How India’s Big Fat Weddings Are Moving Markets

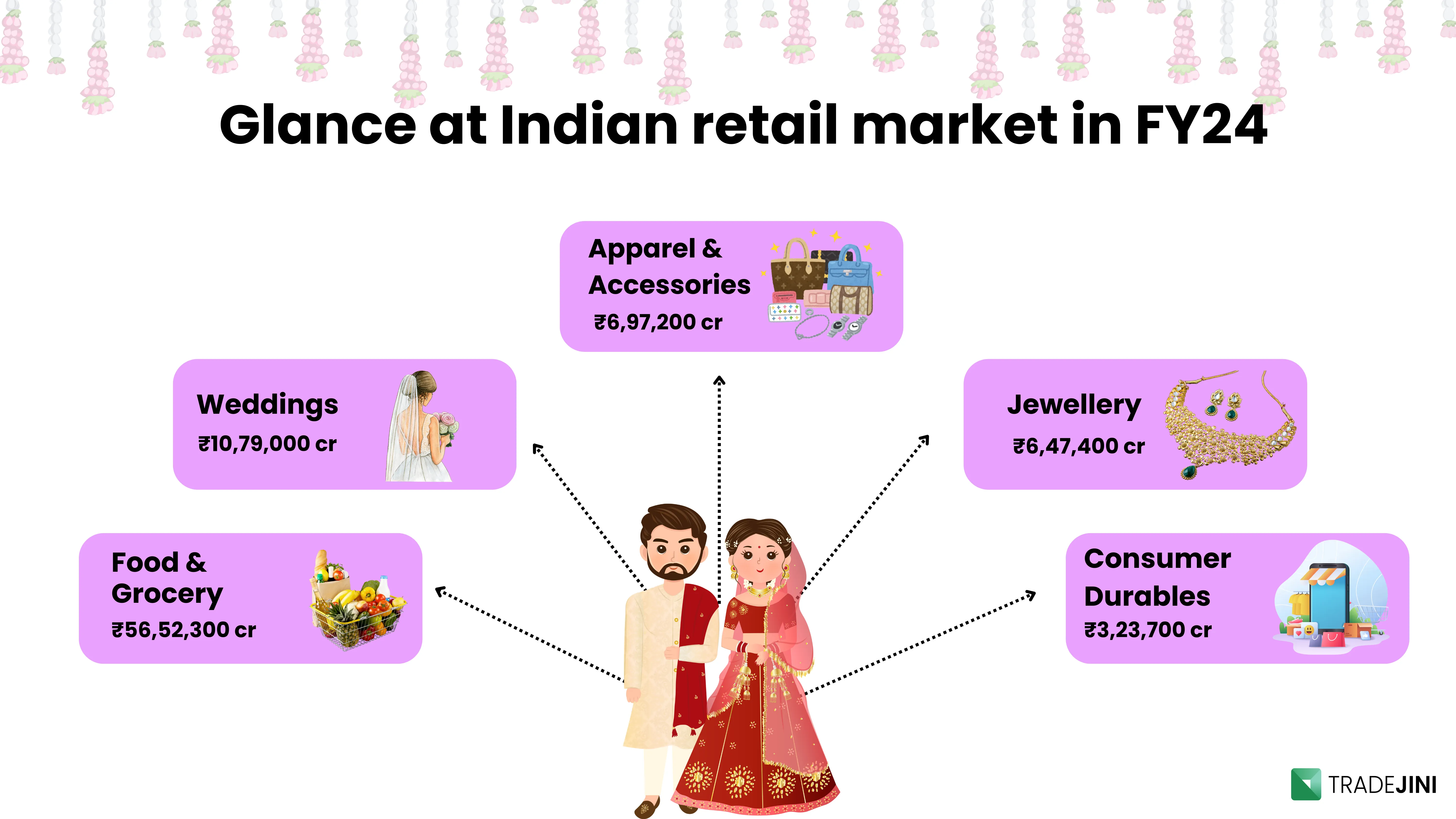

The Indian wedding industry is valued at approximately $130 billion, making it the fourth-largest sector in the country trailing only food, grocery, and real estate. In India, the wedding season is more than just a cultural celebration; it is a powerful economic engine that fuels demand across multiple sectors.

to a 2024 survey by CAIT (Confederation of All India Traders), over 42 lakh weddings took place between January and July 2024, generating an estimated ₹5.5 lakh crore ($66.4 billion) in expenditure.

These figures reaffirm the Indian wedding industry’s stature as one of the country's most powerful economic contributors. What has changed post-pandemic is how this sector is evolving driven by digitalization, lifestyle upgrades, and the aspirations of an expanding middle class.

Spending 3x the Annual Income

In India, the average wedding costs up to three times a family’s annual income (source: WedMeGood, Annual Wedding Industry Report 2023-24). That means if a household earns ₹8 lakhs a year, they might spend over ₹24 lakhs on a wedding, on everything from bridal fashion and makeup to venue hospitality, photography, and catering.

The Core Season and Spending Behaviour

India’s wedding season peaks in two waves:

-

November to mid-December

-

Mid-January to July

These periods often align with the festive calendar, boosting consumer spending. Spending cuts seen during COVID-19 have been replaced with a clear bounce-back: according to a survey by WedMeGood, guest sizes rose by 14.8% year-on-year, and the number of wedding functions increased from 3.2 in 2022 to 4.2 in 2023.

What is also noticeable is that financial responsibility is shifting. About 70% of couples contribute to their weddings (WedMeGood, 2023), with 59% of expenses split equally between families. This changing dynamic reflects not just evolving social norms but also India’s booming millennial and Gen Z workforce, 600 million strong, according to 2024 demographic data.

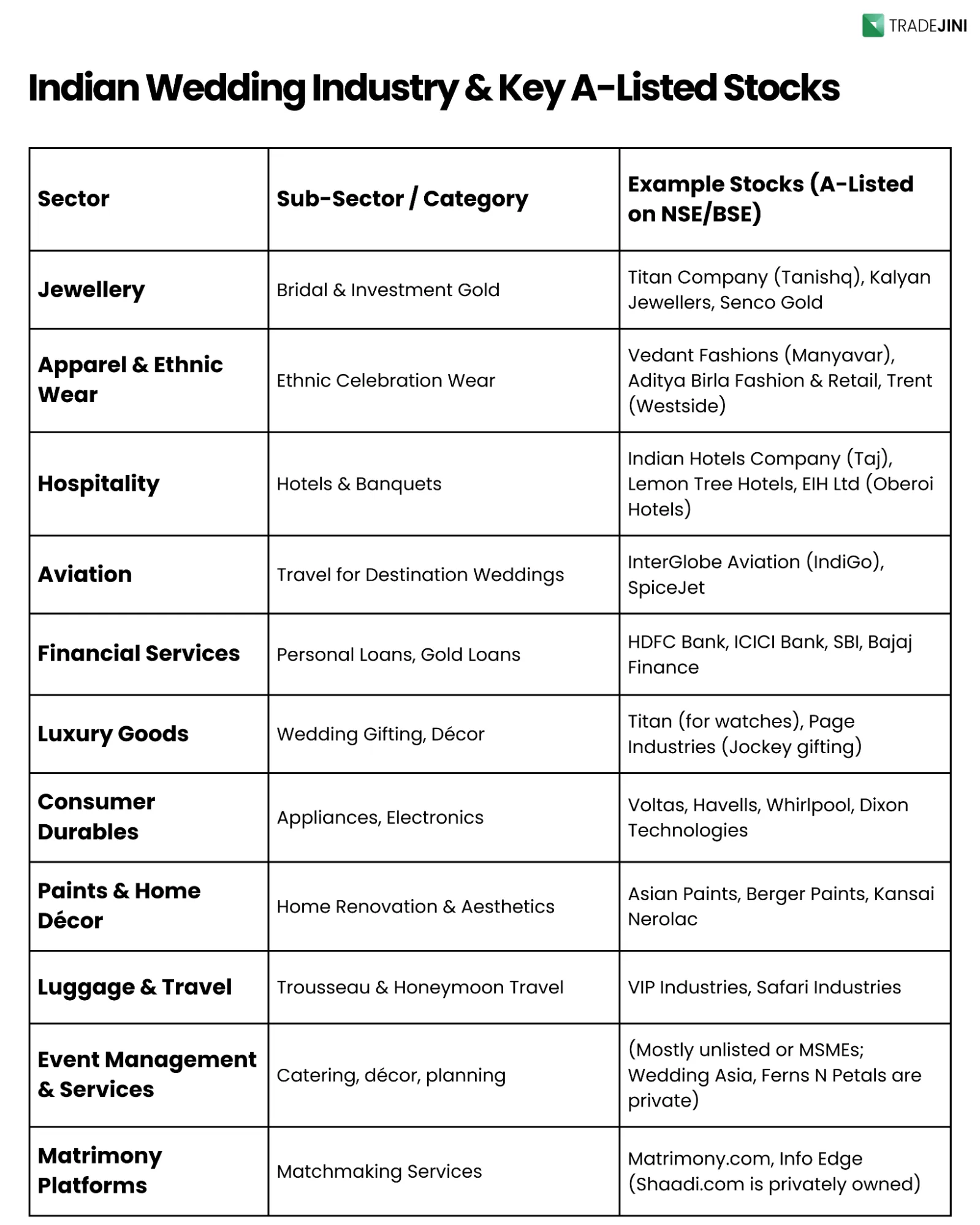

Which Sectors Benefit Most from Wedding Season?

If you're an investor looking to tap into seasonal or thematic opportunities, wedding season is one of the more underappreciated ones. Here's how the wedding boom translates into stock market gains across various sectors:

The wedding season is a rising tide that lifts many boats:

-

Hospitality & Tourism:

The destination wedding trend is turning heritage palaces and beach resorts into profit centers. The hotel sector alone books ₹5,000 crore ($603 million) in wedding-related stays annually (India Today, 2023).

-

Jewellery:

Weddings account for ₹60,000 crore ($7.2 billion) in annual gold jewellery purchases (Business Standard, 2023). With gold import duties reduced from 15% to 6% in early 2024, this trend is set to continue.

-

Apparel:

Wedding fashion drives ₹10,000 crore ($1.2 billion) annually in sales, fueled by rising demand for bridalwear and ceremonial clothing.

-

Logistics:

Transport services do see a spike, thanks to destination weddings and intercity guest movements.

-

Tech & Digital Services:

From wedding planning apps to virtual tours and e-invites, tech-enabled planning is on the rise. Even artificial jewellery and rentals are gaining traction; 36% of brides opted for artificial jewellery, and 16% went with rentals (WedMeGood, 2023).

Digital weddings are here

India’s wedding industry is rapidly going digital, from matchmaking apps to 3D venue walkthroughs and virtual gift registries. Premium subscriptions on matrimonial platforms rise ahead of peak seasons. Digital tools are reshaping how couples plan events, manage invites, and book services like photography and makeup.

Destination Weddings

In 2023, the Ministry of Tourism launched India’s first wedding tourism campaign, highlighting 25 scenic destinations to position India as a global wedding hub. This aims to repatriate some of the $12.1 billion Indians spend on weddings abroad.

Themes include:

-

Beach weddings

-

Royal palaces

-

Nature getaways

-

Himalayan escapes

Hotspots like Goa, Udaipur, Kerala, and Uttarakhand have seen increased bookings. 21% of weddings in 2024 were destination-based, up from 18% in 2022 (WedMeGood).

Employment & Economic Impact

The wedding industry is also a major employment generator, both in the organised and informal sectors (CAIT, Dec 2023). It provides livelihoods for a diverse ecosystem of planners, caterers, musicians, florists, designers, photographers, and artists.

As income levels rise and social media shapes consumer choices, the preference for premium and personalized experiences will likely grow stronger.

Band Baaja Budget

Weddings in India are no longer just cultural milestones; they are a serious economic engine. The ₹10.79 lakh crore wedding industry now competes with core sectors like FMCG, apparel, and electronics in market size.

For investors, this opens up a universe of stocks that benefit from wedding-driven spending. But like any theme, it's important to look beyond the glitter. Gold prices, discretionary income trends, and even weather can impact wedding frequency and expenditure.

‘So remember: in India, wedding bells often ring louder on the markets than you’d expect.’

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)