Celebration at Dalal Street as Nifty breaches 25,000!

Benchmark indices in the Indian stock market reached a historic milestone today as the Nifty touched the 25,000 mark for the first time, buoyed by robust buying in banking and FMCG stocks. This significant achievement marks a new chapter in Indian market history and reflects the growing confidence among investors.

The Indian stock market attempted breaching the milestone yesterday on Monday but fell short merely by less than a half points before falling dramatically.

Today, the Nifty50 index surged to an intraday high of 25,000, while the Bank Nifty also soared to an all-time high, driven by strong performances from major banks like ICICI Bank and SBI. Analysts attribute this rally to positive cues from the global economy, including favorable US economic data and expectations of a potential interest rate cut by the Federal Reserve in September. The overall bullish sentiment was further supported by substantial buying from both Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs), who collectively injected over ₹5,300 crores into the market last Friday.

We will examine the critical phases that have defined Nifty's rise to this historic level. Through this, we aim to provide a comprehensive analysis of the market dynamics at play.

A brief history of the rally

Market’s reaction to 2024 General Elections

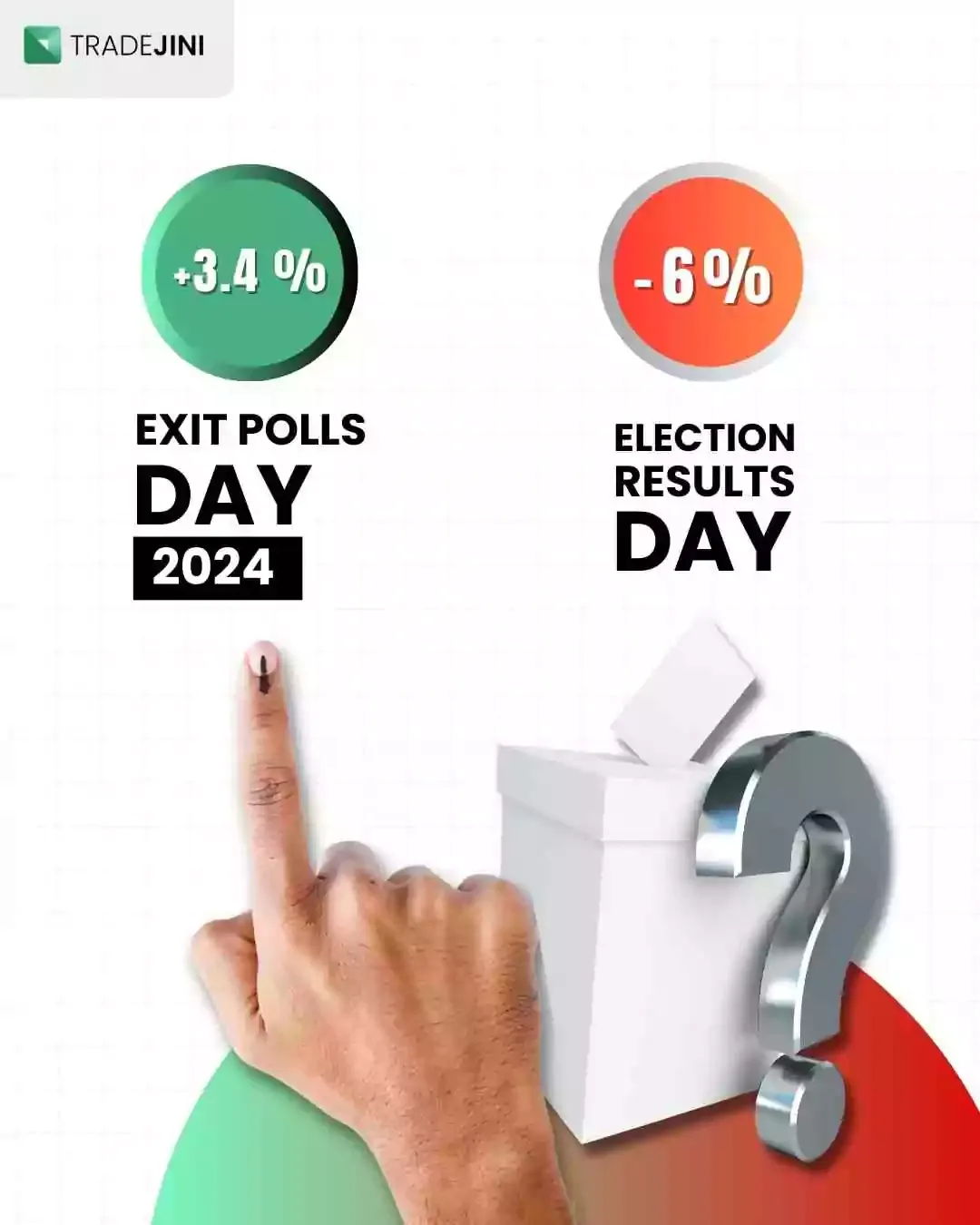

The rally that led Nifty to breach the 25,000 mark can be traced back to the period surrounding the election results. The Indian stock market experienced significant volatility during this time, driven by investor sentiment and the uncertainty associated with the electoral outcomes.

On the day of the election results in 2024, the BSE Sensex plummeted by 2,800 points (3.66%) to close at 73,669.28, while the Nifty50 dropped 809 points (3.6%) to end at 22,409. The total market capitalization of all listed companies on the BSE decreased by approximately ₹8.78 lakh crore, bringing the total to ₹417.13 lakh crore. The India VIX, a measure of market volatility, surged by 20% to around 25 levels, indicating heightened uncertainty among investors. Major contributors to the decline included heavyweights like Reliance Industries and HDFC Bank, with Reliance alone accounting for a 565-point drop.

This market turbulence followed exit polls predicting a substantial victory for the BJP-led NDA alliance in the 2024 Lok Sabha elections. Prior to the results, the markets had reached new all-time highs, buoyed by optimistic sentiment. However, as preliminary results indicated the NDA alliance leading in over 290 seats, investors adopted a cautious and risk-averse stance, leading to the substantial market decline.

Despite the initial volatility, the market began to stabilize as the political landscape became clearer. Investors' confidence was gradually restored as it became evident that the government would focus on economic reforms and growth. The subsequent weeks saw a slow but steady recovery, with market participants reassured by the government's commitment to stability and development. Since then, NIFTY has increased by over 5% before reaching the 25k mark.

Robust earnings reported by heavyweights

A significant driver of Nifty's rally has been the strong earnings reports from major companies. These reports not only boosted investor confidence but also provided a solid basis for market optimism. Several key companies played pivotal roles in this phase of the rally, showcasing robust financial health and growth prospects.

Major IT stocks like TCS, Infosys, HCL Technologies, and Tech Mahindra have significantly contributed to Nifty's impressive rally. These companies reported robust earnings and showed resilience through strategic expansions and innovations. Their strong performance, particularly in digital transformation and technology services, has driven investor confidence, fueling market growth. Other key Nifty players like Reliance Industries have also played a crucial role, showcasing strength across their diverse business portfolios and continuing to attract investor interest through strategic investments and expansions.

The collective performance of these industry leaders has bolstered the overall market sentiment, helping Nifty reach and sustain new highs. Their consistent delivery on earnings projections, coupled with strategic initiatives in high-growth areas, has created a solid foundation for the market's upward trajectory. As these companies continue to innovate and expand, they will remain critical in maintaining the momentum that has propelled Nifty to the 25,000 milestone.

Investors sentiment seems fine towards the Union Budget 2024

The Union Budget presented a crucial phase in Nifty's journey towards the 25,000 mark. Despite being described by some as tame, the budget played a significant role in sustaining market optimism and fostering an environment conducive to long-term growth.

Key Highlights from the Union Budget:

- Capital Expenditure: The budget allocated a substantial ₹11,11,111 crore for capital expenditure, accounting for 3.4% of GDP. This emphasis on infrastructure development, including roads, railways, and power sectors, was seen as a positive step towards boosting economic growth and creating jobs.

- Support for States: A provision of ₹1.5 lakh crore was made for long-term interest-free loans to states for infrastructure projects, encouraging state-level development and investments.

- Agriculture and Rural Development: Increased financial support for irrigation and flood mitigation projects in states like Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim. These initiatives aimed at enhancing agricultural productivity and supporting rural economies.

- Employment and Skilling: The PM Package with an outlay of ₹2 lakh crore focused on employment and skilling initiatives, targeting first-time employees and linking them to the Employees’ Provident Fund Organisation (EPFO).

- Health and Education: Financial support for higher education loans up to ₹10 lakh aimed at making education more accessible.

- Digital Transformation: Emphasis on digital initiatives to enhance the efficiency of government services and improve citizen engagement.

The budget's focus on fiscal consolidation and long-term growth, rather than short-term populist measures, reassured investors about the government's commitment to sustainable economic development. While some market participants were initially unsettled by changes in capital gains tax and Securities Transaction Tax, the overall positive sentiment prevailed by the end of the week.

How did the market react? Initially, traders reacted negatively to the budget's implications, leading to some market volatility. However, by the end of the week, the markets had recovered and reached new highs, indicating a recovery in sentiment. The VIX index, a measure of market volatility, also stabilized, reflecting reduced market fears.

The budget's focus on core areas and strategic initiatives played a pivotal role in maintaining investor confidence. It highlighted the government's commitment to driving economic growth through infrastructure investments, fiscal discipline, and support for key sectors. This bolstered the market's upward momentum, contributing significantly to Nifty's rally.

Positive global cues

Global market trends have always had a significant impact on the Indian stock market, and this phase of Nifty's journey was no different. The recovery of the US market, particularly after a significant drop due to poor IT performance, provided a supportive backdrop for the Indian market.

Wall Street Performance (as of 26 July, 2024):

- S&P 500: Increased by 59.88 points (1.11%) to close at 5,459.10.

- Nasdaq Composite: Rose by 176.16 points (1.03%) to finish at 17,357.88.

- Dow Jones Industrial Average: Saw a significant gain of 654.27 points (1.64%), ending at 40,589.34.

US Inflation Data: A moderate rise in U.S. prices for June indicated cooling inflation, bolstering expectations that the Federal Reserve may begin easing its monetary policy as early as September. This positive inflation data fueled hopes for a potential interest rate cut, with current bets suggesting an 88% chance of a 25-basis-point rate cut at the Fed's September meeting.

Sector Performance: All 11 sectors of the S&P 500 experienced gains, with Industrials and Materials leading the way. The small-cap Russell 2000 index also performed well, marking its third consecutive weekly gain. The positive performance of these sectors, particularly the tech stocks, had a spillover effect on global markets, including India.

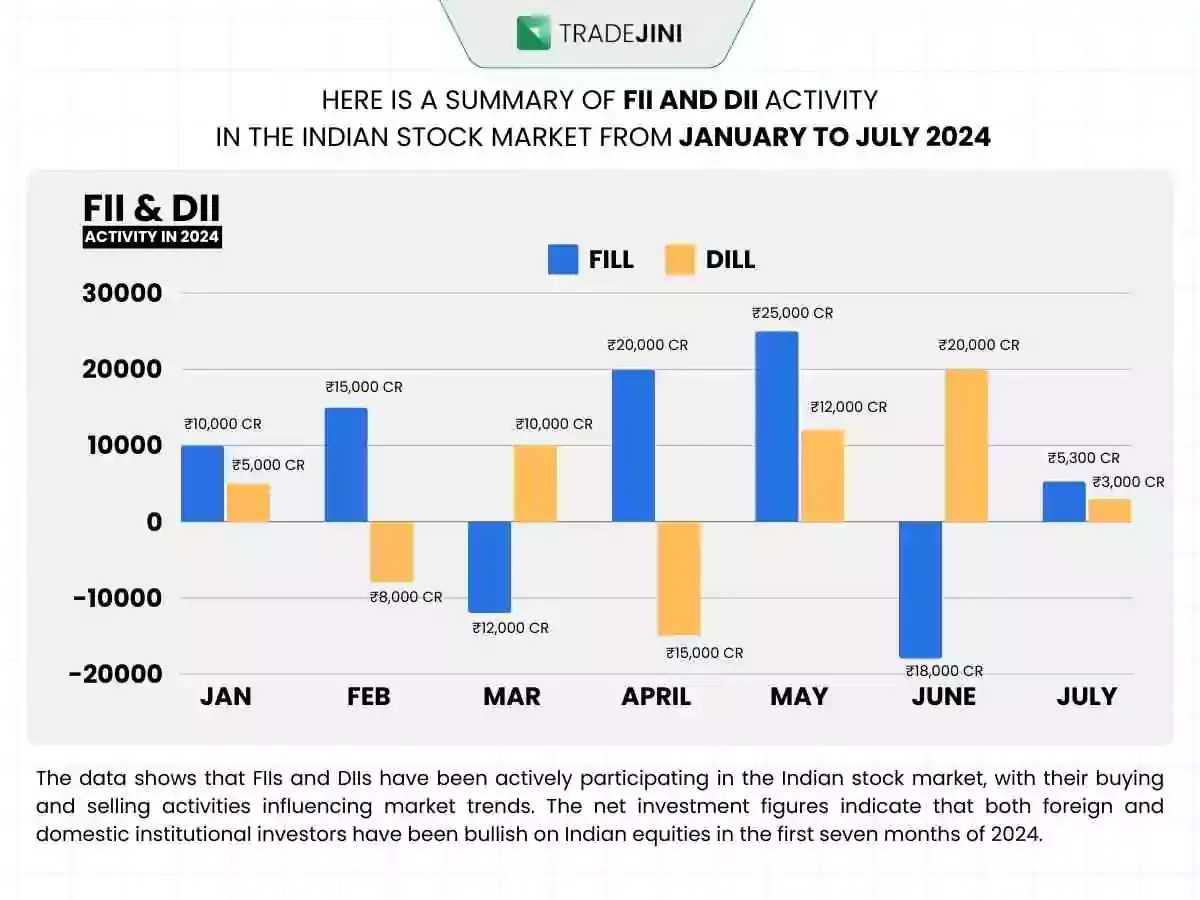

FII and DII activities

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play a pivotal role in the Indian stock market, influencing trends and market sentiment. During Nifty's journey to 25,000, the activities of these institutional investors were crucial in shaping the market's direction.

- Despite the overall positive market sentiment, FIIs were net sellers in the recent period. They offloaded equities worth ₹4,721.26 crore. This selling pressure from FIIs typically would have led to a significant market correction. However, the domestic investors’ strong buying interest managed to counterbalance the impact of FII outflows.

- Domestic Institutional Investors (DIIs), on the other hand, were net buyers, purchasing equities worth ₹8,109.78 crore. DIIs’ substantial buying interest provided the necessary support to the market, preventing it from succumbing to the downward pressure exerted by FII sell-offs. This strong domestic support underpinned the market’s resilience and sustained its upward momentum.

The contrasting activities of FIIs and DIIs highlight the dynamic interplay between domestic and international investors in the Indian market. While FIIs' selling created temporary headwinds, the robust participation of DIIs ensured that the market's trajectory remained positive. This period saw DIIs taking advantage of the opportunities presented by FII sell-offs, reinforcing the market's strength.

Sectoral Impact: The buying and selling activities of institutional investors had varied impacts across different sectors. For instance, DIIs showed a strong preference for sectors like IT, automobiles, infrastructure, metals, and pharma, recording gains of 2-3%. The interest in these sectors contributed to their robust performance and helped sustain the broader market rally.

Long-Term Trends: For the year so far, FIIs have net bought shares worth ₹1.62 lakh crore, while DIIs have net bought shares worth ₹2.5 lakh crore. This long-term trend underscores the significant role of domestic institutional investors in supporting the market amidst fluctuating FII activities. The sustained interest from DIIs reflects their confidence in the long-term growth prospects of the Indian economy.

Options data from Friday already hinted towards 25k

Options data provides critical insights into market sentiment and potential future movements. The options trading activities on the Friday before Nifty breached 25,000 were particularly revealing, indicating strong market participation and bullish sentiment.

Market-wide futures Open Interest: At the start of the August series, market-wide futures open interest stood at ₹4.508 trillion, compared to approximately ₹4.321 trillion at the start of the July series. This increase in open interest suggests heightened market activity and an influx of fresh positions, indicating a bullish outlook among traders.

Rollover data

- Market-wide rollovers: The market-wide rollovers were at 89%, slightly above the three-month average of 88%. This high rollover percentage reflects traders’ confidence in the market’s continued upward momentum.

- Nifty futures rollovers: The rollover for Nifty index futures was lower at 69.69%, compared to 76.25% from the previous month and a three-month average of 72.57%. Despite the lower rollover percentage, the number of shares rolled, which declined to 13.7 million from 15.1 million last month, still indicated strong participation.

- Rollover cost: The rollover cost decreased slightly to 0.21%, compared to a three-month average of 0.40%. Lower rollover costs can be indicative of a lower premium for carrying forward positions, which in turn reflects positive sentiment about future market movements.

Sector-specific rollover insights

- Stock futures rollovers: Stock futures rollovers were at 93%, consistent with the average rollovers of the last three series. Most frontline names had a rollover cost around 63-65 basis points, with a minor day-over-day decrease of 1-2 basis points.

- Open interest additions: Significant open interest additions were noted in sectors like FMCG (₹294 billion long side), Pharmaceuticals (₹227 billion long side), Oil & Gas (₹341 billion long side), Banks (₹860 billion short side), Metals (₹300 billion short side), and Chemicals (₹104 billion long side).

Historical high Open Interest: The August series saw significant historical high open interest in sectors like Auto (₹339 billion), Financial Services (₹397 billion), Information Technology (₹342 billion), Capital Goods (₹287 billion), Consumption (₹100 billion), and Consumer Durables (₹61 billion). This high level of open interest in these sectors indicated strong market interest and potential for significant movements.

Implications for future market movements: The robust options data from Friday suggested a positive outlook for the market. The high open interest, coupled with strong rollovers, indicated that traders were optimistic about the market's future performance. The sector-specific insights provided clues about where traders expected the most significant movements, with long positions in FMCG, Pharmaceuticals, and Oil & Gas, and short positions in Banks and Metals.

How sustainable is the rally?

Reaching the 25,000 mark is a significant milestone for Nifty, but sustaining this level will require continued positive momentum and support from various factors. Let's delve into what it will take for Nifty to hold this feat, the potential challenges, and the upcoming events that will influence its course in the near future.

Upcoming challenges

Maintaining the 25,000 level will hinge on several critical factors, including economic stability, corporate earnings, and investor sentiment. Key economic indicators such as India's GDP growth rate and inflation levels will play crucial roles in sustaining market confidence. The stance of the Reserve Bank of India (RBI) on interest rates will also be closely monitored, as dovish policies can support market growth while hawkish stances might pose challenges.

Corporate earnings will be pivotal, with the performance of major companies in upcoming quarterly results significantly impacting market sentiment. Strong earnings reports will bolster confidence, whereas disappointing results could lead to corrections. Additionally, the sustained performance of key sectors like IT, pharmaceuticals, and consumer goods will be essential for overall market support.

Global influences, particularly US Federal Reserve policies on interest rates and monetary easing, will have significant impacts on the Indian market. Geopolitical stability in regions like Eastern Europe and the Middle East is also vital to maintaining market confidence. Continued support from Domestic Institutional Investors (DIIs) and potential net buying from Foreign Institutional Investors (FIIs), along with sustained participation from retail investors, will be necessary to maintain the momentum and sustain Nifty at this milestone level.

Key events

Several upcoming events will be crucial in determining Nifty's ability to sustain the 25,000 mark, providing insights into economic health, corporate performance, and global market trends. Key economic reports, such as the World Economic Situation and Prospects 2024 and the IMF World Economic Outlook, will offer global GDP growth projections and potential risks. The U.S. Consumer Price Index (CPI) data scheduled for release in August will be critical in assessing inflation trends and potential Federal Reserve actions, while Eurozone inflation reports will provide insights into monetary policy implications in the region. Central bank meetings, including the Federal Reserve's discussion on interest rate policies and the RBI's policy review in August, will also significantly influence global and domestic markets.

Corporate earnings reports for Q2 FY25 from major Indian companies will impact market sentiment and stock valuations across sectors. Additionally, geopolitical events, such as ongoing tensions in Eastern Europe and the Middle East, could affect global oil prices and trade, influencing market stability. Announcements regarding trade policies, especially those involving major economies like the U.S. and China, will also play a vital role in shaping market dynamics. These events collectively will provide a comprehensive view of the economic landscape and influence Nifty's performance in the near future.

As we look forward, the market's ability to sustain and build upon this achievement will be tested by upcoming economic reports, central bank decisions, and global geopolitical events. Investors and analysts remain cautiously optimistic, recognizing both the opportunities and challenges that lie ahead. The resilience and adaptability of the market thus far suggest a promising outlook, but vigilance and strategic planning will be essential to keep the momentum alive.

Key Takeaways

- The Nifty index reached the historic milestone of 25,000, driven by robust buying in banking stocks and positive global economic cues.

- Significant contributions to the rally came from strong earnings reports of major companies, especially in the IT and banking sectors.

- The Union Budget 2024, with its focus on infrastructure and fiscal consolidation, played a crucial role in sustaining market optimism.

- Positive global cues, including favorable US economic data and potential interest rate cuts, further bolstered investor confidence.

- Institutional investors’ activities, with DIIs providing strong support despite FIIs being net sellers, significantly influenced market dynamics and momentum.

Equity

| Equity Delivery | Equity Intraday | Equity Futures | Equity Options | |

|---|---|---|---|---|

| Brokerage | 0.1% or ₹20/ Order whichever is lower | 0.05% or ₹20/ Order whichever is lower | 0.05% or ₹20/ Order whichever is lower | ₹20/ Executed Order |

| STT/CTT | 0.1% on both Buy & Sell | 0.025% on the Sell Side | 0.02% on the Sell Side | 0.1% on the Sell Side 0.125% on exercise |

| GST | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) |

| Stamp Duty | 0.015% on Buyer ₹1500 per Cr | 0.003% on Buyer ₹300 per Cr | 0.002% on Buyer ₹200 per Cr | 0.003% on Buyer ₹300 per Cr |

| Transaction charges | - NSE: ₹297 per Cr - BSE: ₹375 per Cr | - NSE: ₹297 per Cr - BSE: ₹375 per Cr | - NSE: ₹173 per Cr - BSE: Nil | - NSE: ₹3503 per Cr - BSE: ₹3250 per Cr |

| IPFT Charges | NSE: ₹10 per Cr | NSE: ₹10 per Cr | NSE: ₹10 per Cr | NSE: ₹50 per Cr |

| SEBI Charges | ₹10 per Cr | ₹10 per Cr | ₹10 per Cr | ₹10 per Cr |

Currency

| Currency Futures | Currency Options | |

|---|---|---|

| Brokerage | 0.05% or ₹20/ Order whichever is lower | ₹20/ Executed Order |

| STT/CTT | STT: Nil | STT: Nil |

| GST | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) |

| Stamp Duty | 0.0001% on Buyer ₹10 per Cr | 0.0001% on Buyer ₹10 Per Cr |

| Transaction charges | NSE: ₹90 per Cr | NSE: ₹3500 per Cr |

| IPFT Charges | NSE: ₹5 per Cr | NSE: ₹200 per Cr |

| SEBI Charges | ₹10 per Cr | ₹10 per Cr |

Commodity

| Commodities | Commodity Options | |

|---|---|---|

| Brokerage | 0.05% or ₹20/ Order whichever is lower | ₹20/ Executed Order |

| STT/CTT | 0.01% On Sell Side | 0.05% On Sell Side |

| GST | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) | @18% on (Brokerage, Exchange Transaction Charges & SEBI Fees) |

| Stamp Duty | 0.002% on Buyer ₹200 per Cr | 0.003% on Buyer ₹300 per Cr |

| Transaction charges | MCX: ₹210 per Cr | MCX: ₹4180 per Cr |

| SEBI charges | ₹10 per Cr | ₹10 per Cr |

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

_11zon%20(1).webp?alt=media&token=83d64d76-0799-460e-801f-f51f9317853f)