolvency and Bankruptcy Code 2016 (IBC) on 2nd May 2023. A key component of this filing was the moratorium imposed, preventing lenders and lessors from repossessing assets. For Indian airlines, lease payments form a significant portion of operating cash flows, making this development particularly impactful.

The moratorium initiated a series of legal disputes, highlighting India's historically unfavorable laws for lessors despite its status as a signatory to the Cape Town Convention, which protects lessors' rights to leased aircraft.

The Aviation Working Group (AWG), representing global aircraft lessors and manufacturers, downgraded India's rating and placed it on a negative watchlist, warning that lease costs could rise by 25%. Recognizing the need to mitigate these repercussions, the Indian Ministry of Corporate Affairs (MCA) issued a notification exempting aircraft-related transactions from the moratorium provisions under Section 14(1) of the IBC.

This policy shift was applauded globally, with AWG placing India on a positive watchlist. The Ministry estimates that this decision could save Indian airlines over $1.2 billion annually. Below, we examine its impact on publicly exposed aviation companies.

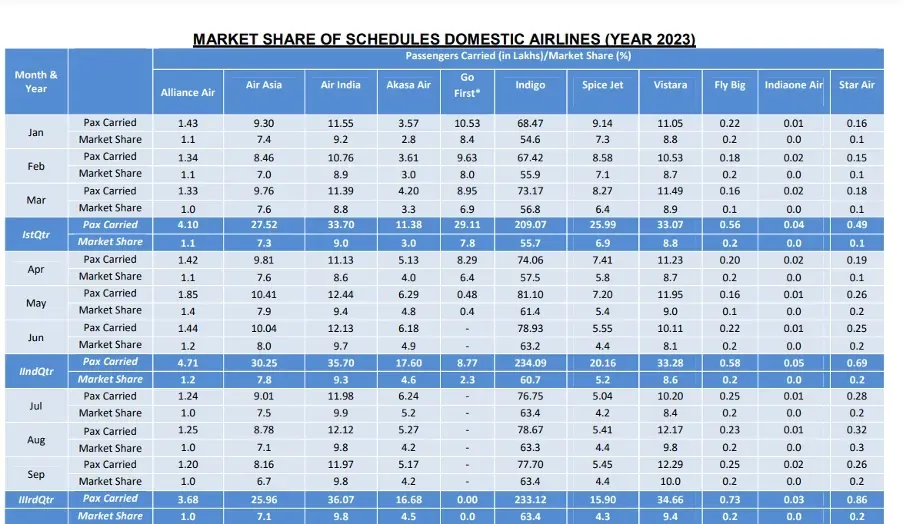

Market Overview: Indian Airlines by Domestic Air Traffic

Three airlines with public exposure dominate the domestic market: IndiGo (Interglobe Aviation Ltd), SpiceJet, and Go First (through its associate Bombay Burmah Trading Company). Other players, such as Air India, AirAsia, Vistara (under Tata Sons), and Akasa Air, remain privately held.

IndiGo (Interglobe Aviation Ltd)

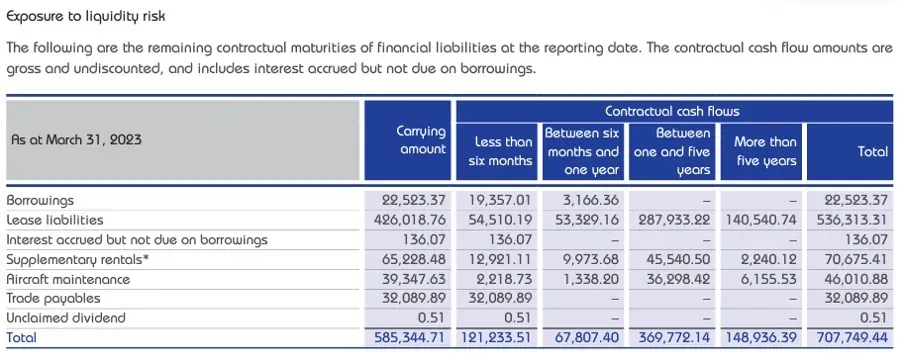

IndiGo is poised to be the largest beneficiary of the new law. As of 31st March 2023:

- Lease Liabilities: $6.5 billion (₹53,600 crore), with $4.8 billion due within five years. Lease liabilities account for 96% of IndiGo's total debt.

- Rental Costs: Expenditure on aircraft and engine rentals represents 28% of costs (down from 40% in the previous year) and 53% of operational cash flow.

IndiGo has made an order for over 1,000 airplanes from Airbus, with 47% of India’s 800 leased commercial aircraft under its operations. The exemption ensures cost stability for IndiGo, cementing its market leadership.

SpiceJet Limited

SpiceJet faces a unique scenario where the new law strengthens lessors’ positions:

- Legal Challenges: Four lessors have filed cases with the National Company Law Tribunal. SpiceJet claims it is close to settling dues with Celestial Aviation.

- Financial Health: With lease liabilities of ₹6,700 crore and a loss of ₹1,513 crore in FY23, SpiceJet’s ability to manage its obligations remains precarious.

- Recent Developments: SpiceJet issued 48.1 million shares to clear ₹231 crore of dues to nine lessors, and its promoter infused ₹500 crore for operational stability.

The new provisions may accelerate financial pressures on SpiceJet, as lessors now have increased leverage.

Go First

Go First’s insolvency directly impacts its parent entity, Bombay Burmah Trading Company (BBTC):

- Lessors' Advantage: The new law enables lessors to repossess Go First’s aircraft, limiting its operational recovery.

- Financial Exposure: BBTC had invested ₹944 crore in Go First, which it fully impaired in FY23. Remaining dues of ₹90 crore were also written off.

- Current Status: Go First has received one expression of interest from Jindal Power Ltd as part of its insolvency process. However, the new provisions may reduce Go First’s appeal to potential buyers.

Special Mention: Jet Airways

Jet Airways, though listed, has not operated for over four years and primarily generates revenue through aircraft leasing. The new policy has limited impact on its operations.

Implications for the Aviation Sector

The exemption from the IBC moratorium strengthens well-capitalized airlines like IndiGo while pushing weaker players like SpiceJet and Go First further into distress. The policy promotes consolidation in a historically fragmented and financially unsound sector, ensuring a more robust competitive landscape.

This shift reinforces India’s position as a viable market for global lessors, stabilizing lease costs and attracting further investment in the aviation sector.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)