India’s startup growth hit by funding winter

In 2023, the Indian startup ecosystem saw a staggering 67% drop in funding compared to the previous year. This resulted in the closure of over 35,000 startups, highlighting the harsh realities of the funding slowdown.

History: The Funding Meltdown

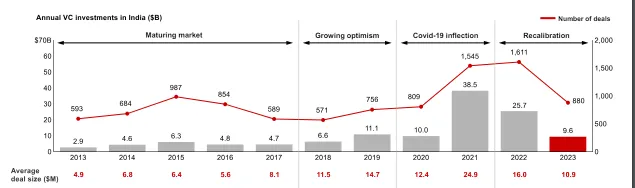

Indian startups have been facing the heat amid a drastic fall in funding that has led to the closure of over 35,000 companies. Venture capital funding in India significantly slowed down in CY 2023, where it stood at $9.6 billion, a drastic fall from CY 2022, where it stood at over $25.7 billion. India’s share of total global venture capital (VC) was valued at 2.9%, a 1.9% plummet from CY 2022. The number of unicorns India produced in CY 2023 stood at just two, which is a significant collapse from CY 2022’s 22 unicorns. Indian startups raised over $2.3 billion in the first quarter of 2024, which is a 3.1% decline in comparison to the first quarter of CY 2023. This apparent funding winter does not seem to be confined to India but rather a global trend.

Data by Bain & Company

Cause and Effect

The cause of this funding drought in India is not confined to domestic factors; it ends with global factors as well, due to the majority of Indian startups raising capital from foreign funds. Factors such as high interest rates, rising global inflation rates (which have been surging rapidly since mid-2020), diminishing global consumption, and geopolitical instability (e.g., strained United States and China relations, Russia-Ukraine conflict, and Israel-Palestine conflict) have caused financial sanctions that create blockages of capital and increase the risk of major countries entering a recession.

The overvaluation of startups and the tiny superuser set, which forces startups to target less than 10% of the population, are examples of domestic factors driving the growth in Indian consumption, according to Indian venture capital firm Blume Ventures. The culmination of all such factors has extensively impacted VC funding domestically and globally.

Some potential reasons for a global funding freeze are:

- Rising interest rates: Central banks raising interest rates can make it more expensive for investors to borrow money, leading them to be more cautious about investing in risky ventures like startups.

- Economic uncertainty: Events like the Russia-Ukraine war or ongoing trade tensions can create economic instability, making investors hesitant to invest in new businesses.

- Market correction: After a period of rapid growth in startup valuations, there might be a correction where valuations become more realistic.

Impact on Startups

The funding winter has significantly and negatively impacted startups in the following ways:

- Reduced Funding Availability: With less VC money available, securing funding becomes more competitive. Startups with strong business models and clear paths to profitability are more likely to attract investors during this time.

- Increased Scrutiny: Investors are becoming more selective in their investments. They are demanding a clearer path to profitability and a more measured approach to growth.

- Focus on Fundamentals: The emphasis has shifted from rapid growth at any cost to a focus on sustainable business models and profitability. Startups need to demonstrate a clear path to financial viability to secure funding.

Also Read: 9 Best Options to Get Funds For Stock Trading In India

Strategies Startups can Adopt

- Prioritize profitability and focus on profitable customers.

- Find alternate sources of funding, such as crowdfunding, peer-to-peer lending, debt, grants, or bootstrapping.

- Form strategic and long-term partnerships.

- Optimize expenditure.

- Strengthen fundamentals.

- Develop a sound marketing and sales strategy by identifying target consumers.

- Set ambitious yet achievable targets.

It’s Not All Bleak

Despite such a meltdown, global investors remain extremely bullish on India, as it has the fastest growing economy, strong macroeconomic metrics, the youngest working population in the world, and a large reserve of available talent. While the funding winter continues to cast its shadow, there are some tentative signs of a potential thaw. Early data for 2024 suggests a slight increase in overall funding compared to 2023. Additionally, experts predict a focus on specific sectors, such as Artificial Intelligence (AI), Data Analytics, Fintech, and InsurTech, which may see continued investor interest.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)