The Importance of RTA Agents in Mutual Fund Management

If you have ever invested in mutual funds, you may have come across the term 'RTA' or Registrar and Transfer Agents. While they operate behind the scenes, RTAs play a crucial role in ensuring that mutual fund transactions run smoothly. But what exactly do they do, and why are they so important?

What are RTA Agents in Mutual Funds?

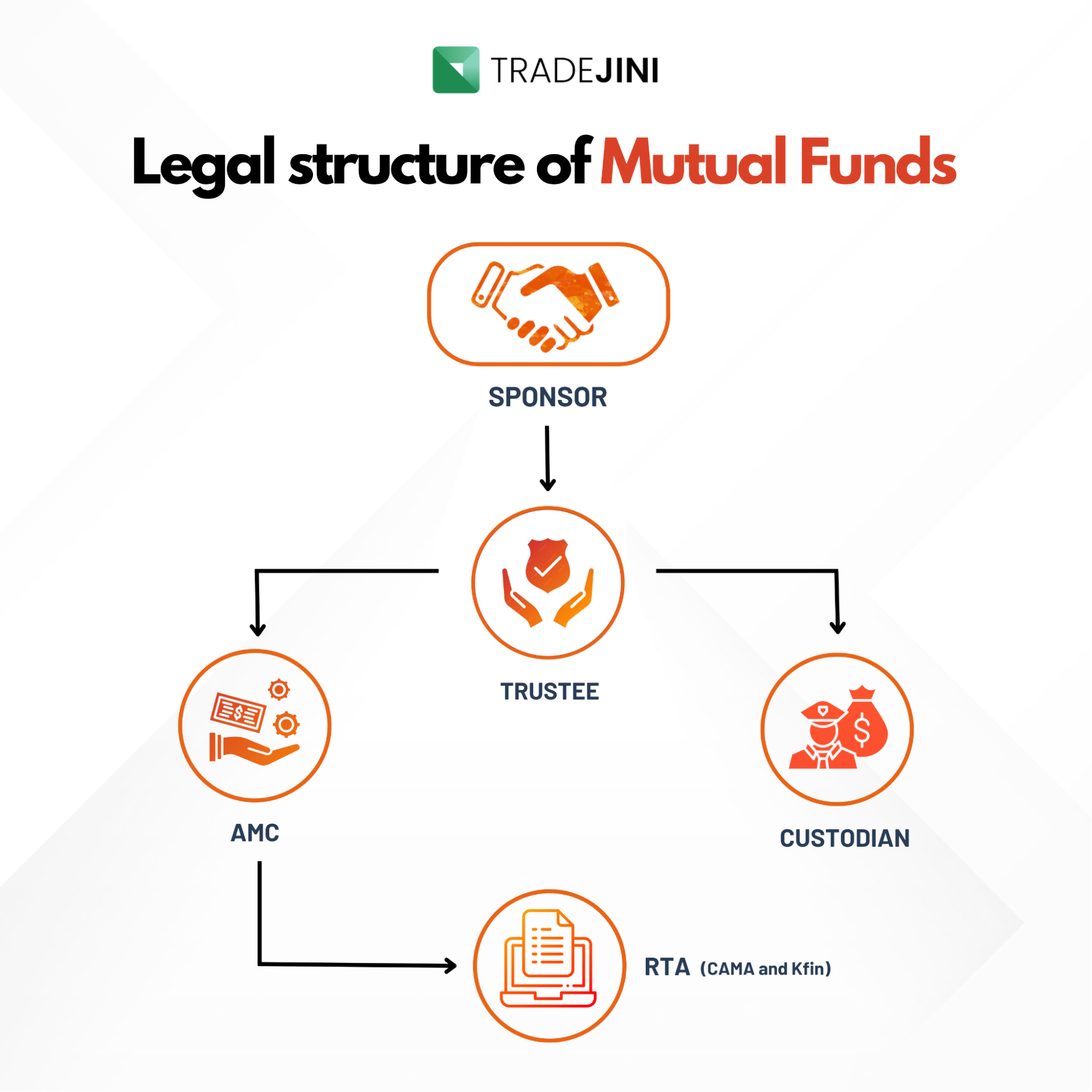

A Registrar and Transfer Agent (RTA) acts as a bridge between mutual fund houses and investors. They handle a range of administrative tasks, including processing transactions, maintaining investor records, and ensuring compliance with regulatory requirements. Without RTAs, the mutual fund industry would struggle to manage millions of investor accounts efficiently.

RTA Agent role and responsibilities

RTAs are functional entities that are responsible for a variety of tasks that help streamline investment processes. Some of their core functions include:

- Processing Transactions: Mutual fund RTA handles applications for purchases, redemptions, and switches in mutual fund schemes.

- Record-Keeping: They maintain investor details, including KYC compliance, bank mandates, and nominee details.

- Dividend and Payout Distribution: RTAs ensure that dividends, interest, and redemption proceeds reach investors on time.

- Customer Support: They assist with account statements, tax reports, and transaction history.

- Regulatory Compliance: RTA agents help mutual fund companies comply with SEBI regulations and other legal requirements.

Major RTA Agents in India

Two key RTAs dominate the mutual fund industry in India, offering seamless services to investors:

- CAMS (Computer Age Management Services): One of the largest RTAs, CAMS serves numerous AMCs and investors with a strong technology-driven platform and an extensive service network.

- KFin Technologies: Previously known as Karvy, KFin Technologies is another major player that supports mutual funds and financial institutions with a broad spectrum of services.

These RTAs operate through a vast network of service centres across India, making it easy for investors to manage their mutual fund investments conveniently.

CAMS and Kfin: Different AMC’s registered

When investing in mutual funds, it’s essential to know which RTA manages your funds. CAMS and KFin each handle different AMCs, so knowing your RTA can simplify investment tracking and management.

If you hold investments across multiple AMCs, a simple Google search will show which RTA handles which funds. If all your funds are managed by a single RTA, you can view your entire portfolio in one place through their official portal. This eliminates the hassle of switching between different platforms and makes monitoring your investments much easier.

Beyond portfolio tracking, RTAs also handle crucial mutual fund documentation, such as updating personal details, processing transactions, and addressing investor service requests. Understanding which RTA manages your funds can help streamline administrative tasks and make investment management smoother.

Importance of RTA Agents

RTAs play a crucial role in ensuring that the mutual fund ecosystem operates efficiently. Here’s why they are important:

- Operational Efficiency: By managing administrative tasks, RTAs allow AMCs to focus on fund management and investment strategies.

- Cost-Effectiveness: Their centralized operations reduce costs for AMCs, which can lead to lower expenses for investors.

- Transparency and Accuracy: Their advanced systems ensure precise record-keeping and seamless transaction processing.

- Accessibility: With widespread service centres and online portals, RTAs offer easy access to investor services.

How RTAs Manage Large Volumes of Investor Data

Given the massive scale of mutual fund investments in India, RTAs have developed sophisticated mechanisms to handle large volumes of investor data efficiently. Here’s how they manage it:

- Advanced Data Management Systems: RTAs use cutting-edge data platforms to ensure secure and accurate record-keeping.

- Integrated Technology Platforms: By integrating with banks, stock exchanges, and AMCs, RTAs facilitate real-time transactions and reporting.

- Automation and Robotics: Many RTAs employ Robotic Process Automation (RPA) to automate routine tasks, reducing errors and speeding up processing times.

- Disaster Recovery and Business Continuity: RTAs maintain robust disaster recovery centres to ensure uninterrupted services during technical failures or emergencies.

- Cybersecurity Measures: Given the sensitive nature of financial data, RTAs implement stringent security protocols, including ISO 27001:2013 certification, to protect investor information.

- Real-Time Data Access and Reporting: Investors can access their holdings through online platforms and mobile apps, enabling transparency and ease of tracking.

- Customer Support and Communication: Dedicated call centres and automated alerts via email/SMS keep investors informed about their transactions and fund performance.

Regulatory Oversight

RTAs operate under the regulatory framework of the Securities and Exchange Board of India (SEBI). Compliance with SEBI’s guidelines ensures that investor data and transactions remain secure, transparent, and efficient.

Conclusion

Registrar and Transfer Agent RTA may not always be in the spotlight, but they are the backbone of the mutual fund industry. By handling administrative tasks, ensuring compliance, and providing essential investor services, RTAs enhance transparency and efficiency in the financial ecosystem. For investors, understanding the role of RTAs helps navigate the complexities of mutual fund investments with ease, making financial planning simpler and more accessible.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)