Mastering the Risk and Return Relationship Dynamics in Stock Market Investing

Understanding the Relationship Between Risk and Return in Stock Market Investing

“Stocks are risky. Bank deposits are safe. Don’t buy stocks! Keep your money safe.” Haven’t you heard such statements before? We are sure you have.

Mastering the relationship between risk and return is crucial for success in stock market investing. Understanding how risk and return interact can help investors make informed decisions, manage their portfolios effectively, and achieve their financial goals. By delving into the dynamics of risk and return in stock market investing, investors can develop strategies to balance risk tolerance with return expectations, optimize their investment decisions, and navigate the complexities of the market with confidence.

The Nature of Risk in Investing

Stocks, unlike bank deposits, are inherently volatile. They can move sharply up or down in the short term, making them a riskier asset class. However, over longer periods, stocks have been proven to deliver much higher average returns compared to bank deposits or other asset classes.

What is Risk?

Risk is the possibility of losing the principal amount invested. For example, if you invest Rs 20,000 in stocks today and the market value drops to Rs 18,000 the next day, this represents the primary risk of investing in stocks.

However, all investments carry some form of risk:

- Bank Deposits: Carry inflation risk where returns may not keep pace with inflation, reducing purchasing power.

- Market Volatility: Fluctuations in stock prices due to market conditions.

- Economic and Geopolitical Factors: Changes in the economy or global events.

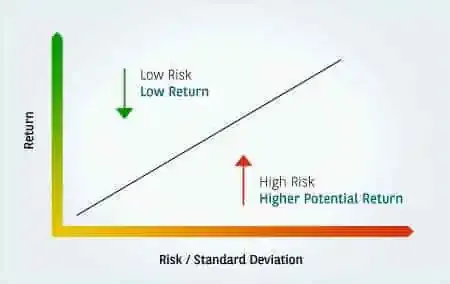

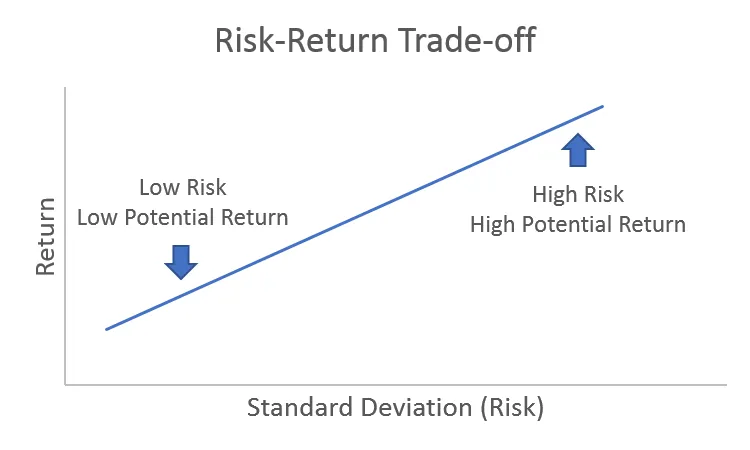

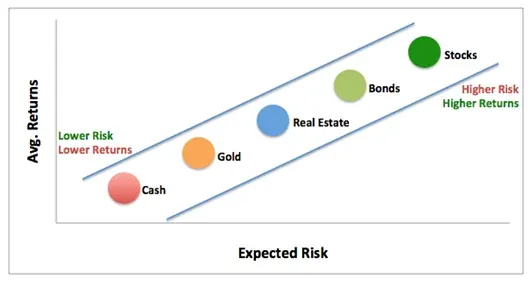

Generally, investments with higher risks offer the potential for higher returns, whereas safer investments, such as bank deposits, tend to provide lower returns.

What is Return?

Return refers to the amount gained or lost on an investment, usually expressed as a percentage of the initial investment. Assets that provide higher returns are often associated with higher risk levels.

The Risk-Return Relationship

The risk-return relationship is a fundamental concept in investing that highlights the trade-off between the potential for higher returns and the level of risk an investor must assume. Riskier investments have the potential for greater gains but also a higher potential for losses. This dynamic is essential for investors to understand when making decisions aligned with their financial goals and risk tolerance.

Balancing Risk and Return

Finding a risk-free investment is nearly impossible. Assets with little to no risk typically provide low returns, while high-return assets come with increased risk.

To manage risks effectively, investors can:

- Diversify Portfolios: Spread investments across multiple stocks or assets to reduce the impact of poor performance in any single investment.

- Invest in Mutual Funds: Professional fund managers build diversified portfolios that balance risk and return.

- Hold a Mix of Assets: Combine stocks, bonds, gold, and cash to stabilize returns and reduce overall portfolio risk.

- Adopt a Long-Term Perspective: Holding investments for longer periods often reduces volatility and increases the likelihood of better returns.

Practical Considerations

- Time Horizon: The longer the investment period, the lower the associated risks and the higher the likelihood of achieving better returns.

- Risk Appetite: Assess your ability to tolerate losses and choose investments that align with your financial goals.

- Inflation Impact: Consider the impact of inflation on your investments. Even low-risk assets can erode value over time due to inflation.

Conclusion

Understanding and managing the risk-return relationship is essential for successful investing. While stocks carry higher risks, they also offer the potential for superior long-term returns compared to safer investments like bank deposits. By intelligently assessing your risk tolerance, diversifying your portfolio, and adopting a long-term approach, you can achieve a balance that optimizes your returns without compromising your financial stability. Take on calculated risks to ensure your investments grow and outpace inflation over time.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)