How to Invest in Mutual Funds, ETFs, Index Funds

Where should I invest my money?’ It’s one of the most common questions new investors ask. With investing no longer reserved for a privileged few—thanks to technology and transparent platforms like CubePlus—we now have several types of pooled funds to choose from: mutual funds, index funds, and ETFs.

While they may sound similar and often overlap, each serves a slightly different purpose. Understanding their differences can help you make smarter investment choices.

Let’s walk through each in a simple and practical way.

First Things First: What Are These?

-

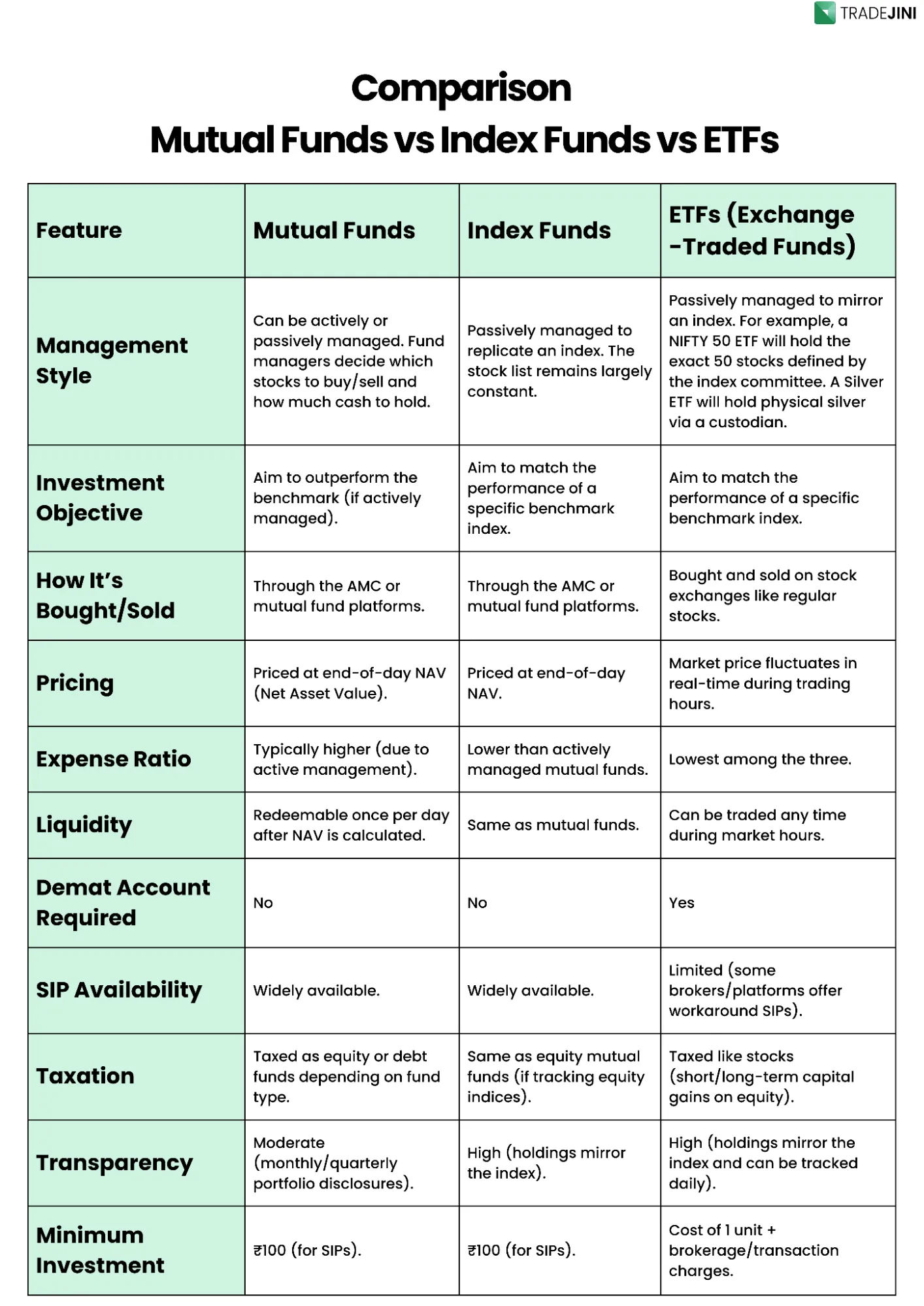

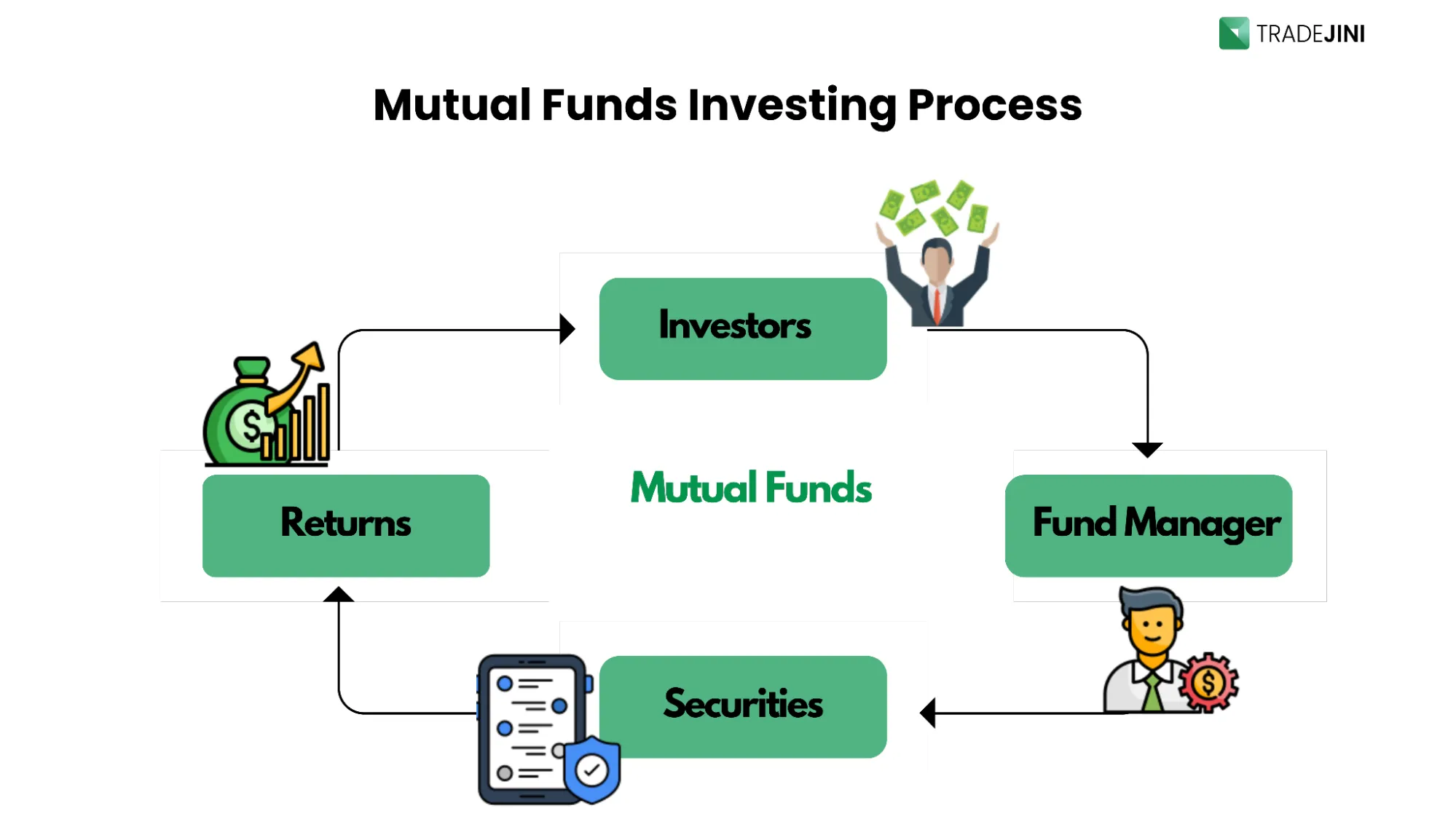

Mutual funds are pooled investments where money from several investors is managed by professionals and allocated across assets like stocks, bonds, or a mix of both.

-

Index funds are mutual funds that aim to replicate a specific market index like the Nifty 50 or Sensex. They don’t try to outperform — they aim to match the market.

-

ETFs (Exchange-Traded Funds) are also built to mirror an index but are traded on the stock exchange, like any listed company stock.

In short, all index funds are mutual funds, but not all mutual funds are index funds. ETFs are like index funds with stock-like flexibility.

Mutual Funds

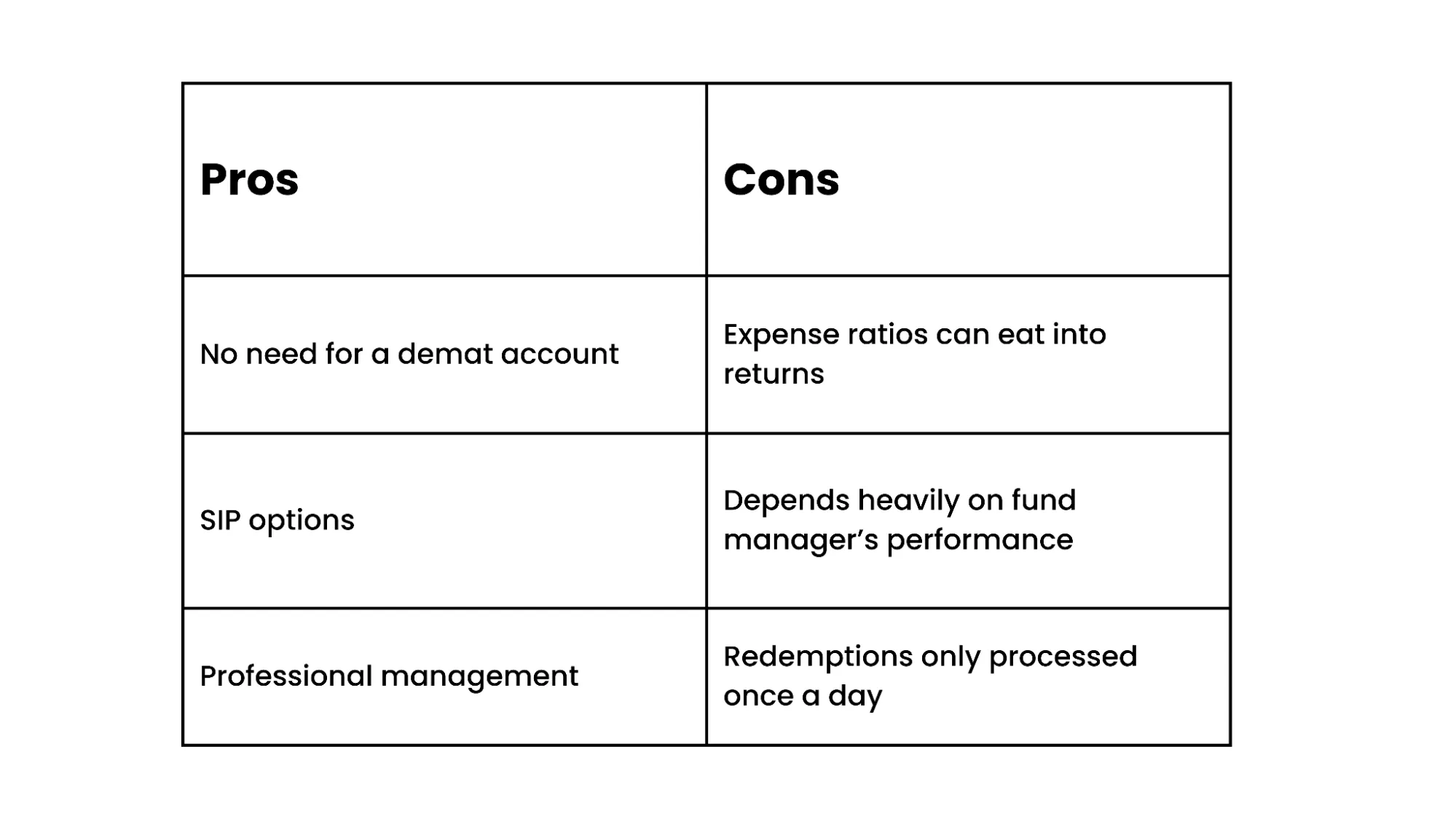

Mutual funds are ideal for investors who prefer professional management. You invest, and a fund manager allocates your money, often aiming to beat the market.

There are thousands of mutual fund options in India, ranging from large-cap to small-cap, debt to hybrid, and even international or thematic funds.

But active management comes at a cost: higher expense ratios, and many funds don’t consistently outperform the market.

When do mutual funds make sense?

-

When you prefer a long-term, goal-based approach

-

When you don’t want to track the markets daily

-

When you prefer SIPs over lump sums

-

When willing to pay more for convenience

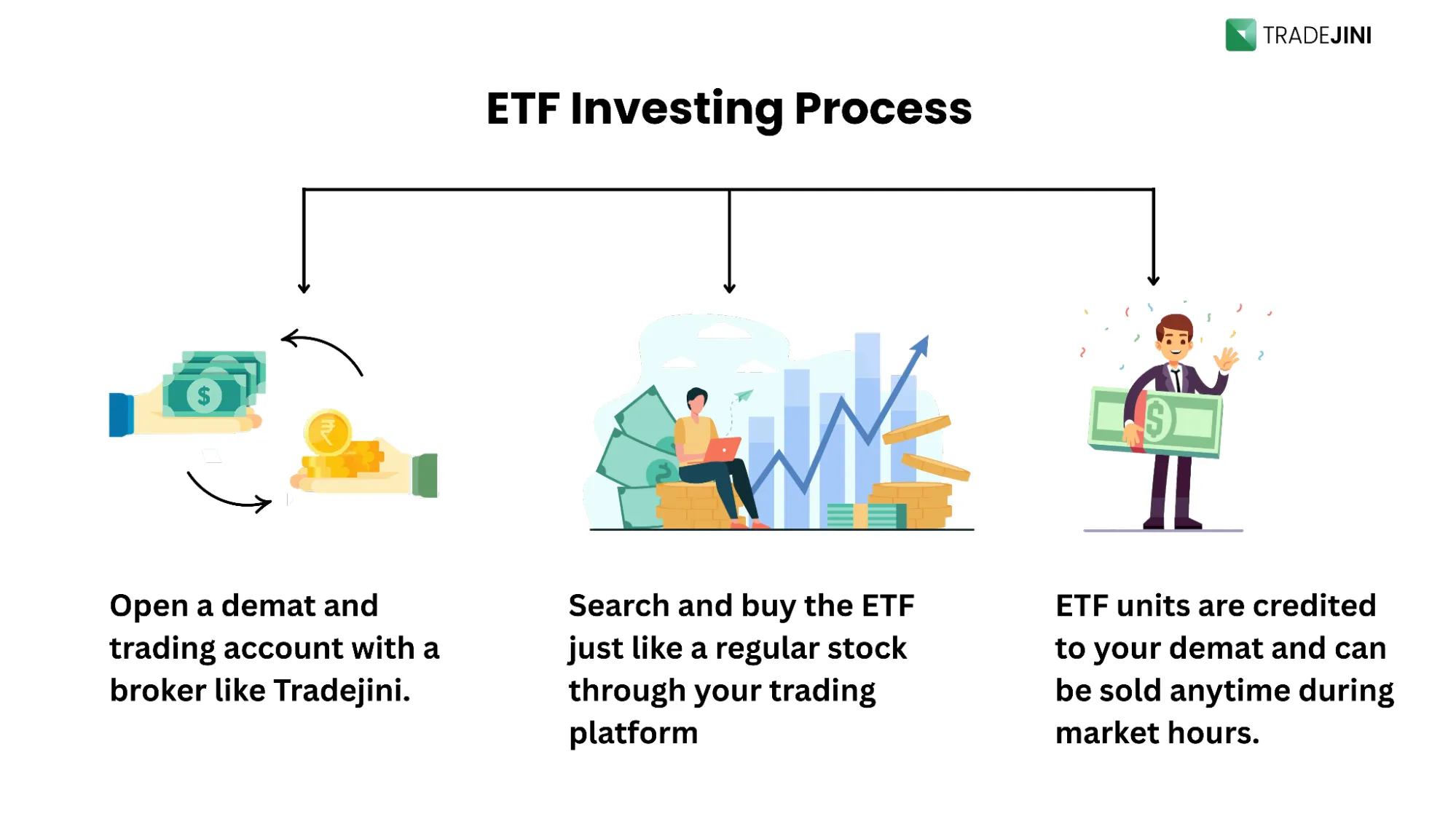

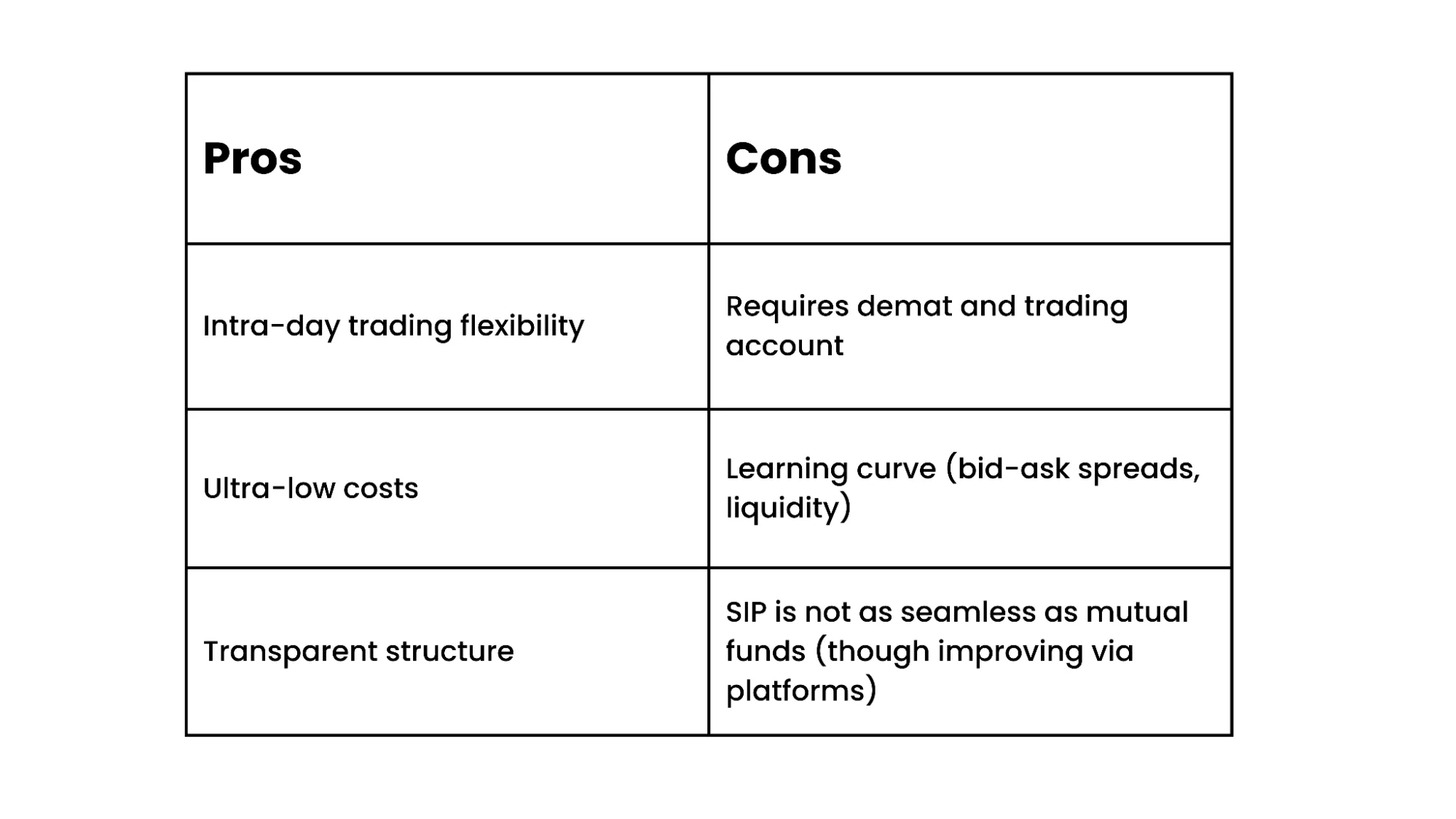

ETFs (Exchange-Traded Funds)

ETFs are like a mix of mutual funds and stocks. They track a particular index, commodity, or asset — just like index funds — but they trade on stock exchanges in real-time, like regular shares. This makes them ideal for investors who want market exposure with more control and lower costs.

How do ETFs work?

ETFs are built to mimic an index like the Nifty 50 or a commodity like gold. But behind the scenes, a structured ecosystem ensures smooth functioning and price accuracy. Here’s a simplified view:

-

AMC (Asset Management Company): Designs and manages the ETF product. It ensures the ETF portfolio mirrors the index and declares daily iNAV (indicative NAV).

-

Authorised Participants (APs): Large institutions like banks or brokers help create or redeem ETF units. They deliver a basket of securities to the AMC in exchange for ETF units.

-

Custodian: Safely holds the underlying assets (stocks, gold, etc.) that back the ETF units. Ensures every unit is backed by actual holdings.

-

Market Makers: These entities ensure liquidity by continuously offering buy/sell quotes on the exchange. They also help keep ETF prices aligned with NAV using arbitrage.

-

Pricing Mechanism: Unlike mutual funds or index funds, ETF prices move in real-time on stock exchanges, based on demand-supply and underlying asset values.

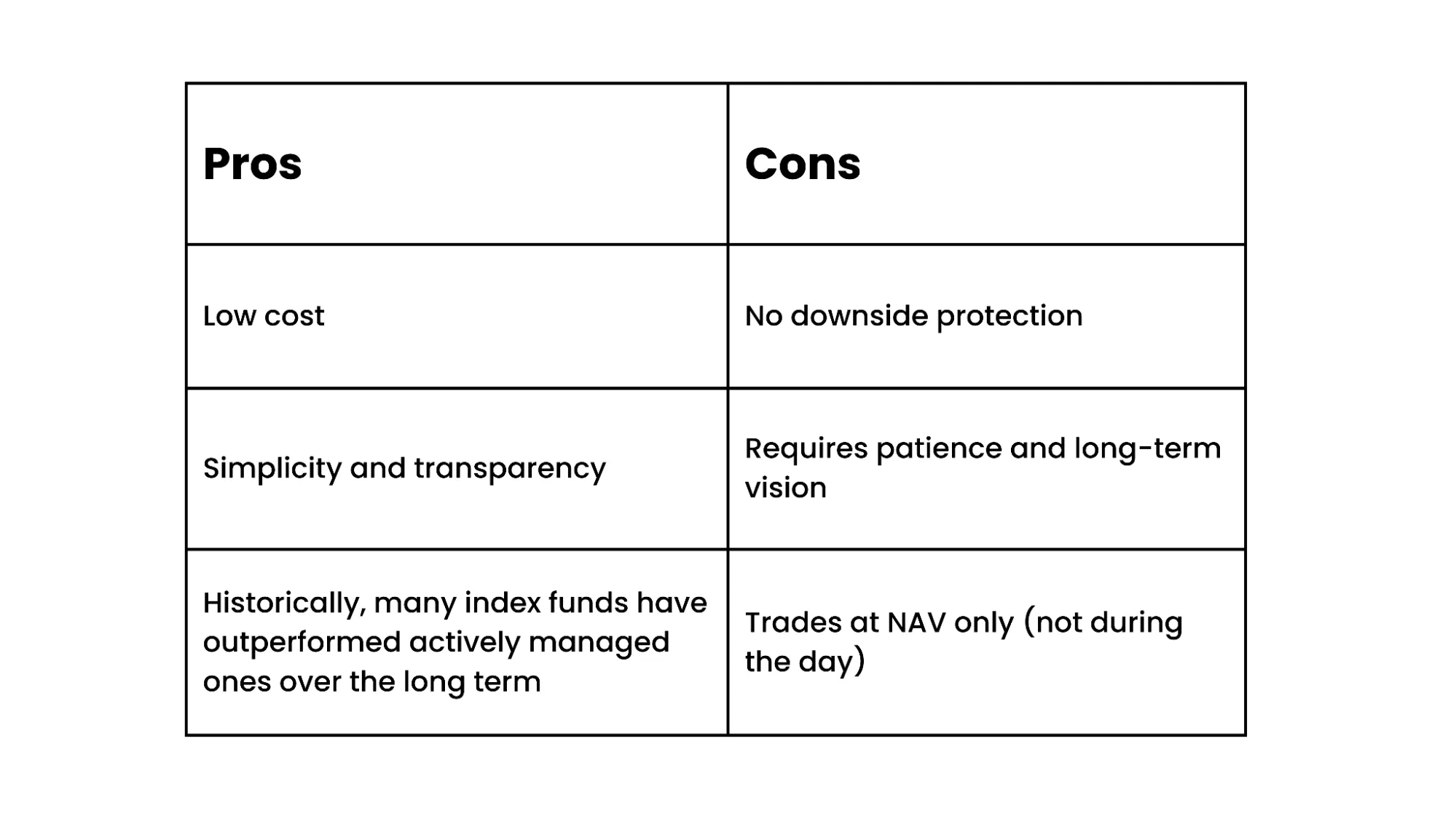

Index Funds

An index fund is a type of mutual fund that mirrors a stock market index. So, when you invest in a Nifty 50 index fund, your money is spread across the same 50 companies that make up the Nifty 50.

For instance, the Nifty 50 index fund will hold all 50 stocks in the same proportion as the index. In the Nifty 50 index fund, for example, all 50 stocks will be held in the same proportion as the index. So if the market goes up 8%, your index fund will rise around the same. No fancy strategies, no predictions, just pure market tracking.

The biggest advantage? Cost. Since there’s no active stock picking or fund manager intervention, expense ratios are significantly lower.

When do index funds make sense?

-

When you want broad market exposure at minimum costs

-

When you believe in long-term index performance

-

When you You prefer low-maintenance, passive investing

Which one’s right for you?

Whether you choose mutual funds, index funds, or ETFs, the right option depends on your goals, risk comfort, and how hands-on you want to be. Mutual funds offer expert management, index funds bring cost-efficiency, and ETFs give you real-time control. There’s no one-size-fits-all, but with the right mix, your portfolio can be smarter, simpler, and aligned to your future.

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

.webp?alt=media&token=276ba94b-423e-4c31-a416-db6ae23c9cd4)