How RateGain is Unlocking ₹2000 Cr Potential

We have moved past the days when bookings were done over the counter, pricing was fixed for weeks, and hotel marketing meant glossy brochures. Today, tech dictates how fast, smart, and personalized your travel experience can be. And right at the heart of this digital shift sits RateGain Travel Technologies, quietly building the rails for the global travel industry.

RateGain Travel Technologies is a leading global SaaS (Software as a Service) provider offering innovative tech solutions to the travel and hospitality sector. Founded in 2004 and headquartered in India, the company has grown into one of the world's largest processors of hotel bookings, pricing intelligence, and customer travel intent data. RateGain helps its clients drive revenue through guest acquisition, retention, and wallet share expansion.

The company’s platform is used daily by 3,200+ customers and 700+ partners in over 100 countries, reflecting its wide-scale adoption and embeddedness in the travel ecosystem.

So, how is RateGain unlocking a ₹2000 crore revenue potential? Let’s break it down.

RateGain: Business Model simplified (as of 9MFY25)

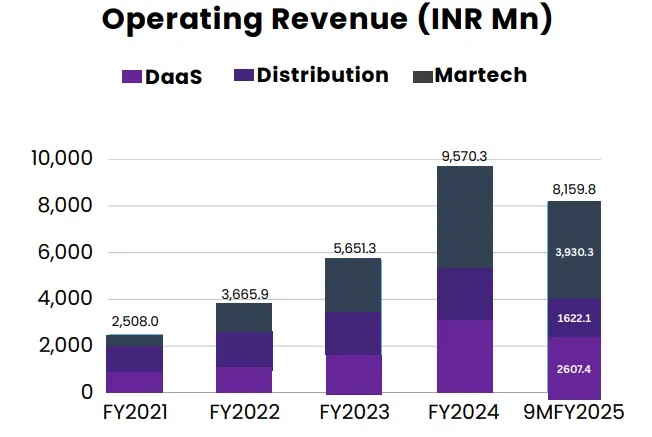

1.Marketing Technology (MarTech)—48% of total revenue

Travel and hospitality companies, including hotels and airlines, can efficiently manage and market their brands on websites like Google, TripAdvisor, and social media thanks to RateGain's MarTech solutions. Delivered through a subscription-based model, these tools support businesses in monitoring guest engagement, enhancing their digital presence, and increasing direct bookings without excessive dependence on intermediaries, making them essential tools in modern travel management strategies. RateGain’s suite of tools acts as an advanced travel agency software stack, supporting distribution, pricing, and guest engagement functions in a single platform.

This segment has witnessed significant growth, contributing 48.2% of the company’s revenue in the first nine months of FY25, up from 37% in FY23, reflecting the rising demand for digital marketing within the travel industry.

2.Data-as-a-Service (DaaS) – 32% of total revenue

This division provides real-time data and insights that enable travel companies to make more informed and dynamic pricing decisions. Leveraging RateGain's proprietary technology and APIs, clients can track competitor pricing, monitor price parity across multiple platforms, and gain a deeper understanding of traveller intent and booking patterns.

As pricing becomes more dynamic and competitive, more companies are relying on data tools, leading to an increase in DaaS revenue from 29% in FY23 to 32% in FY25.

3.Distribution—20% of total revenue

This segment serves as an essential link between hotels and online travel agencies (OTAs) and booking platforms like GDS (Global Distribution Systems). Using tools like RezGain and DHISCO, hotels can seamlessly share their room availability and pricing with platforms like Expedia, Booking.com, and any major online travel agency globally, while ensuring real-time updates to prevent overbookings and revenue loss, enabling every travel agency—from traditional firms to modern digital platforms, to seamlessly access hotel inventory. Despite its importance, the revenue contribution from this segment has declined from 34% in FY23 to 20% in FY25, as RateGain strategically shifts its focus toward higher-margin areas like MarTech.

Presence across the entire value chain

RateGain operates across all major touchpoints of the travel and hospitality value chain, serving both travel providers and intermediaries. Its client base includes 16 Global Fortune 500 companies, 26 of the top 30 hotel chains, and 4 of the top 5 airlines. The company also works with 7 of the top 10 car rental providers, 25 of the top 30 OTAs, as well as key players in the ecosystem such as GDS systems, Destination Management Organizations (DMOs), tour operators, and wholesalers—demonstrating its deep integration across the global travel landscape.

RateGain’s revenue mix

|

RateGain’s revenue model is diversified, with 42.2% generated through transactional engagement (hotel bookings), followed by 35.0% from hybrid models and 22.8% from subscriptions. |

|

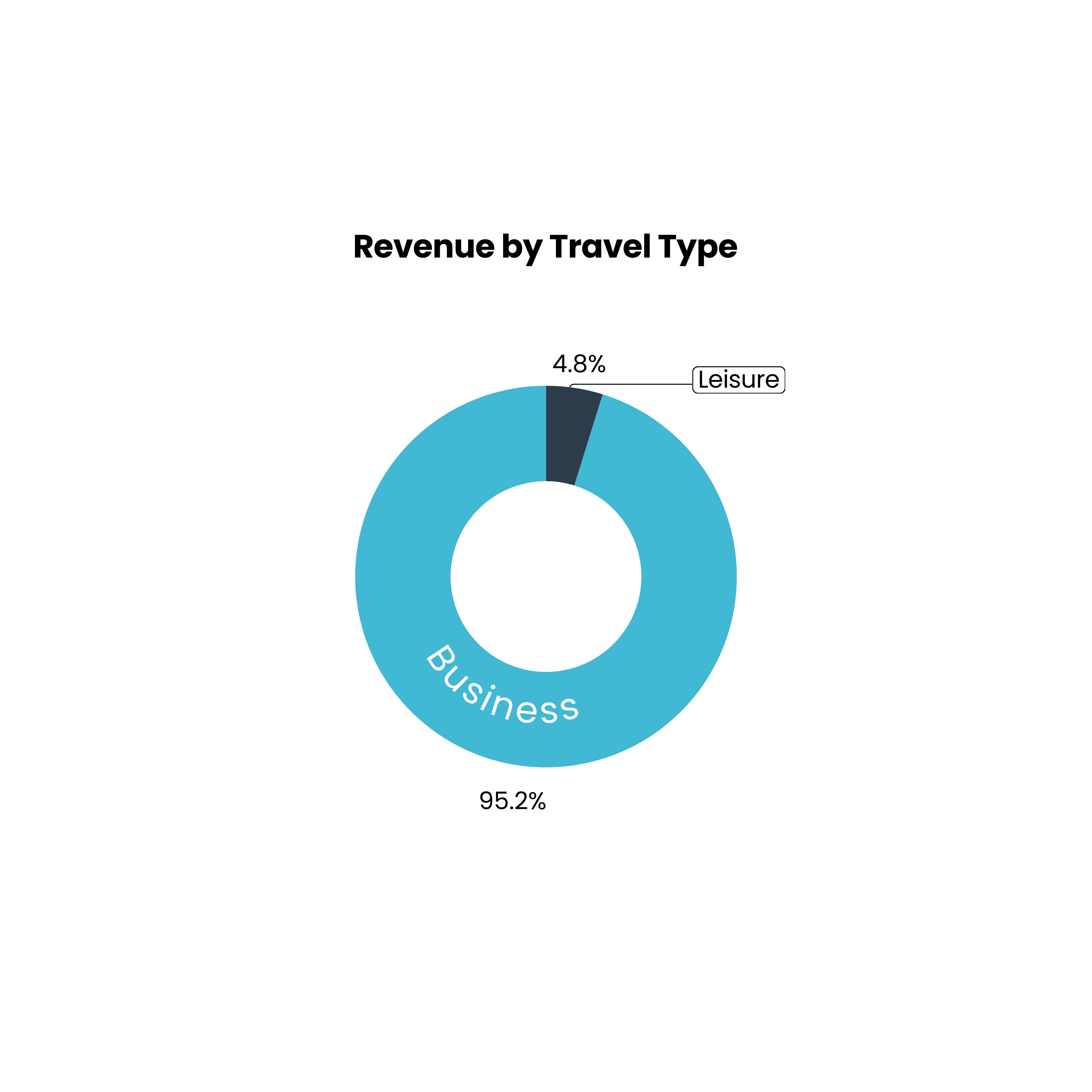

Business travel (corporate travel) accounts for 95.2% of revenue, while leisure travel accounts for just 4.8%. |

|

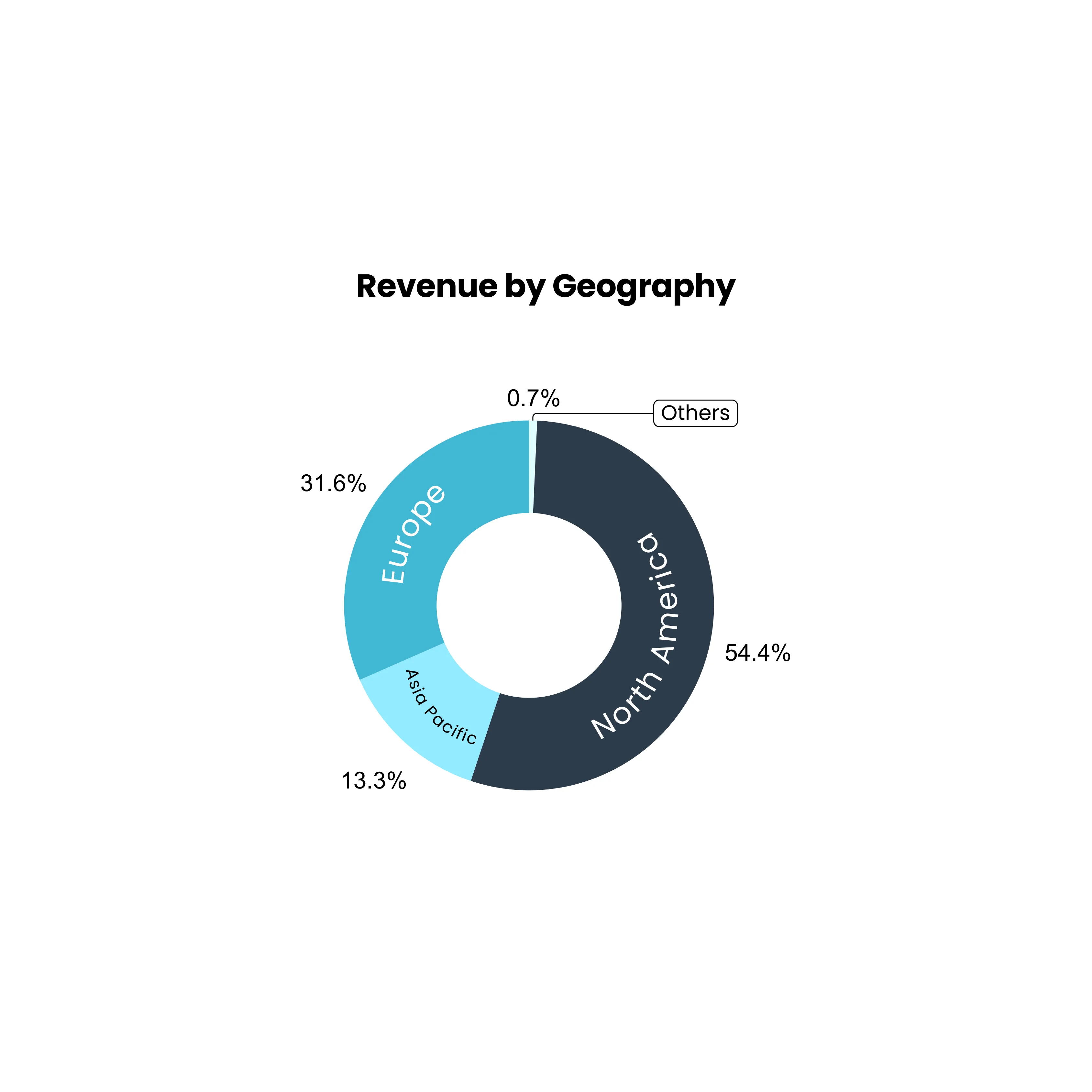

North America contributes the largest share at 54.4%, followed by Europe (31.6%), Asia Pacific (13.3%), and others (0.7%). |

|

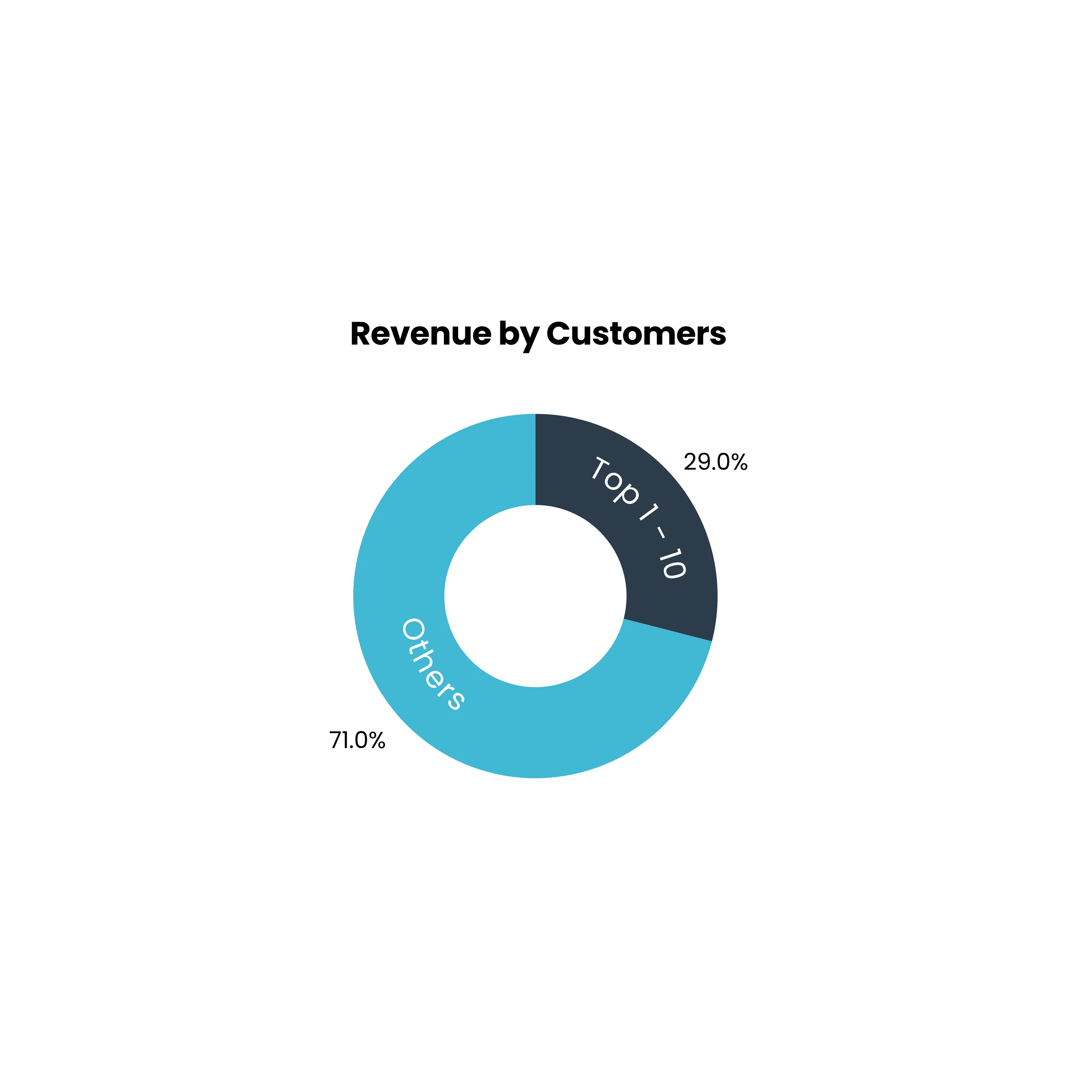

The top 10 customers account for 29.0% of revenue, while 71.0% comes from the broader customer base. |

KPIs: Recurring Revenue Model and High Retention Rates

1. Net Revenue Retention (NRR) – 105%

Net Revenue Retention (NRR) measures the revenue growth or contraction from existing customers over a period, accounting for expansions, downgrades, and churn. An NRR of 105% indicates that RateGain is generating 5% more revenue from its existing customer base without acquiring new clients. This implies that RateGain's high product stickiness and customer satisfaction translate into strong upselling and cross-selling capabilities across its product suite.

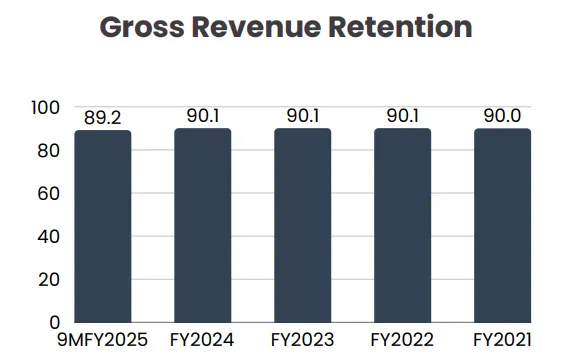

2. Gross Revenue Retention (GRR) – 90%

Gross Revenue Retention (GRR) excludes upsells and reflects the percentage of recurring revenue retained from existing customers after accounting for downgrades and churn. A GRR of 90% suggests that customer churn is low and contract value erosion is minimal.

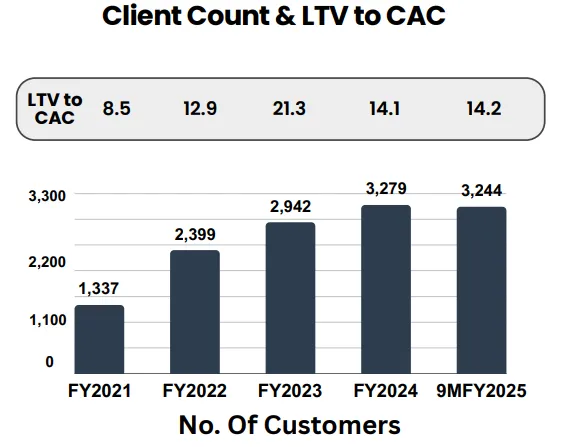

3. LTV/CAC ratio – 14.2

The Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio indicates how much value a company generates from a customer relative to what it spends to acquire them. An LTV/CAC of 14.2 is exceptionally strong, far exceeding the SaaS industry benchmark of 3–5x. This reflects highly efficient customer acquisition strategies, long customer lifecycles with high average contract values, and strong unit economics that drive profitability per customer and enhance overall scalability.

Such a high ratio signifies that RateGain’s customer relationships are extremely profitable, enabling the company to enjoy strong margins while pursuing a capital-light and scalable growth strategy.

Financial metrics

1. Revenue and profit trajectory:

RateGain has been on a steady growth path, with operating revenue rising from ₹367 crore in FY2022 to ₹957 crore in FY2024 and reaching ₹1,072 crore in the trailing twelve months (TTM). Over the last three years, the company has clocked an impressive sales CAGR of 56%. At the same time, its Earnings Per Share (EPS) has seen a sharp jump from ₹0.78 in FY2022 to ₹17.31 in TTM, translating into a profit CAGR of 87%.

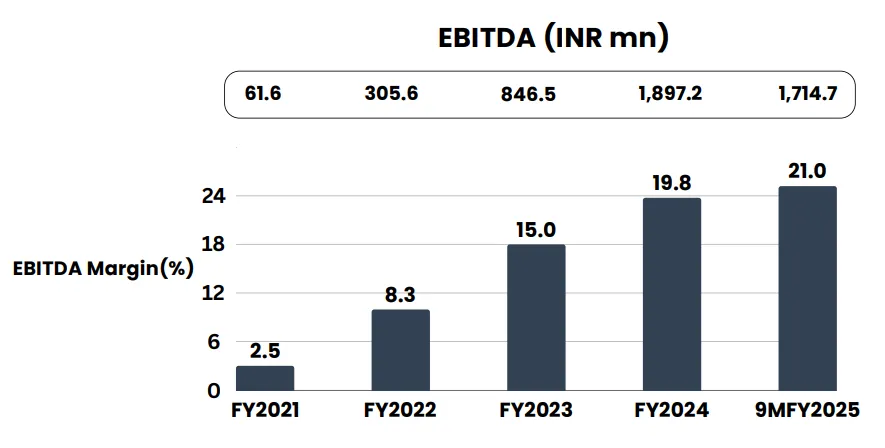

2. Operating efficiency:

The company’s EBITDA margin has improved from 9% in FY2022 to 21% in TTM, indicating enhanced operational efficiency and better cost control.

3. Expense management

Although expenses have risen with scale, reaching ₹846 crore in the trailing twelve months (TTM), expense growth has been proportionately lower than that of revenues, which has positively impacted the company's margin profile. Additionally, the company has successfully kept interest costs at a minimal level of ₹1 crore in the TTM, reflecting its consistent focus on a low-debt strategy.

Valuations and estimated earnings growth

With several strategic catalysts, RateGain Travel Technologies is well-positioned for future expansion. The company has a pipeline of large enterprise clients and maintains a healthy cash reserve of approximately ₹1,500 crore. This war chest not only provides operational stability but also enables the company to pursue strategic acquisitions and mergers to accelerate growth.

Over the past four years, RateGain has consistently outperformed its own guidance, a testament to the management's strong execution capabilities and focused approach. Looking ahead, the company has set a revenue target of ₹2,000 crore over the next three years, growing at a CAGR of 25%.

Assuming margins remain consistent with current levels, the company could generate operating profits of around ₹500 crores. With an estimated other income of ₹100 crore and minimal interest costs due to a debt-free balance sheet, the Profit Before Tax (PBT) is projected to be ₹540 crores. After accounting for a 25% tax rate, the estimated Profit After Tax (PAT) would be approximately ₹405 crores.

Based on the current equity base, this translates to an expected earnings per share (EPS) of ₹34. At the current market price of ₹450, the stock trades at a forward price-to-earnings (P/E) ratio of approximately 13, offering a compelling valuation relative to its growth prospects, especially when compared to a global travel bookings company like ‘Make My Trip,’ trading at a P/E ratio of 54.

Overall, RateGain appears attractively valued considering its strong fundamentals, strong growth trajectory, and proven management track record.

Risks and challenges

RateGain faces certain business risks that warrant consideration. Despite a diversified client base, there remains a degree of client concentration risk, as top clients still contribute significantly to overall revenue. The company also operates in a highly competitive environment, facing pressure from both global and regional SaaS providers offering similar travel and hospitality solutions. Additionally, travel spending is inherently sensitive to macroeconomic cycles, making RateGain vulnerable to economic slowdowns that could impact client budgets and demand. Furthermore, with a substantial portion of its revenue coming from international markets, the company is exposed to currency volatility, which may affect its profit margins due to forex fluctuations.

A compelling bet on travel tech

RateGain Travel Technologies is well-positioned to capitalize on the global rebound in travel and rising demand for intelligent SaaS-based solutions. With a strong client base, expanding high-margin MarTech business, and robust data capabilities, the company offers a compelling play on the intersection of technology and travel. RateGain stands out as a differentiated play in the SaaS space for investors looking at digital enablers of the experience economy.

*Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

.webp?alt=media&token=9e541654-93ff-4509-a955-e54e24ce0199)