Rising Heat Fuels Cooling and FMCG Demand

_1_11zon.webp?alt=media&token=4cf9b021-c931-418e-a919-2bb17519a310)

As temperatures rise across India, companies in the cooling, FMCG, and beverage sectors are gearing up for a promising summer season. With early heat waves hitting regions like Mumbai and forecasts predicting record-high temperatures, consumer demand for summer-related products is expected to surge. This presents a significant growth opportunity for businesses, despite a high base from last year’s strong performance.

What’s Driving the Demand?

-

Several factors are fueling the anticipated sales spike

Unseasonal Heat: February’s unexpected heatwave has driven early demand for air conditioners, refrigerators, and beverages.

Consumer Finance Boost: Flexible financing schemes, including consumer loans and credit card purchases, are encouraging higher spending in the cooling industry.

Premiumization Trend: While affordable models still dominate, there is a steady rise in demand for premium and feature-rich products, such as Wi-Fi-enabled and hot-and-cold air conditioners.

Sectors and Summer Stocks in the Spotlight

With the rising temperatures, certain categories are expected to see strong growth:

-

Air Conditioning and Cooling Systems

Air conditioner (AC) manufacturers are preparing for potential growth in Q4, building on last year’s strong sales. However, component shortages, particularly compressors, remain a challenge. Companies like Blue Star, Voltas, Symphony, Lloyd, Whirlpool, and Johnson Hitachi are in focus. While the government has eased some import restrictions on larger components to prevent supply chain disruptions, India’s push for self-reliance in manufacturing may limit short-term availability.

-

Seasonal Sales Trends

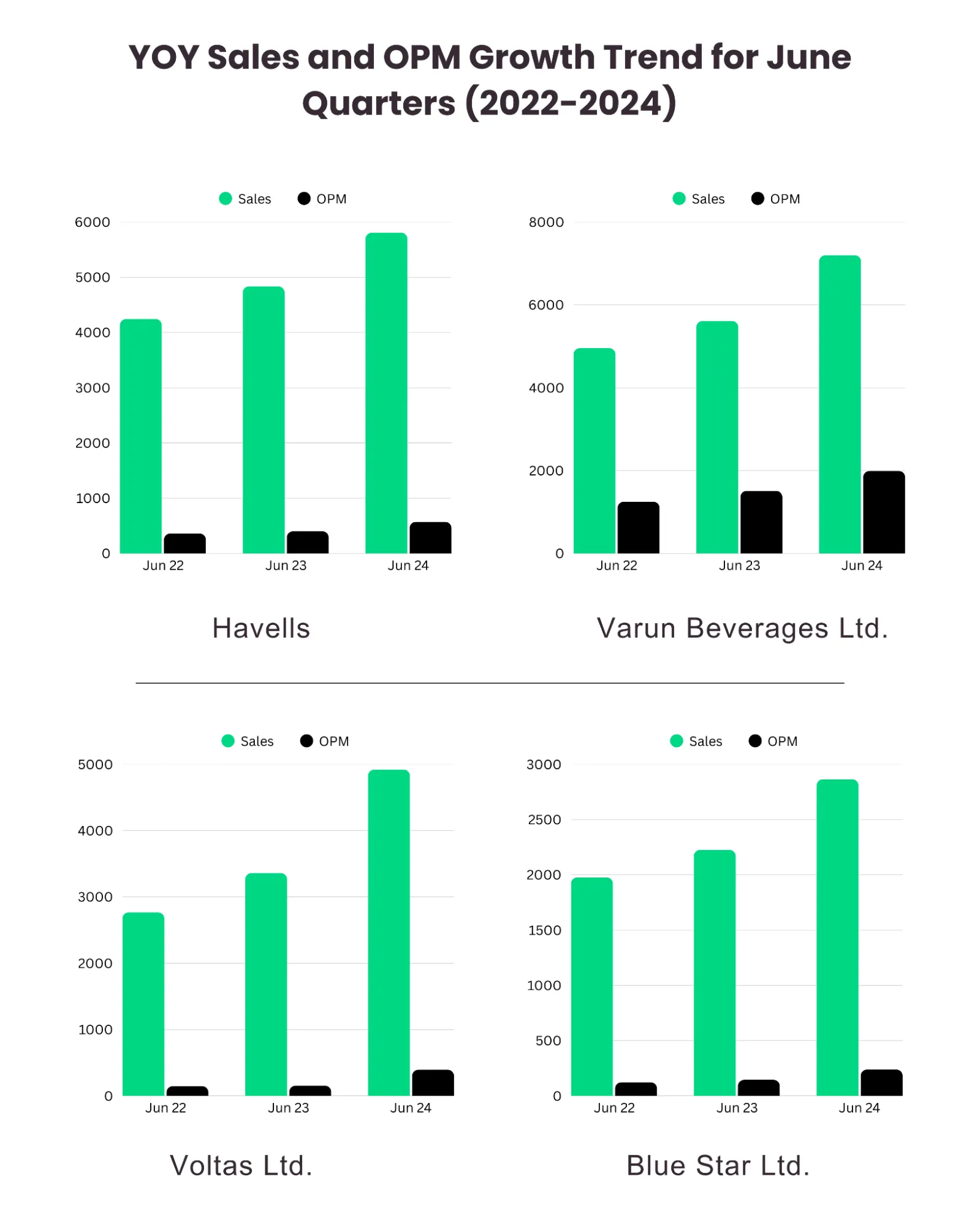

The bar graphs showcase the YOY sales and operating profit margins growth trend for June quarters of Havells, VBL, Voltas, and Blue Star over three consecutive years (2022, 2023, and 2024). A clear seasonal pattern emerges, with sales peaking during the summer months of April, May, and June, as reflected in the Q1 results. This surge is primarily driven by increased consumer demand for cooling appliances (Havells, Voltas and Blue star) and beverages (VBL) during India’s scorching summer.

Proxy players in India's room AC Industry

Amber Enterprises India Limited focuses on manufacturing room air conditioners (RACs) and their components as a leading OEM/ODM provider in India. They produce complete RAC units, including split and window types, and key parts like heat exchangers, motors, and PCB assemblies. Amber supplies these products to major brands such as LG, Daikin, and Blue Star, catering to the growing demand in India’s air conditioning market.

EPACK Durable Private Limited is another key ODM player, specializing in the design and production of room air conditioners and components like heat exchangers and copper tubing. Operating as India’s second-largest RAC ODM, EPACK manufactures split and window AC units and supplies them to brands like Voltas, Samsung, and Carrier, supporting the consumer durables sector with high-capacity production.

Rising demand for cooling appliances may boost sales for companies like Orient Electric, Havells, and Crompton Greaves, which offer fans, coolers, and smaller appliances.

Ice cream business – Kwality Wall’s Kwality Wall’s, a well-known ice cream brand under Hindustan Unilever (HUL), is a key player in the company’s Foods & Refreshments segment. Popular sub-brands such as Cornetto, Magnum, and Kwality Wall’s enjoy strong traction among urban consumers. The segment generates estimated annual sales of ₹2,000–2,500 crore. In January 2024, Unilever Plc, HUL’s parent company, announced plans to spin off its global ice cream business—including Kwality Wall’s in India—into a separate, standalone entity.

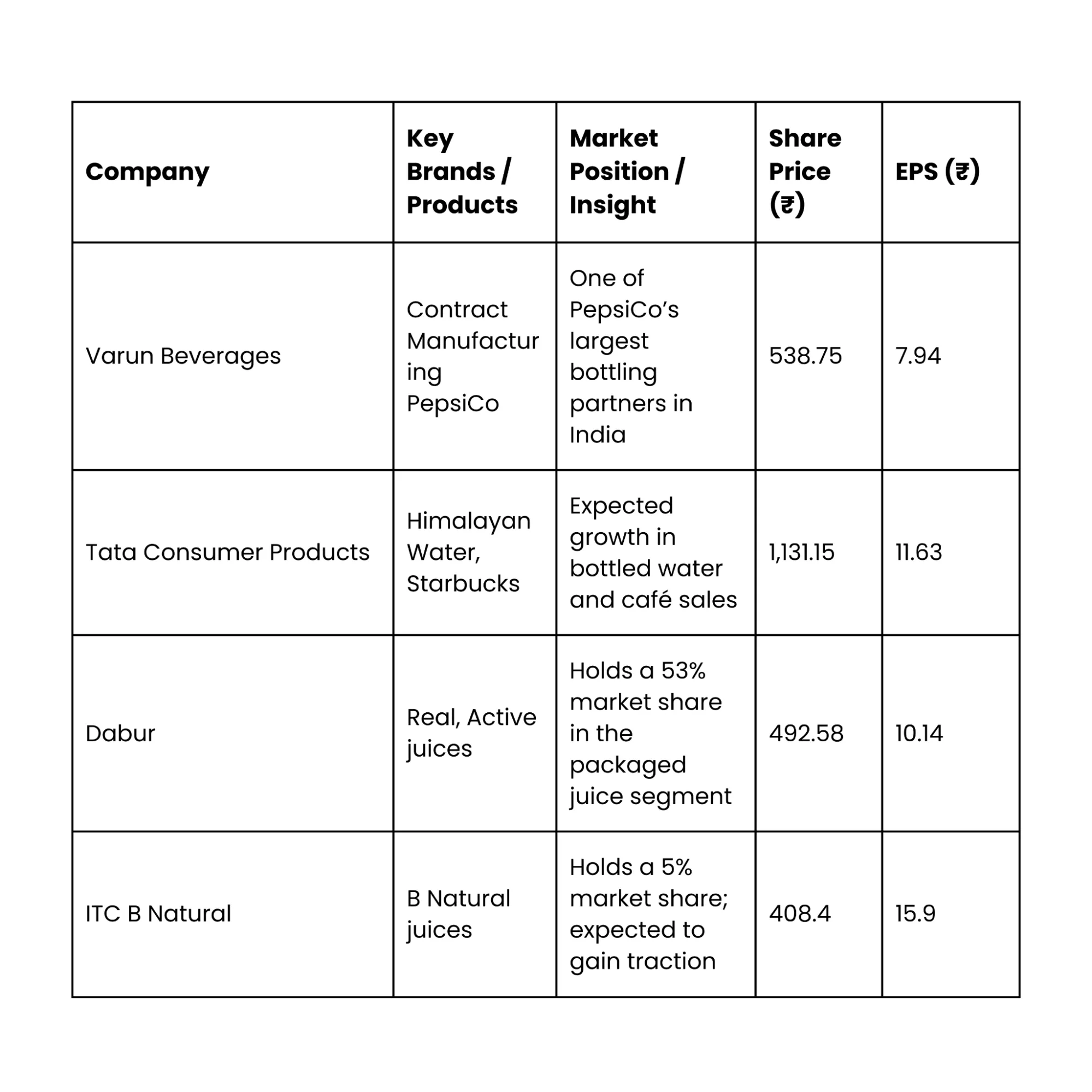

Beverages and FMCG

The beverage segment is set for a strong season, driven by both alcoholic and non-alcoholic drinks. Key players to watch include:

Challenges to watch

-

Component shortages: The industry remains heavily reliant on imported compressors, particularly from China. Manufacturers have expressed concerns about supply chains keeping pace with rising demand.

-

Tariffs and self-reliance push: The government’s emphasis on local manufacturing through non-tariff barriers could create temporary supply constraints, especially for smaller-capacity compressors.

-

Competition and Price Sensitivity: As more brands enter the cooling market, competition is intensifying. Price-sensitive consumers continue to prioritize value-for-money products, requiring brands to balance pricing with premium features.

A hot market with cooler gains

While competition in the cooling and FMCG sectors is fierce, the overall outlook remains positive. With consumers in smaller towns driving the bulk of the demand and premium products gradually gaining ground, companies are optimistic about the growth this summer. However, supply chain efficiency and inventory management will be key to meeting the rising demand without bottlenecks. For investors and businesses alike, this summer presents an opportunity to ride the heatwave with cooling products, beverages, and FMCG stocks likely to stay in focus.

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial, investment, or trading advice. Always conduct your research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)