India’s CDMO Boom: A Rising Global Powerhouse

.jpg?alt=media&token=a540a64a-00b3-434b-93da-e8076e5f65b4)

What is CDMO?

A Contract Development and Manufacturing Organization (CDMO) offers end-to-end services to pharmaceutical and biotech companies. These include drug development, formulation, clinical trial manufacturing, and large-scale commercial production. CDMOs simplify the complex drug development process, helping companies bring products to market faster and more cost-effectively.

Why India?

India offers pharmaceutical contract manufacturing services at costs nearly 20% lower than China, while upholding global regulatory standards. With a strong manufacturing base, numerous USFDA-approved facilities, and a growing reputation for quality and reliability, India is rapidly emerging as the preferred destination for pharma outsourcing.

Moving beyond generics

India is rapidly shifting from traditional generic drug production to cutting-edge treatments:

- Cell & Gene Therapy: CAGR 45%

- Antibody-Drug Conjugates (ADCs): CAGR 25%

- Nucleic Acid Therapeutics (RNA-based treatments): CAGR 36%

This shift positions India as a significant player in the global innovation ecosystem.

Is India’s CDMO market set to double?

India is already the world’s largest supplier of generic drugs and holds over 40% market share in the U.S. over-the-counter (OTC) drug exports. It also produces approximately 60% of the world’s vaccines. A revised forecast by Mordor Intelligence (2024) now projects that India’s contract manufacturing market will double in the next five years:

- 2024 Market Size: US$22.51 billion

- 2029 Projected Market Size: US$44.63 billion

- CAGR (2024–2029): 14.67%

Geopolitical shifts & BIOSECURE Act

With the U.S. pushing forward the BIOSECURE Act to reduce dependency on Chinese pharma supply chains, global drug makers are increasingly shifting contracts to CDMO companies in India. This pivot presents a significant long-term opportunity for Indian players.

Factors driving India’s CDMO prominence

- Cost Advantage: Significantly lower R&D and manufacturing costs.

- Skilled Workforce: Large pool of highly educated scientists and engineers.

- Operational Expertise: Numerous USFDA-approved manufacturing facilities across the country.

The global CDMO market & India’s role

The global CDMO market, valued at US$242.62 billion in 2024, is projected to reach US$465.14 billion by 2032 (CAGR 8.5%). With geopolitical tensions and supply chain disruptions leading companies to diversify beyond China, India is emerging as a strong alternative, leveraging:

650+ USFDA-approved plants — the highest outside the U.S.

20% lower production costs compared to China.

English-speaking workforce, enabling smooth global collaboration.

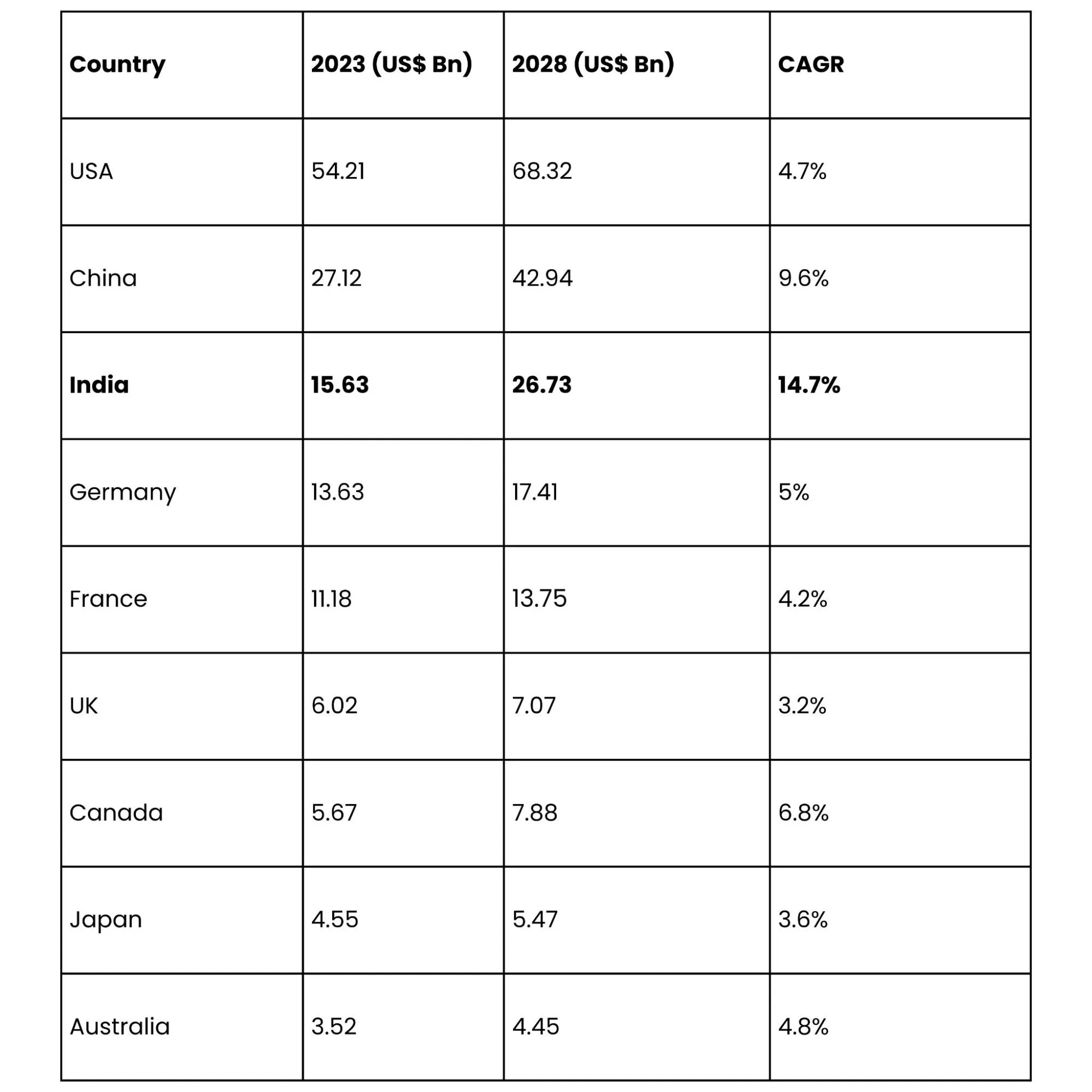

Country-Wise CDMO Growth Forecast (2023-2028)

Key players in India’s CDMO ecosystem

India’s list of CDMO companies is primarily dominated by players specializing in small molecule manufacturing, with a significant and growing presence in biologics and cell & gene therapy.

-

Small Molecule Manufacturing: This is the largest and most mature segment within the Indian CDMO space, with an estimated 180+ companies actively engaged. These firms offer services ranging from process development and API production to formulation manufacturing. Notable players in this segment include Cipla, known for its global generic drug manufacturing capabilities, and Navin Fluorine, which provides high-value fluorinated intermediates and speciality chemicals for pharmaceutical applications.

-

Biologics, Cell & Gene Therapy: While still in its nascent stage, this segment is rapidly expanding in response to global demand for complex biologics and next-generation therapies. Approximately 46 companies in India are active in this area, focusing on monoclonal antibodies, biosimilars, and advanced therapies. Emerging leaders include companies such as Biocon Biologics, which has established global partnerships for biosimilar development and manufacturing, and Intas Pharmaceuticals, known for its growing biologics portfolio.

Major investments fueling India’s CDMO growth

Some of the top listed CDMO companies in India are making strategic investments to scale operations:

- Aurigene Pharmaceutical Services (Dr. Reddy’s subsidiary): Built a biologics facility in Genome Valley, Hyderabad for cutting-edge drug development.

- Aragen Life Sciences: INR 20 billion (US$230M) investment in Telangana for drug discovery and manufacturing.

- Divi’s Laboratories: Developing a 500-acre facility in Andhra Pradesh to expand API production.

- Laurus Labs: INR 9.9 billion (US$114M) investment to pivot from APIs to antiretroviral and intermediate drug production.

- Jubilant Pharmova: US$370M investment to expand injectable drug manufacturing in Spokane & Montreal.

Government support

-

PLI scheme:

The Production Linked Incentive (PLI) Scheme in India is a government initiative launched in 2020 to boost domestic manufacturing and reduce import dependency across key sectors, including pharmaceuticals. For pharmaceutical contract manufacturing, it allocates approximately US$1.72 billion (₹15,000 crore) to incentivize the production of critical Active Pharmaceutical Ingredients (APIs), Key Starting Materials (KSMs), and high-value drugs like biologics and complex generics. Companies receive financial incentives, ranging from 5% to 20% of incremental sales, for meeting production targets over a period from FY 2022-23 to FY 2028-29. The scheme aims to enhance India’s self-reliance strengthen its position as a global pharma hub and create jobs while cutting reliance on imports, particularly from China.

-

Bulk Drug Parks:

A government initiative in India designed to strengthen the country’s pharmaceutical supply chain by creating specialized industrial zones for the production of Active Pharmaceutical Ingredients (APIs) and bulk drugs. Launched with a budget of approximately US$361 million, the scheme aims to establish three mega parks in Gujarat, Himachal Pradesh, and Andhra Pradesh, each receiving up to ₹1,000 crore in grant-in-aid. These parks provide shared infrastructure—such as effluent treatment plants, solvent recovery units, and power facilities to reduce manufacturing costs and environmental impact for companies producing APIs and intermediates. The initiative supports India’s goal of self-reliance in pharmaceuticals by lowering dependency on imported APIs (especially from China) and indirectly benefits CDMOs and other pharma firms by enhancing cost competitiveness and production capacity.

| Summary | |

|---|---|

| PLI Scheme (US$1.72B) | CDMOs like Aurobindo, Hetero, and Dr. Reddy’s have scaled API and high-value drug production, reducing import reliance. As of April 2025, over 50 projects are operational, with investments exceeding US$2.4B, strengthening India’s CDMO ecosystem. |

| Bulk Drug Parks (US$799.9M) | Parks in Gujarat, Himachal Pradesh, and Andhra Pradesh are enhancing API manufacturing infrastructure, indirectly benefiting CDMOs by cutting costs. Progress is steady, with full operation targeted for 2027-28, boosting self-reliance. |

| FDI (US$23.48B, 2000-2024) | Rising FDI (likely >US$24B by April 2025) reflects global confidence in India’s CDMO sector, fueling advanced manufacturing and R&D. Companies like Sun Pharma and Cipla leverage this to meet international demand. |

Private equity players are also backing India’s rise:

- Advent International acquired Suven Pharmaceuticals (US$1.09 billion).

- Goldman Sachs invested US$276.6 million in Aragen Life Sciences.

- Carlyle Group took a stake in Piramal Pharma to expand CDMO capabilities.

Challenges and the road ahead

Despite its strong momentum, India faces challenges in

- Large-molecule biologics production requires more investment in infrastructure and expertise.

- Building global credibility, with a focus on stringent quality control and compliance.

- Scaling up R&D and manufacturing for complex therapies.

However, with strong policy support, increasing investments, and a skilled workforce, India is well on its way to becoming a global leader in pharmaceutical manufacturing. If the current growth trajectory continues, India could potentially surpass China in the CDMO space, shaping the future of global healthcare and biotechnology.

India’s CDMO moment is now

The ascent in pharmaceutical contract manufacturing in India’s space is not just a trend; it’s a structural shift. With a robust talent pool, competitive manufacturing costs, and strong policy support, the country is moving beyond its traditional role as a generic drug supplier to become a strategic partner in high-value drug development and manufacturing. With a growing list of CDMO companies focused on innovation, India is poised to rival China and reshape the global pharmaceutical landscape. Continued focus on innovation, quality, and scale will be key to transforming this momentum into long-term global leadership.

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)