Mutual Funds Made Easy: How to Grow Your Wealth with Confidence

Have you ever thought about how to make your money grow without constantly worrying about where to invest it? This is where mutual funds come into play. They allow individuals to pool their money together, allowing an expert fund manager to handle the investments on their behalf. To generate returns that align with the collective objectives of all investors in the fund.

Everyone contributes to this as a team effort, and an expert charts the best path to success. These funds are diversified across various securities like stocks, bonds, or other assets, reducing risks while aiming for steady returns.

In India, mutual funds are strictly regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and fairness. The regulations are designed to protect investors while maintaining the integrity of the industry.

The History of Mutual Funds in India

Mutual funds in India began in 1963 when the Government of India and the Reserve Bank of India (RBI) launched the first mutual fund scheme to promote savings and investments. For nearly 20 years, the industry was dominated by the Unit Trust of India (UTI).

The landscape changed in 1987 when SBI Mutual Fund entered the market, followed by other public-sector players. A pivotal moment came in 1993 when private sector companies were allowed to establish Asset Management Companies (AMCs), leading to increased competition and innovation. By 1996, SEBI implemented regulations to protect investors, and the AMFI Association of Mutual Funds in India was formed to further develop the industry.

Mutual Funds Sahi Hai Campaign

Fast forward to today, and mutual funds have become an integral part of many Indian households' financial plans. To encourage more participation, AMFI launched the widely popular ‘Mutual Funds Sahi Hai’ campaign. You have probably seen it on TV, heard it on the radio, or read about it in newspapers. This campaign, available in multiple languages, aims to simplify mutual fund concepts and break down misconceptions.

How Do Mutual Funds Work?

Have you ever thought about how to make your money work for you without feeling overwhelmed? That’s where mutual funds come in! They pool money from many investors, creating a larger capital base for investment so you are not going it alone!

What does this doing alone mean in the stock market? you invest in a specific stock that you choose but here With mutual funds, your investments are diversified across various asset classes, which helps reduce risk. It’s like not putting all your eggs in one basket! Plus, experienced fund managers handle the investment decisions for you, using their market expertise to grow your money.

Need quick access to your funds? No problem! You can buy or sell your shares on any business day. And the best part? Mutual funds have low minimum investment requirements, making them accessible for everyone, whether you are just starting out or looking to expand your portfolio!

Types of Mutual Fund Schemes

A. Types of Mutual Fund Scheme Based on Asset Class

When it comes to mutual funds, there’s no one-size-fits-all approach. Different funds cater to various investment goals and risk appetites. Let’s dive into the types of mutual funds to invest in different schemes, starting with how they’re classified based on the assets they invest in.

1. Equity Funds

You are looking for high rewards, but you understand that this journey could be bumpy. Equity funds are like taking the thrilling, high-speed highway where the wind blows through your hair. They invest in stocks, which can go up and down quickly but offer the potential for high returns in the long term.

-

Large-Cap Funds: These funds focus on well-established, financially stable companies with a proven track record. They’re relatively less risky compared to other equity funds and are suitable for conservative equity investors. Additionally, these funds appeal to income seekers, as many large-cap companies distribute regular dividends to their shareholders.

-

Mid-Cap Funds: These invest in medium-sized companies that are in the growth phase. While they offer higher growth potential than large-cap funds, they also carry more volatility.

-

Small-Cap Funds: Target smaller companies with high growth potential but come with significant risk. These funds are suitable for seasoned investors with a higher risk appetite.

-

Multi-Cap Funds: These provide a balanced mix by investing across large, mid, and small-cap companies, offering diversification within the equity segment.

-

Sector/Thematic Funds: Invest in specific sectors like technology, and healthcare, or themes like infrastructure or ESG (Environmental, Social, and Governance). These are high-risk, high-reward options for investors confident about a particular industry or trend.

| Category | Ranking Based on Market Cap | Description |

|---|---|---|

| Large-Cap | Top 1st to 100th company | The largest companies by market cap are typically well-established and financially stable. |

| Mid-Cap | 101st to 250th company | Medium-sized companies with high growth potential but slightly higher risk than large-caps. |

| Small-Cap | 251st company onwards | Small-sized companies with significant growth opportunities but higher risk and volatility. |

2. Debt Funds

For those who prefer a smooth, predictable journey, debt funds are the way to go. They are like driving on a calm, well-maintained road where you know exactly what to expect. They invest in bonds and fixed-income securities, offering steady returns with lower risk.

They invest in fixed-income securities like bonds, debentures, and government securities. Popular subcategories include:

-

Liquid Funds: Perfect for parking surplus funds for short durations, these invest in highly liquid instruments with minimal risk.

-

Short-Term Debt Funds: Focus on bonds and other instruments with short maturity periods, providing slightly better returns than liquid funds.

-

Gilt Funds: Invest exclusively in government securities, making them one of the safest debt fund options. These are ideal for risk-averse investors.

3. Hybrid Funds

Imagine a route that mixes both adventure and calm. Hybrid funds combine the speed of equity funds with the smoothness of debt funds. This is the perfect option for travellers who want a balance between risk and stability.

Aggressive Hybrid Funds: With a higher allocation to equities, typically invest 65% to 80% in equities and the remaining 20% to 35% in debt instruments. These funds aim for growth and are suitable for those willing to take on more risk.

Conservative Hybrid Funds: Focus more on debt, making them a safer option for investors who prioritize stability over high returns .Generally allocate 75% to 90% of their assets to debt instruments, with only 10% to 25% in equities.

4. Money Market Funds

Money Market Funds are for when you need to park your money temporarily but safely. They invest in short-term, low-risk instruments, like Treasury bills and commercial paper, perfect for keeping your funds in a safe place while you plan the next phase of your journey.

B. Types of Mutual Fund Scheme Based on Investment Objective

There are different types of mutual funds to invest in, each tailored to specific objectives. Just as every individual has unique needs, mutual fund schemes are designed to align with various financial goals.

- Growth Funds: The Long-Term Dreamers: Imagine planting a seed and watching it grow into a mighty tree over the years. That’s what growth funds are all about. These funds primarily invest in equity, aiming for capital appreciation. If you’re someone who’s ready to think long-term and ride out market ups and downs, growth funds could be your perfect match. They come with higher risks but also the potential for significant rewards!

- Income Funds: Your Steady Income Stream: If you prefer a more stable approach, income funds might just be your cup of tea. These funds focus on generating regular income by investing in fixed-income securities like bonds. Think of them as a reliable friend who always shows up with a paycheck! They are generally considered safer than equity funds, making them ideal for conservative investors looking for consistent returns.

- Tax-Saving Funds (ELSS): Save Taxes While You Grow : Who doesn’t love saving on taxes? Enter Equity Linked Savings Schemes (ELSS)! These funds invest mainly in equities and offer tax benefits under Section 80C of the Income Tax Act. Plus, they come with a three-year lock-in period, which means your money is working hard for you while you enjoy some tax savings. It’s a win-win!

C. Types of Mutual Fund Scheme Based on Structure

- Open-Ended Funds: Most mutual funds in India fall under this category, and they offer incredible flexibility. You can buy or sell units at any time based on the Net Asset Value (NAV) on any business day. This means if you need cash for an unexpected expense or want to invest more when the market dips, you can do so without any hassle. Perfect for those who appreciate the freedom to manage their investments actively!

- Close-Ended Funds: These funds come with a fixed maturity period, meaning they have a set timeline for when they will mature. You can only buy units during the initial offer period, which adds a bit of excitement! After that, if you want to trade your units, you will have to do so on the stock exchanges. This structure can be appealing if you are looking for a long-term investment without worrying about daily fluctuations.

- Interval Funds: These unique hybrids allow you to buy or sell units during specified intervals typically every few months. It’s like having the best of both worlds! You get to enjoy some liquidity while still benefiting from a more structured investment approach. If you’re someone who likes a little bit of everything, interval funds could be your perfect match.

D. Types of Mutual Fund Scheme Based on Management Style

- Active Funds:Think of active funds as your personal investment coach! Managed by skilled fund managers, these funds are all about picking the right stocks to beat the market. They’re constantly researching and making moves based on what’s happening in the economy and the stock market.

- Passive Funds (Index Funds): These funds replicate the performance of a particular market index, like the Nifty 50 or Sensex, by investing in the same securities in the same proportion. Exchange-Traded Funds (ETFs) are also part of this category.

E. Specialized Schemes

- Fund of Funds (FoF): A Fund of Funds invests in other mutual funds, offering diversified exposure and helping spread risk while aiming for solid returns.

- Global/International Funds: These funds invest in foreign markets, providing access to international stocks and bonds, enhancing diversification and opening new growth opportunities.

- Solution-Oriented Schemes: Designed for specific financial goals like retirement or education, these funds often have a target maturity date and may offer tax advantages. For instance, mutual funds for retirement planning help individuals build a corpus over time, ensuring financial security in their golden years. Such schemes can help you stay on track to meet key milestones in life.

The Role of Fund Managers in Managing Risk

Fund manager role is crucial in navigating the complexities of investment risk. Here’s how they do it:

- Expertise and Analysis: Fund managers leverage their expertise and market analysis to select investments that align with the fund’s objectives. They conduct thorough research to identify opportunities and assess potential risks associated with individual securities.

- Continuous Monitoring: They don’t just set it and forget it! Fund manager role is continuously monitoring market conditions and the performance of individual securities. This allows them to make timely adjustments to the portfolio as needed, ensuring that investments remain aligned with market dynamics.

- Informed Decision-Making: Making informed decisions is key to mitigating risks. Fund managers analyze various factors, including economic trends and sector performance, to reduce exposure to underperforming investments or sectors that may pose higher risks.

- Diversification: One of the fundamental strategies they employ is diversification spreading investments across multiple asset classes, sectors, and geographical regions. This approach helps cushion the impact of poor performance in any single area, enhancing overall portfolio stability. For example, a balanced fund might include stocks, bonds, and real estate assets to reduce volatility.

Fund managers use diversification as a key strategy to minimize risk in investment portfolios. Here’s how they do it:

- Spreading Investments: Diversification involves allocating funds across various asset classes, sectors, and geographical regions. By investing in a mix of stocks, bonds, real estate, and other assets, fund managers reduce the impact of poor performance in any single investment. For example, if one sector is struggling, another might be thriving, helping to offset losses.

- Risk Mitigation: The primary goal of diversification is to limit overall portfolio risk. Different assets behave differently under varying market conditions. By mixing investments with different risk profiles like combining volatile stocks with more stable bonds fund managers can create a balanced portfolio that withstands market fluctuations better.

- Strategic Allocation: Fund managers carefully evaluate how much to allocate to each asset class based on market conditions and investor goals. This strategic allocation helps ensure that the portfolio remains resilient against downturns while still pursuing growth opportunities.

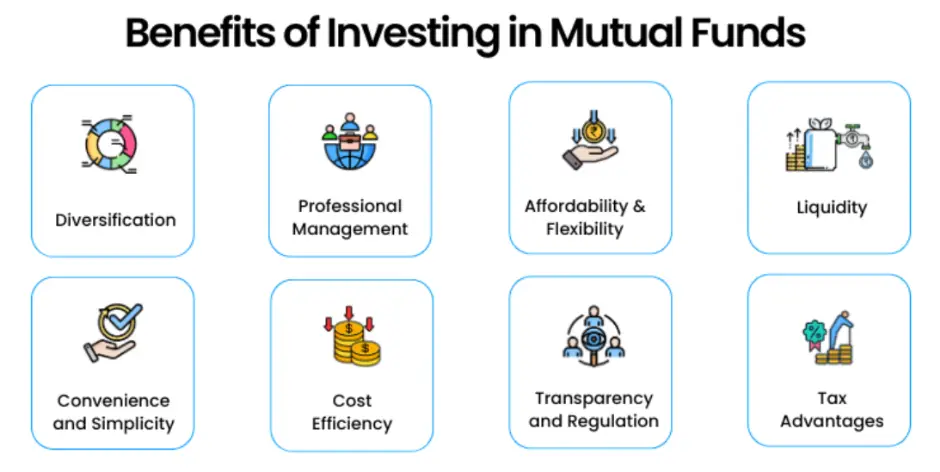

Benefits of Investing in Mutual Funds

Investing in mutual funds comes with a host of advantages that can enhance your financial journey.

Risks Associated with Mutual Funds

Investing in mutual funds offers diversification and professional management, but it's important to understand the risks involved. Here are some key risks to consider:

- Market Risk: The value of your investments can fluctuate due to market volatility. Factors like economic changes, political events, or global trends can influence market performance, affecting fund returns.

- Credit Risk: When investing in funds with debt securities, there’s a chance that the issuer may default on their obligations, potentially leading to a loss.

- Interest Rate Risk: Bond prices are inversely related to interest rates. Any increase in interest rates can reduce the value of bonds held in the fund.

- Management Risk: A fund’s performance depends on the expertise and decisions of its manager. Poor investment choices can impact returns negatively.

How to Invest in Mutual Funds

A Journey into Mutual Fund Investing

Nowadays mutual funds have become the talk of town and rite from Genz to retired people. Many of them dream of financial stability, a comfortable retirement, and the ability to support their loved ones. Many have heard about mutual funds and they felt a spark of curiosity. Mutual funds for retirement planning is the first step to be taken when you start earning. But they are not aware of the steps on how to invest in mutual funds and how to select schemes as they have just heard about returns but not much literature on mutual funds, how it works and which scheme can be bet suitable for them.

Step1: Setting the Goals

Before diving into mutual funds, it’s essential to clarify your financial goals. Are you saving for a dream home, a child’s education, or retirement? Your objectives will shape your investment strategy. Younger investors, like those in Gen Z, may take on higher risks due to their time horizon, while those in their 40s might focus on stability and planning for significant milestones. Mutual funds offer tailored options for every stage of life, making them a versatile choice for all investors.

Step 2: Choosing the Right Fund

Choosing the right mutual fund often starts online, where investors can explore various types. A stock trading app can help compare different mutual fund categories, such as equity, debt, and hybrid funds, based on historical performance and expense ratios. These apps also provide risk assessment tools to help align investments with financial goals and risk tolerance.

Step 3: Opening the Account

The next step is opening an investment account, which can be done directly through an Asset Management Company (AMC) or via online platforms. After completing the KYC process and gathering necessary documents, investors can quickly set up their accounts and embark on their mutual fund journey.

Step 4: The Investment Method

Deciding how much to invest is crucial. Many opt for a Systematic Investment Plan (SIP), allowing them to make regular investments without feeling overwhelmed. This approach enables gradual wealth accumulation as monthly contributions are automatically directed into chosen mutual funds.

Chapter 5: Monitoring Performance

Investors should regularly track their investments through online platforms, checking fund performance with anticipation. Celebrating small victories is important, but they must also remember that market fluctuations are normal. Whereas risk management in mutual funds is the top priority. Adjustments may be needed based on changing financial goals or market conditions to keep investments aligned with long-term objectives.

SIP, STP, SWP, and Switching

Understanding strategies like SIP (Systematic Investment Plan), STP (Systematic Transfer Plan), SWP (Systematic Withdrawal Plan), and switching between funds is vital for effective money management. SIPs allow for regular investments, STPs enable transfers between funds based on risk appetite, SWPs provide regular income withdrawals, and switching lets investors adjust their portfolios as needed.

Key Strategies for Risk Management in Mutual Funds

To manage your portfolio, risk management in mutual funds is very important. Investors should diversify their portfolios across different assets, rely on professional management from fund managers, and practice strategic asset allocation. Regular portfolio reviews ensure alignment with financial goals. Systematic Investment Plans (SIPs) help mitigate market volatility, while risk assessment tools guide investors in selecting suitable mutual funds based on their risk tolerance.

Conclusion

Mutual funds offer a versatile investment option for individuals aiming to grow wealth over time. With benefits like professional management, diversification, and risk-based options, they cater to both novice and experienced investors. Supported by the AMFI Association of Mutual Funds in India, mutual funds have gained popularity through increased transparency and investor awareness. Options like Systematic Investment Plans (SIPs) and lump-sum investments make them accessible to all. Understanding their structure, types, and potential returns empowers investors to make informed decisions. By using these tools wisely, individuals can build strong financial portfolios and achieve long-term financial goals effectively.

_11zon.webp?alt=media&token=bd974821-aee4-43a5-b467-01d1a67a570b)

_20_11zon.webp?alt=media&token=6659b2e6-927e-42de-8375-e227e579f556)

_11zon.webp?alt=media&token=a8f3f55c-dc70-4d42-844e-6874ceff69ce)

_11zon.webp?alt=media&token=a05d2324-cace-44ed-a35f-50f9e63be9c3)

_11zon.webp?alt=media&token=14cd8f87-8add-49ce-84f1-ca07a0c52b0c)