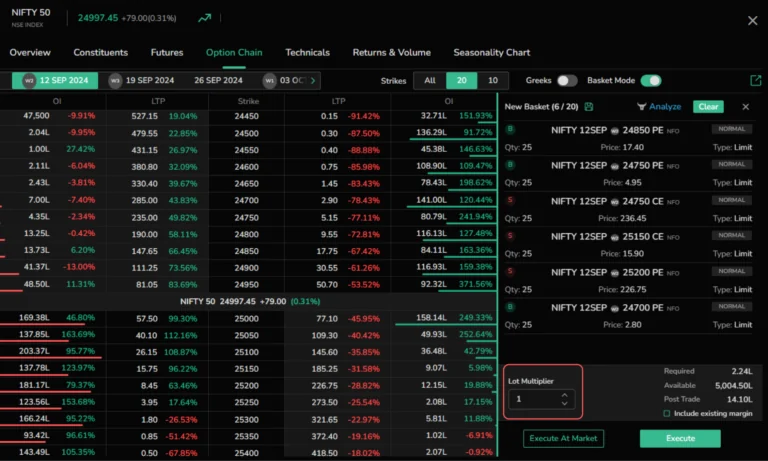

CubePlus Option Chain

The Option Chain in CubePlus is more than just a table of numbers; it is a strategic resource designed to align with a trader’s psychology and thought process. CubePlus provides the tools to act decisively in fast-moving markets, bridging the gap between data and execution.

Table of Contents

Key Features of the CubePlus Option Chain

- Comprehensive Strike Price Display:

- Display all available strike prices and categorize them for easy decision-making.

- Focus on ITM, ATM, or OTM strikes based on your strategy and market view.

- Real-Time Data Updates:

- Get live updates on bid/ask prices, open interest (OI), and last traded prices (LTP).

- Traders can spot opportunities the moment they arise.

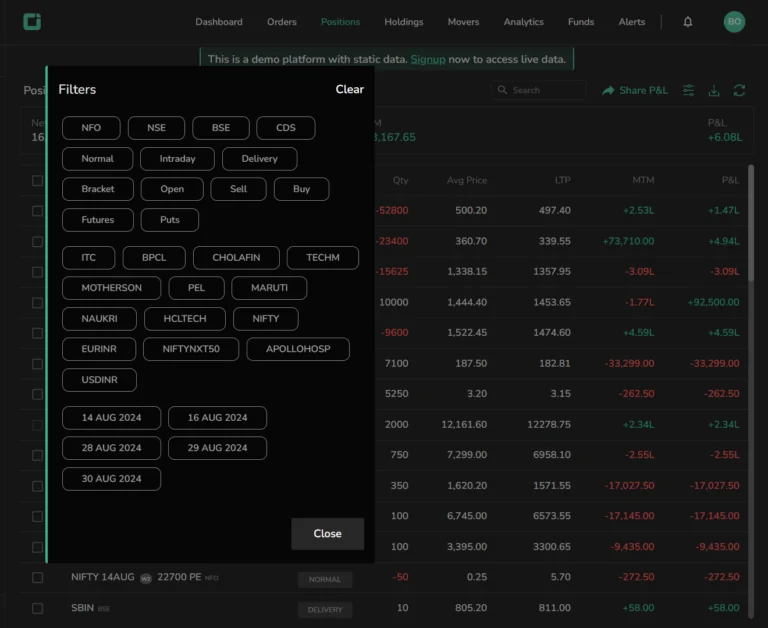

- Interactive Filters:

- Filter by moneyness, expiry dates, or implied volatility to declutter the view.

- Stay laser-focused on trades aligned with your market hypothesis.

- Open Interest Heatmaps:

- Visualize OI clusters to identify support and resistance levels.

- Traders can gauge the crowd’s sentiment to confirm or counter their own market bias.

Understanding the Trader’s Mindset with CubePlus

Traders constantly seek patterns, confirmations, and edges. CubePlus understands this by providing actionable insights:

- In the Money (ITM): Focus on high-probability options for conservative strategies.

- At the Money (ATM): Use these strikes for liquidity and delta-neutral strategies.

- Out of the Money (OTM): Identify cost-effective options for high-reward, low-risk trades.

Practical Applications of the CubePlus Option Chain

- Reading Market Sentiment:

- Thought Process: "Where is the market’s interest piling up?" High OI indicates zones of trader commitment.

- Example: High OI at the 18,000 strike in Nifty calls signals a potential resistance level. A trader eyeing a breakout waits for an OI reduction or price move beyond this level for confirmation.

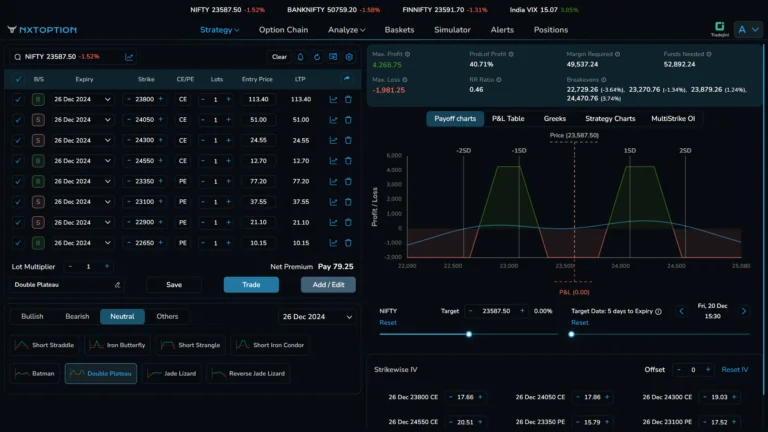

- Building Complex Strategies:

- Thought Process: "What’s the most efficient risk-reward setup for my view?"

- Example: A trader expecting range-bound action in Reliance constructs an iron condor, selecting strikes directly in CubePlus. The system’s real-time liquidity indicators ensure efficient execution.

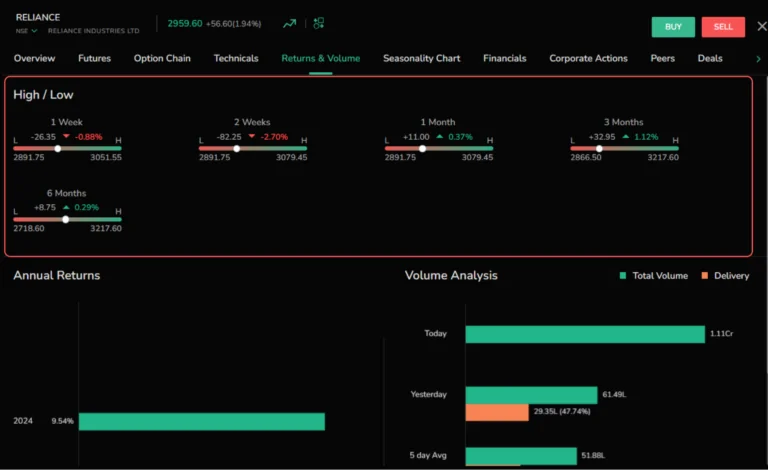

- Risk Management Based on OI and Volume:

- Thought Process: "Where should I set my safety net?"

- Example: For TCS, high OI at the 1,500 put acts as a psychological support. A trader sets their stop-loss below this level, protecting against sharp downturns.

- Liquidity Insights for Scalpers:

- Thought Process: "How quickly can I enter and exit positions?"

- Example: A scalper analyzing Bank Nifty options uses CubePlus’ bid-ask spread data to ensure minimal slippage during rapid trades.

- Confirmation of Market Trends:

-

Thought Process: "Does the crowd agree with my directional bias?"

-

Example: Increasing OI with price movement at a strike confirms strong market participation. Traders use this as a signal to scale positions.

-

Enhanced Tools for Trader-Focused Decisions

- Implied Volatility Insights:

- Thought Process: "Are options expensive or cheap right now?"

- Example: CubePlus highlights rising IV during Adani Enterprises’ earnings week. A trader sells premium-heavy OTM options to capitalize on time decay post-announcement.

- Built-In Greeks Analysis:

- Thought Process: "What’s the sensitivity of my position?"

- Example: By assessing Theta, a trader holding ATM Nifty options adjusts their position before time decay erodes premium value.

- Customizable Alerts:

- Thought Process: "How can I stay updated without constant monitoring?"

- Example: CubePlus sends an alert for a 15% increase in OI at a key strike, signaling fresh market participation. This allows traders to act without being glued to screens.

CubePlus in Action: Real-World Scenarios

- Defensive Hedging:

- Scenario: An Infosys investor hedges a portfolio by buying puts at the 1,400 strike.

- Trader’s Take: "With CubePlus confirming high OI at this level, I’m assured this strike offers liquidity for my hedge."

- Anticipating Reversals:

- Scenario: Nifty shows declining OI at higher calls and rising OI at lower puts.

- Trader’s Take: "The crowd is bearish. CubePlus’ trend visualization helps me pivot to a short bias with confidence."

Why CubePlus Resonates with Traders

- Simplicity Meets Depth: The interface is intuitive yet packed with advanced analytics.

- Real-Time Precision: Stay ahead with live data and customizable alerts.

- Tailored Strategies: Adapt the tool to fit your trading style, whether scalping, swing trading, or hedging.

Conclusion

CubePlus Option Chain is designed for the trader’s psyche—from seeking confirmations to managing risks. By aligning with real-world trading thought processes, CubePlus turns market data into actionable strategies. Ready to sharpen your edge?

Dive into CubePlus Option Chain today and trade smarter, not harder!

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)

_15_11zon.webp?alt=media&token=6e728422-56ca-4a66-8564-3bcd050f7b6d)